Kraft 2006 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2006 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

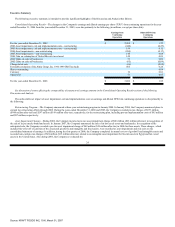

reimburse Altria Group, Inc. in cash for the Black-Scholes fair value of the stock options. To the extent that holders of Altria Group, Inc. stock rights receive

Kraft stock rights, Altria Group, Inc. will pay to the Company the fair value of the Kraft stock rights less the value of projected forfeitures. Based upon the

number of Altria Group, Inc. stock awards outstanding at December 31, 2006, the net amount of these reimbursements would be a payment of approximately

$133 million from the Company to Altria Group, Inc. Based upon the number of Altria Group, Inc. stock awards outstanding at December 31, 2006, the

Company would have to issue 28 million stock options and 3 million shares of restricted stock and stock rights. The Company estimates that the issuance of these

awards would result in an approximate $0.02 decrease in diluted earnings per share. However, these estimates are subject to change as stock awards vest (in the

case of restricted stock) or are exercised (in the case of stock options) prior to the Record Date for the distribution.

As discussed in Note 2.Summary of Significant Accounting Policies, the Company is currently included in the Altria Group, Inc. consolidated federal

income tax return, and federal income tax contingencies are recorded as liabilities on the balance sheet of Altria Group, Inc. Prior to the distribution of Kraft

shares, Altria Group, Inc. will reimburse the Company in cash for these liabilities, which are approximately $300 million, plus interest.

As discussed in Note 4.Related Party Transactions, a subsidiary of Altria Group, Inc. currently provides the Company with certain services at cost plus a

5% management fee. After the Distribution Date, the Company will undertake these activities, and any remaining limited services provided by a subsidiary of

Altria Group, Inc. will cease in 2007. All intercompany accounts will be settled in cash within 30 days of the Distribution Date.

Other:

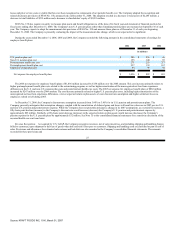

In October 2005, the Company announced that, effective January 1, 2006, its Canadian business would be realigned to better integrate it into the Company's

North American business by product category. Beginning in the first quarter of 2006, the operating results of the Canadian business were being reported

throughout the North American food segments. Kraft North America Commercial's segments are North America Beverages; North America Cheese &

Foodservice; North America Convenient Meals; North America Grocery; and North America Snacks & Cereals. In addition, in the first quarter of 2006, the

Company's international businesses were realigned to reflect the reorganization announced within Europe in November 2005. The two revised international

segments are European Union; and Developing Markets, Oceania & North Asia, the latter to reflect the Company's increased management focus on developing

markets. Accordingly, prior period segment results have been restated.

In June 2005, the Company sold substantially all of its sugar confectionery business for pre-tax proceeds of approximately $1.4 billion. The Company has

reflected the results of its sugar confectionery business prior to the closing date as discontinued operations on the consolidated statements of earnings. The

Company recorded a loss on sale of discontinued operations of $297 million in the second quarter of 2005, related largely to taxes on the transaction.

The Company's operating subsidiaries generally report year-end results as of the Saturday closest to the end of each year. This resulted in fifty-three weeks

of operating results in the Company's consolidated statement of earnings for the year ended December 31, 2005, versus fifty-two weeks for the years ended

December 31, 2006 and 2004.

23

Source: KRAFT FOODS INC, 10-K, March 01, 2007