Kraft 2006 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2006 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

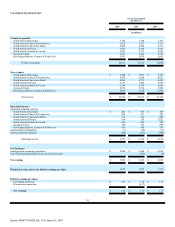

respectively. Total pre-tax restructuring charges for the program incurred from January 2004 through December 31, 2006 were $1.6 billion and specific programs

announced will result in the elimination of approximately 9,800 positions. Approximately 60% of the pre-tax charges to date are expected to require cash

payments.

In addition, the Company expects to incur approximately $550 million in capital expenditures to implement the restructuring program. From January 2004

through December 31, 2006, the Company spent $245 million in capital, including $101 million spent in 2006, to implement the restructuring program.

Cumulative annualized cost savings as a result of the restructuring program were approximately $540 million and $260 million through December 31, 2006 and

2005, respectively, and are anticipated to reach approximately $700 million by the end of 2007, all of which are expected to be used in support of brand-building

initiatives.

Asset Impairment Charges:

As discussed further in Note 3.Asset Impairment, Exit and Implementation Costs, the Company incurred pre-tax asset impairment charges of $424 million,

$269 million and $20 million during the years ended December 31, 2006, 2005 and 2004, respectively. These charges were recorded as asset impairment and exit

costs on the consolidated statements of earnings.

These asset impairment charges primarily related to various sales of the Company's brands and assets, as well as the 2006 re-evaluation of the business

model for the Company'sTassimo hot beverage system, the revenues of which lagged the Company's projections. This evaluation resulted in a $245 million

non-cash pre-tax asset impairment charge related to lower utilization of existing manufacturing capacity. In addition, the Company anticipates that the

impairment will result in related cash expenditures of approximately $3 million, primarily related to decommissioning of idle production lines. The Company

also anticipates further charges in 2007 related to negotiations with product suppliers.

Acquisitions and Dispositions:

One element of the Company's growth strategy is to strengthen its brand portfolios and/or expand its geographic reach through a disciplined program of

selective acquisitions and divestitures. The Company is constantly reviewing potential acquisition candidates and from time to time sells businesses to accelerate

the shift in its portfolio toward businesses—whether global, regional or local—that offer the Company a sustainable competitive advantage. The impact of any

future acquisition or divestiture could have a material impact on the Company's consolidated financial position, results of operations or cash flows, and future

sales of businesses could in some cases result in losses on sale.

During 2006, the Company acquired the Spanish and Portuguese operations of United Biscuits ("UB"), and rights to all Nabisco trademarks in the European

Union, Eastern Europe, the Middle East and Africa, which UB has held since 2000, for a total cost of approximately $1.1 billion. The Spanish and Portuguese

operations of UB include its biscuits, dry desserts, canned meats, tomato and fruit juice businesses as well as seven manufacturing facilities and 1,300 employees.

From September 2006 to December 31, 2006, these businesses contributed net revenues of $111 million. The non-cash acquisition was financed by the

Company's assumption of $541 million of debt issued by the acquired business immediately prior to the acquisition, as well as $530 million of value for the

redemption of the Company's outstanding investment in UB, primarily deep-discount securities. The redemption of the Company's investment in UB resulted in a

pre-tax gain on closing of $251 million ($148 million after-tax or $0.09 per diluted share).

Aside from the debt assumed as part of the acquisition price, the Company acquired assets consisting primarily of goodwill of $734 million, other intangible

assets of $217 million, property, plant and equipment of $161 million, receivables of $101 million and inventories of $34 million. These amounts

32

Source: KRAFT FOODS INC, 10-K, March 01, 2007