Kraft 2006 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2006 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Group, Inc. stockholders in a tax-free transaction. SeeKraft Spin-Off from Altria Group, Inc. within the Description of the Company section above for further

details.

Market Risk

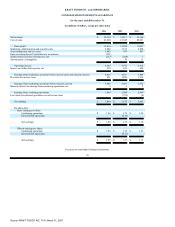

The Company operates globally, with manufacturing and sales facilities in various locations around the world, and utilizes certain financial instruments to

manage its foreign currency and commodity exposures. Derivative financial instruments are used by the Company, principally to reduce exposures to market

risks resulting from fluctuations in foreign exchange rates and commodity prices by creating offsetting exposures. The Company is not a party to leveraged

derivatives and, by policy, does not use financial instruments for speculative purposes.

During the years ended December 31, 2006, 2005 and 2004, ineffectiveness related to cash flow hedges was not material. At December 31, 2006, the

Company was hedging forecasted transactions for periods not exceeding the next fifteen months, and expects substantially all amounts reported in accumulated

other comprehensive earnings (losses) at December 31, 2006 to be reclassified to the consolidated statement of earnings within the next twelve months.

Foreign Exchange Rates. The Company uses forward foreign exchange contracts and foreign currency options to mitigate its exposure to changes in

exchange rates from third-party and intercompany actual and forecasted transactions. Substantially all of the Company's derivative financial instruments are

effective as hedges. The primary currencies to which the Company is exposed, based on the size and location of its businesses, include the euro, Swiss franc,

British pound and Canadian dollar. At December 31, 2006 and 2005, the Company had foreign exchange option and forward contracts with aggregate notional

amounts of $2.6 billion and $2.2 billion, respectively. The effective portion of unrealized gains and losses associated with forward and option contracts is

deferred as a component of accumulated other comprehensive earnings (losses) until the underlying hedged transactions are reported on the Company's

consolidated statement of earnings. In 2007, the Company also anticipates entering into additional hedging instruments to mitigate its exposure to changes in

exchange rates relating to distributions contemplated in advance of theKraft Spin-Off from Altria Group, Inc., as referred to within the Description of the

Company section above.

Commodities. The Company is exposed to price risk related to forecasted purchases of certain commodities used as raw materials by its businesses.

Accordingly, the Company uses commodity forward contracts as cash flow hedges, primarily for coffee, milk, sugar and cocoa. In general, commodity forward

contracts qualify for the normal purchase exception under SFAS No. 133 and are, therefore, not subject to the provisions of SFAS No. 133. In addition,

commodity futures and options are also used to hedge the price of certain commodities, including milk, coffee, cocoa, wheat, corn, sugar, soybean oil, natural gas

and heating oil. For qualifying contracts, the effective portion of unrealized gains and losses on commodity futures and option contracts is deferred as a

component of accumulated other comprehensive earnings (losses) and is recognized as a component of cost of sales in the Company's consolidated statement of

earnings when the related inventory is sold. Unrealized gains or losses on net commodity positions were immaterial at December 31, 2006 and 2005. At

December 31, 2006 and 2005, the Company had net long commodity positions of $533 million and $521 million, respectively.

Value at Risk. The Company uses a value at risk ("VAR") computation to estimate the potential one-day loss in the fair value of its interest rate-sensitive

financial instruments and to estimate the potential one-day loss in pre-tax earnings of its foreign currency and commodity price-sensitive derivative financial

instruments. The VAR computation includes the Company's debt; short-term investments; foreign currency forwards, swaps and options; and commodity futures,

forwards and options. Anticipated transactions, foreign currency trade payables and receivables, and net investments in foreign subsidiaries, which the foregoing

instruments are intended to hedge, were excluded from the computation.

50

Source: KRAFT FOODS INC, 10-K, March 01, 2007