Kraft 2006 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2006 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

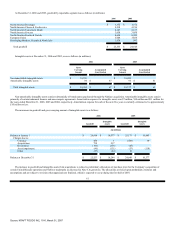

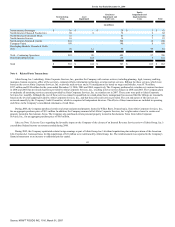

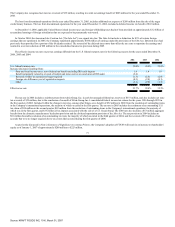

For the Year Ended December 31, 2004

Restructuring

Costs

Asset

Impairment

Total Asset

Impairment and

Exit Costs

Equity

Impairment and

Implementation

Costs

Total

(in millions)

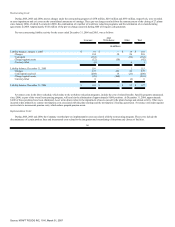

North America Beverages $ 36 $ — $ 36 $ 5 $ 41

North America Cheese & Foodservice 68 8 76 6 82

North America Convenient Meals 41 41 4 45

North America Grocery 16 16 7 23

North America Snacks & Cereals 222 222 18 240

European Union 180 180 8 188

Developing Markets, Oceania & North

Asia 20 12 32 49 81

Total—Continuing Operations 583 20 603 97 700

Discontinued Operations 124 124 8 132

Total $ 583 $ 144 $ 727 $ 105 $ 832

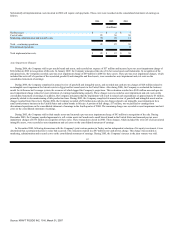

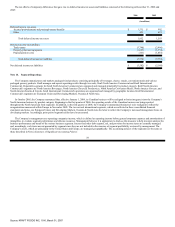

Note 4. Related Party Transactions:

Altria Group, Inc.'s subsidiary, Altria Corporate Services, Inc., provides the Company with various services, including planning, legal, treasury, auditing,

insurance, human resources, office of the secretary, corporate affairs, information technology, aviation and tax services. Billings for these services, which were

based on the cost to Altria Corporate Services, Inc. to provide such services and a 5% management fee based on wages and benefits, were $178 million,

$237 million and $310 million for the years ended December 31, 2006, 2005 and 2004, respectively. The Company performed at a similar cost various functions

in 2006 and 2005 that previously had been provided by Altria Corporate Services, Inc., resulting in lower service charges in 2006 and 2005. The Company plans

to undertake all remaining services currently provided by Altria Corporate Services, Inc. at a similar cost in 2007. These costs were paid to Altria Corporate

Services, Inc. monthly. Although the cost of these services cannot be quantified on a stand-alone basis, management has assessed that the billings are reasonable

based on the level of support provided by Altria Corporate Services, Inc., and that they reflect all services provided. The cost and nature of the services are

reviewed annually by the Company's Audit Committee, which is comprised of independent directors. The effects of these transactions are included in operating

cash flows in the Company's consolidated statements of cash flows.

During 2006, the Company purchased certain real estate and personal property located in Wilkes Barre, Pennsylvania, from Altria Corporate Services, Inc.,

for an aggregate purchase price of $9.3 million. In addition, the Company assumed all of Altria Corporate Services, Inc.'s rights under a lease for certain real

property located in San Antonio, Texas. The Company also purchased certain personal property located in San Antonio, Texas from Altria Corporate

Services, Inc., for an aggregate purchase price of $6.0 million.

Also, see Note 13.Income Taxes regarding the favorable impact to the Company of the closure of an Internal Revenue Service review of Altria Group, Inc.'s

consolidated federal income tax return recorded during 2006.

During 2005, the Company repatriated certain foreign earnings as part of Altria Group, Inc.'s dividend repatriation plan under provisions of the American

Jobs Creation Act. Increased taxes for this repatriation of $21 million were reimbursed by Altria Group, Inc. The reimbursement was reported in the Company's

financial statements as an increase to additional paid-in capital.

69

Source: KRAFT FOODS INC, 10-K, March 01, 2007