Kraft 2006 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2006 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

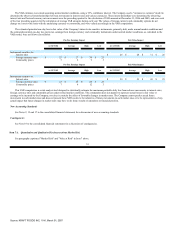

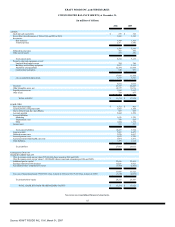

The VAR estimates were made assuming normal market conditions, using a 95% confidence interval. The Company used a "variance/co-variance" model to

determine the observed interrelationships between movements in interest rates and various currencies. These interrelationships were determined by observing

interest rate and forward currency rate movements over the preceding quarter for the calculation of VAR amounts at December 31, 2006 and 2005, and over each

of the four preceding quarters for the calculation of average VAR amounts during each year. The values of foreign currency and commodity options do not

change on a one-to-one basis with the underlying currency or commodity, and were valued accordingly in the VAR computation.

The estimated potential one-day loss in fair value of the Company's interest rate-sensitive instruments, primarily debt, under normal market conditions and

the estimated potential one-day loss in pre-tax earnings from foreign currency and commodity instruments under normal market conditions, as calculated in the

VAR model, were as follows (in millions):

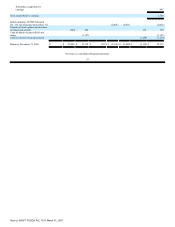

Pre-Tax Earnings Impact

Fair Value Impact

At 12/31/06

Average

High

Low

At 12/31/06

Average

High

Low

Instruments sensitive to:

Interest rates $ 26 $ 28 $ 31 $ 26

Foreign currency rates $ 25 $ 27 $ 36 $ 23

Commodity prices 3 6 9 3

Pre-Tax Earnings Impact

Fair Value Impact

At 12/31/05

Average

High

Low

At 12/31/05

Average

High

Low

Instruments sensitive to:

Interest rates $ 29 $ 39 $ 45 $ 29

Foreign currency rates $ 23 $ 25 $ 28 $ 23

Commodity prices 7 6 12 3

This VAR computation is a risk analysis tool designed to statistically estimate the maximum probable daily loss from adverse movements in interest rates,

foreign currency rates and commodity prices under normal market conditions. The computation does not purport to represent actual losses in fair value or

earnings to be incurred by the Company, nor does it consider the effect of favorable changes in market rates. The Company cannot predict actual future

movements in such market rates and does not present these VAR results to be indicative of future movements in such market rates or to be representative of any

actual impact that future changes in market rates may have on its future results of operations or financial position.

New Accounting Standards

See Notes 2, 15 and 17 to the consolidated financial statements for a discussion of new accounting standards.

Contingencies

See Note 18 to the consolidated financial statements for a discussion of contingencies.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk.

See paragraphs captioned "Market Risk" and "Value at Risk" in Item 7 above.

51

Source: KRAFT FOODS INC, 10-K, March 01, 2007