Kraft 2006 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2006 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

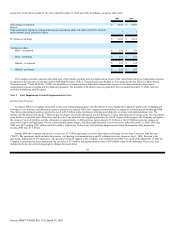

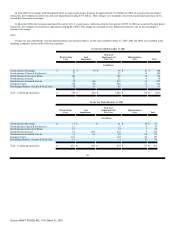

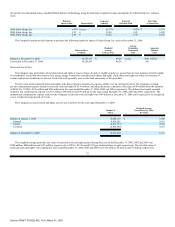

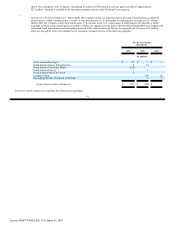

Note 8. Short-Term Borrowings and Borrowing Arrangements:

At December 31, 2006 and 2005, the Company's short-term borrowings and related average interest rates consisted of the following:

2006

2005

Amount

Outstanding

Average

Year-End

Rate

Amount

Outstanding

Average

Year-End

Rate

(in millions)

Commercial paper $ 1,250 5.4% $ 407 4.3%

Bank loans 465 6.5 398 5.5

$ 1,715 $ 805

The fair values of the Company's short-term borrowings at December 31, 2006 and 2005, based upon current market interest rates, approximate the amounts

disclosed above.

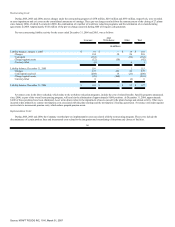

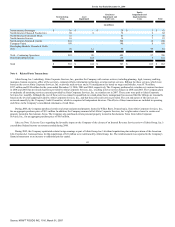

The Company maintains revolving credit facilities that have historically been used to support the issuance of commercial paper. At December 31, 2006, the

Company had a $4.5 billion, multi-year revolving credit facility that expires in April 2010 on which no amounts were drawn.

The Company's revolving credit facility, which is for its sole use, requires the maintenance of a minimum net worth of $20.0 billion. At December 31, 2006,

the Company's net worth was $28.6 billion. The Company expects to continue to meet this covenant. The revolving credit facility does not include any other

financial tests, any credit rating triggers or any provisions that could require the posting of collateral.

In addition to the above, certain international subsidiaries of Kraft maintain credit lines to meet the short-term working capital needs of the international

businesses. These credit lines, which amounted to approximately $1.1 billion as of December 31, 2006, are for the sole use of the Company's international

businesses. Borrowings on these lines amounted to approximately $200 million and $400 million at December 31, 2006 and 2005, respectively. At December 31,

2006 the Company also had approximately $0.3 billion of outstanding short-term debt related to its United Biscuits acquisition discussed in Note 6.Acquisitions.

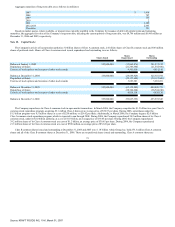

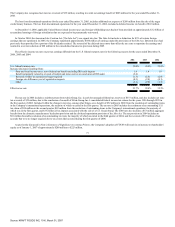

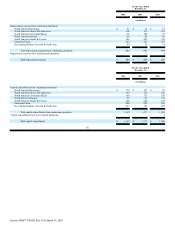

Note 9. Long-Term Debt:

At December 31, 2006 and 2005, the Company's long-term debt consisted of the following:

2006

2005

(in millions)

Notes, 4.00% to 7.55% (average effective rate 5.62%), due through 2031 $ 8,290 $ 9,537

7% Debenture (effective rate 11.32%), $200 million face amount, due 2011 170 165

Foreign currency obligations 15 16

Other 24 25

8,499 9,743

Less current portion of long-term debt (1,418) (1,268)

$ 7,081 $ 8,475

72

Source: KRAFT FOODS INC, 10-K, March 01, 2007