Kraft 2006 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2006 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

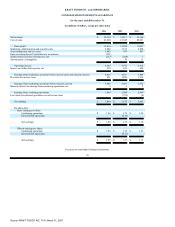

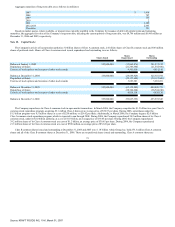

expense for stock option awards for the years ended December 31, 2005 and 2004 (in millions, except per share data):

2005

2004

Net earnings, as reported $ 2,632 $ 2,665

Deduct:

Total stock-based employee compensation expense determined under fair value method for all stock

option awards, net of related tax effects 7 7

Pro forma net earnings $ 2,625 $ 2,658

Earnings per share:

Basic—as reported $ 1.56 $ 1.56

Basic—pro forma $ 1.56 $ 1.56

Diluted—as reported $ 1.55 $ 1.55

Diluted—pro forma $ 1.55 $ 1.55

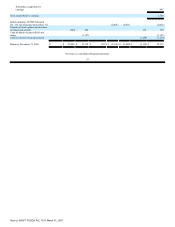

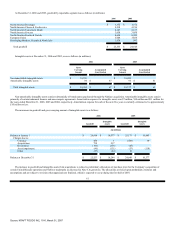

The Company elected to calculate the initial pool of tax benefits resulting from tax deductions in excess of the stock-based employee compensation expense

recognized in the statement of earnings under FASB Staff Position 123(R)-3, "Transition Election Related to Accounting for the Tax Effects of Share-Based

Payment Awards." Under SFAS No. 123(R), tax shortfalls occur when actual tax deductible compensation expense is less than cumulative stock-based

compensation expense recognized in the financial statements. Tax shortfalls of $8 million were recognized for the year ended December 31, 2006, and were

recorded in additional paid-in capital.

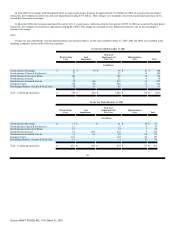

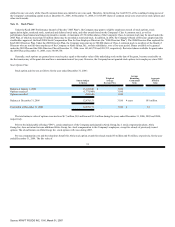

Note 3. Asset Impairment, Exit and Implementation Costs:

Restructuring Program:

In January 2004, the Company announced a three-year restructuring program with the objectives of leveraging the Company's global scale, realigning and

lowering its cost structure, and optimizing capacity utilization. In January 2006, the Company announced plans to expand its restructuring efforts through 2008.

The entire restructuring program is expected to result in $3.0 billion in pre-tax charges reflecting asset disposals, severance and implementation costs. The

decline of $700 million from the $3.7 billion in pre-tax charges previously announced was due primarily to lower than projected severance costs, the cancellation

of an initiative to generate sales efficiencies, and the sale of one plant that was originally planned to be closed. As part of this program, the Company anticipates

the closure of up to 40 facilities and the elimination of approximately 14,000 positions. Approximately $1.9 billion of the $3.0 billion in pre-tax charges are

expected to require cash payments. Pre-tax restructuring program charges, including implementation costs for the years ended December 31, 2006, 2005 and

2004 were $673 million, $297 million and $641 million, respectively. Total pre-tax restructuring charges incurred since the inception of the program in

January 2004 were $1.6 billion.

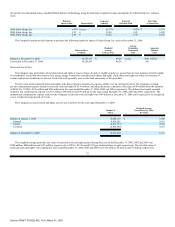

During 2006, the Company announced a seven-year, $1.7 billion agreement to receive information technology services from Electronic Data Systems

("EDS"). The agreement, which includes data centers, web hosting, telecommunications and IT workplace services, began on June 1, 2006. Pursuant to the

agreement, approximately 670 employees, who provided certain IT support to the Company, were transitioned to EDS. As a result of the agreement, in 2006 the

Company incurred pre-tax asset impairment and exit costs of $51 million and implementation costs of $56 million related to the transition. These costs were

included in the pre-tax restructuring program charges discussed above.

65

Source: KRAFT FOODS INC, 10-K, March 01, 2007