Kraft 2006 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2006 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

entitled to one vote each, while Class B common shares are entitled to ten votes each. Therefore, Altria Group, Inc. held 98.5% of the combined voting power of

the Company's outstanding capital stock at December 31, 2006. At December 31, 2006, 161,915,095 shares of common stock were reserved for stock options and

other stock awards.

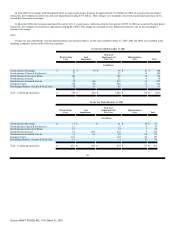

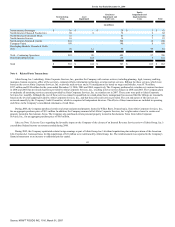

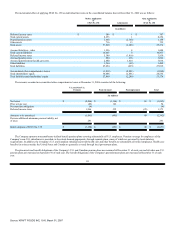

Note 11. Stock Plans:

Under the Kraft 2005 Performance Incentive Plan (the "2005 Plan"), the Company may grant to eligible employees awards of stock options, stock

appreciation rights, restricted stock, restricted and deferred stock units, and other awards based on the Company's Class A common stock, as well as

performance-based annual and long-term incentive awards. A maximum of 150 million shares of the Company's Class A common stock may be issued under the

2005 Plan, of which no more than 45 million shares may be awarded as restricted stock. In addition, in 2006, the Company's Board of Directors adopted and the

stockholders approved, the Kraft 2006 Stock Compensation Plan for Non-Employee Directors (the "2006 Directors Plan"). The 2006 Directors Plan replaced the

Kraft 2001 Directors Plan. Under the 2006 Directors Plan, the Company may grant up to 500,000 shares of Class A common stock to members of the Board of

Directors who are not full-time employees of the Company or Altria Group, Inc., or their subsidiaries, over a five-year period. Shares available to be granted

under the 2005 Plan and the 2006 Directors Plan at December 31, 2006, were 143,669,750 and 481,555, respectively. Restricted shares available for grant under

the 2005 Plan at December 31, 2006, were 38,669,750.

Generally, stock options are granted at an exercise price equal to the market value of the underlying stock on the date of the grant, become exercisable on

the first anniversary of the grant date and have a maximum term of ten years. However, the Company has not granted stock options to its employees since 2002.

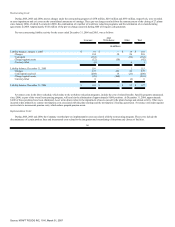

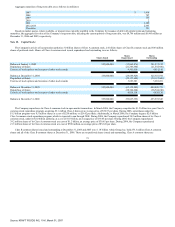

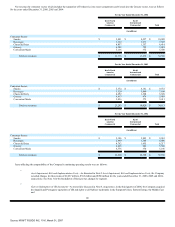

Stock Option Plan:

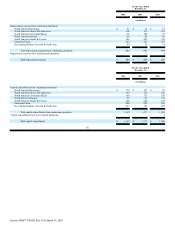

Stock option activity was as follows for the year ended December 31, 2006:

Shares Subject

to Option

Weighted

Average

Exercise Price

Average

Remaining

Contractual

Term

Aggregate

Intrinsic

Value

Balance at January 1, 2006 15,145,840 $ 31.00

Options exercised (1,779,049) 31.00

Options cancelled (388,640) 31.00

Balance at December 31, 2006 12,978,151 31.00 4 years $61 million

Exercisable at December 31, 2006 12,978,151 31.00 4 61

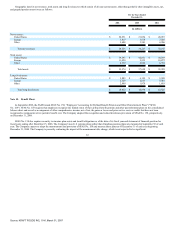

The total intrinsic value of options exercised was $6.7 million, $0.6 million and $3.4 million during the years ended December 31, 2006, 2005 and 2004,

respectively.

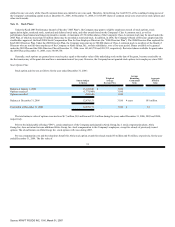

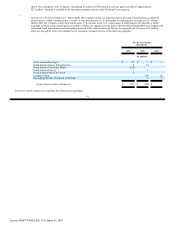

Prior to the initial public offering ("IPO"), certain employees of the Company participated in Altria Group, Inc.'s stock compensation plans. Altria

Group, Inc. does not intend to issue additional Altria Group, Inc. stock compensation to the Company's employees, except for reloads of previously issued

options. The reload feature on Altria Group, Inc. stock options will cease during 2007.

Pre-tax compensation cost and the related tax benefit for Altria stock option awards for reloads totaled $3 million and $1 million, respectively, for the year

ended December 31, 2006. The fair value of

74

Source: KRAFT FOODS INC, 10-K, March 01, 2007