Kraft 2006 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2006 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

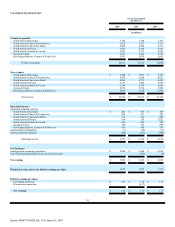

2006 compared with 2005

The following discussion compares consolidated operating results for 2006 with 2005.

The Company's 2005 results included 53 weeks of operating results compared with 52 weeks in 2006. The Company estimates that this extra week

positively impacted net revenues and operating income by approximately 2% in 2005 (approximately $625 million and $100 million, respectively), causing a

negative comparison to 2006.

Volume decreased 961 million pounds (5.0%), including the 53rd week in 2005 results. Excluding the impact of divestitures, the acquisition of UB and the

53rd week of shipments in 2005, volume decreased 0.4%, due primarily to the discontinuation of certain ready-to-drink and foodservice product lines and lower

grocery shipments in North America, partially offset by higher shipments of meat, biscuits and cheese in North America and higher shipments in Developing

Markets, Oceania & North Asia.

Net revenues increased $243 million (0.7%), due primarily to favorable volume/mix ($244 million, including the 53rd week in 2005), higher net pricing

($229 million, reflecting commodity-driven pricing, partially offset by increased promotional spending), favorable currency ($145 million) and the acquisition of

UB ($111 million), partially offset by the impact of divested businesses ($488 million).

Operating income decreased $226 million (4.8%), due primarily to higher pre-tax asset impairment and exit costs ($523 million), 2005 net gains on the sales

of businesses ($108 million), higher marketing costs ($85 million) and the impact of divestitures ($71 million), partially offset by the 2006 gain on redemption of

the Company's UB investment ($251 million), the 2006 net gains on sales of businesses ($117 million), higher net pricing ($72 million, reflecting

commodity-driven pricing, partially offset by increased promotional spending and higher costs), lower fixed manufacturing costs ($40 million), favorable

volume/mix ($32 million, including the 53rd week in 2005), favorable currency ($29 million) and the acquisition of UB ($18 million).

Currency movements increased net revenues by $145 million and operating income by $29 million. These increases were due primarily to the weakness of

the U.S. dollar against the Canadian dollar and the Brazilian real, partially offset by the strength of the U.S. dollar against the euro.

Interest and other debt expense, net decreased $126 million (19.8%) due primarily to $46 million of pre-tax interest income associated with the conclusion

of a tax audit at Altria Group, Inc., lower debt levels and the redemption of higher coupon Nabisco bonds, partially offset by higher short-term interest rates.

The Company's income tax rate decreased by 5.7 percentage points to 23.7%. The 2006 tax rate includes a reimbursement from Altria Group, Inc. in cash

for unrequired federal tax reserves of $337 million, and net state tax reversals of $39 million, due to the conclusion of an audit of Altria Group, Inc.'s

consolidated federal income tax returns for the years 1996 through 1999. Included within the change in tax rates, among other things, are a benefit of $52 million

in 2006 and $82 million in 2005 from the resolution of outstanding items in the Company's international operations. In addition, in 2005 income taxes include

$24 million from the settlement of an outstanding U.S. tax claim, $33 million of tax impacts associated with the sale of a U.S. biscuit brand and a $53 million

aggregate benefit from the domestic manufacturers' deduction provision and the dividend repatriation provision of the Jobs Act.

Earnings from continuing operations of $3,060 million increased $156 million (5.4%), due primarily to the tax benefit discussed above and lower interest

expense, partially offset by lower operating income (reflecting higher asset impairment and exit costs in 2006). Diluted EPS from continuing operations, which

was $1.85, increased by 7.6%.

37

Source: KRAFT FOODS INC, 10-K, March 01, 2007