Kraft 2006 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2006 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

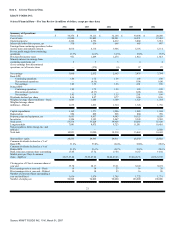

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operation.

Description of the Company

Kraft Foods Inc. ("Kraft"), together with its subsidiaries (collectively referred to as the "Company"), manufactures and markets packaged food products,

consisting principally of beverages, cheese, snacks, convenient meals and various packaged grocery products. Kraft manages and reports operating results

through two units, Kraft North America Commercial and Kraft International Commercial. Reportable segments for Kraft North America Commercial are

organized and managed principally by product category. Kraft International Commercial's operations are organized and managed by geographic location. At

December 31, 2006, Altria Group, Inc. held 98.5% of the combined voting power of Kraft's outstanding capital stock and owned 89.0% of the outstanding shares

of Kraft's capital stock.

Kraft Spin-Off from Altria Group, Inc.:

On January 31, 2007, the Altria Group, Inc. Board of Directors announced that Altria Group, Inc. plans to spin off all of its remaining interest (89.0%) in the

Company on a pro rata basis to Altria Group, Inc. stockholders in a tax-free transaction. The distribution of all the Kraft shares owned by Altria Group, Inc. will

be made on March 30, 2007 ("Distribution Date"), to Altria Group, Inc. stockholders of record as of the close of business on March 16, 2007 ("Record Date").

The exact distribution ratio will be calculated by dividing the number of Class A common shares of Kraft held by Altria Group, Inc. by the number of Altria

Group, Inc. shares outstanding on the Record Date. Based on the number of shares of Altria Group, Inc. outstanding at December 31, 2006, the distribution ratio

would be approximately 0.7 shares of Kraft Class A common stock for every share of Altria Group, Inc. common stock outstanding. Prior to the distribution,

Altria Group, Inc. will convert its Class B shares of Kraft common stock, which carry ten votes per share, into Class A shares of Kraft, which carry one vote per

share. Following the distribution, only Class A common shares of Kraft will be outstanding and Altria Group, Inc. will not own any shares of Kraft.

Holders of Altria Group, Inc. stock options will be treated as public stockholders and will, accordingly, have their stock awards split into two instruments.

Holders of Altria Group, Inc. stock options will receive the following stock options, which, immediately after the spin-off, will have an aggregate intrinsic value

equal to the intrinsic value of the pre-spin Altria Group, Inc. options:

•

a new Kraft option to acquire the number of shares of Kraft Class A common stock equal to the product of (a) the number of Altria

Group, Inc. options held by such person on the Distribution Date and (b) the approximate distribution ratio of 0.7 mentioned above; and

•

an adjusted Altria Group, Inc. option for the same number of shares of Altria Group, Inc. common stock with a reduced exercise price.

Holders of Altria Group, Inc. restricted stock or stock rights awarded prior to January 31, 2007, will retain their existing award and will receive restricted

stock or stock rights of Kraft Class A common stock. The amount of Kraft restricted stock or stock rights awarded to such holders will be calculated using the

same formula set forth above with respect to new Kraft options. All of the restricted stock and stock rights will not vest until the completion of the original

restriction period (typically, three years from the date of the original grant). Recipients of Altria Group, Inc. stock rights awarded on January 31, 2007, did not

receive restricted stock or stock rights of Kraft. Rather, they will receive additional stock rights of Altria Group, Inc. to preserve the intrinsic value of the original

award.

To the extent that employees of the remaining Altria Group, Inc. receive Kraft stock options, Altria Group, Inc. will reimburse the Company in cash for the

Black-Scholes fair value of the stock options to be received. To the extent that Kraft employees hold Altria Group, Inc. stock options, the Company will

22

Source: KRAFT FOODS INC, 10-K, March 01, 2007