Kraft 2006 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2006 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

business model for itsTassimo hot beverage system, the revenues of which lagged the Company's projections. This evaluation resulted in a $245 million

($157 million after-tax) non-cash asset impairment charge related to lower utilization of existing manufacturing capacity. These charges were recorded as asset

impairment and exit costs on the consolidated statement of earnings. In addition, the Company anticipates that the impairment will result in related cash

expenditures of approximately $3 million, primarily related to decommissioning of idle production lines. The Company also anticipates further charges in 2007

related to negotiations with product suppliers.

During 2005, the Company sold its fruit snacks assets and incurred a pre-tax asset impairment charge of $93 million ($60 million after-tax) in recognition of

the sale. During December 2005, the Company reached agreements to sell certain assets in Canada and a small biscuit brand in the United States and incurred

pre-tax asset impairment charges of $176 million ($80 million after-tax) in recognition of these sales. These transactions closed in the first quarter of 2006. These

charges, which included the write-off of all associated intangible assets, were recorded as asset impairment and exit costs on the consolidated statement of

earnings.

For further details on the restructuring program or asset impairment and implementation costs, see Note 3 to the Consolidated Financial Statements and

the Business Environment section of the following Discussion and Analysis.

Gain on Redemption of United Biscuits Investment—In 2006, the Company realized a pre-tax gain of $251 million ($148 million after-tax) on the

redemption of its outstanding investment in United Biscuits.For further details see Note 6 to the Consolidated Financial Statements.

Gains on Sales of Businesses—The 2006 gains on sales of businesses were due primarily to the sale of the Company's rice brand and assets, partially offset

by the loss on the sale of a U.S. coffee plant and tax expense of $57 million related to the sale of the Company's pet snacks brand and assets. The 2005 gains on

sales of businesses were due primarily to the gain on sale of the Company's U.K. desserts assets.

Income Tax Benefit—The 2006 tax benefit reflects a reimbursement from Altria Group, Inc. in cash for unrequired federal tax reserves of $337 million and

pre-tax interest of $46 million ($29 million after-tax), as well as net state tax reversals of $39 million, due to the conclusion of an audit of Altria Group, Inc.'s

consolidated federal income tax returns for the years 1996 through 1999. Included within the change in tax rate, among other things, are a benefit of $52 million

in 2006 and $82 million in 2005 from the resolution of outstanding items in the Company's international operations. In addition, 2005 income taxes include

$24 million from the settlement of an outstanding U.S. tax claim, $33 million in tax impacts associated with the sale of a U.S. biscuit brand and a $53 million

aggregate benefit from the domestic manufacturers' deduction provision and the dividend repatriation provision of the American Jobs Creation Act.

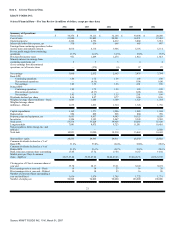

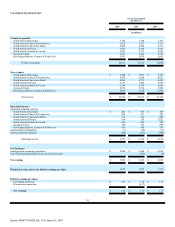

Operations—The $73 million increase in results from operations, which includes the 53rd week in 2005, was due primarily to the following:

•

Higher income in North America Snacks & Cereals, reflecting higher pricing and lower marketing costs, partially offset by higher

commodity costs and increased promotional spending.

•

Higher income in Developing Markets, Oceania & North Asia, reflecting higher pricing and favorable volume/mix, partially offset by

increased marketing costs, higher product costs, and the 2005 recovery of a previously written-off account receivable.

•

Higher income in North America Cheese & Foodservice, reflecting lower commodity costs, partially offset by lower net pricing and lower

volume/mix.

25

Source: KRAFT FOODS INC, 10-K, March 01, 2007