Kraft 2006 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2006 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

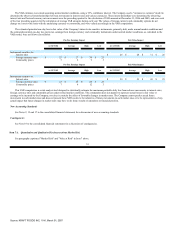

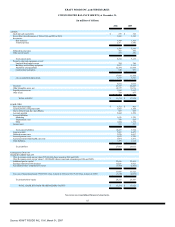

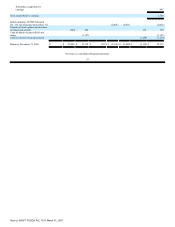

Aggregate Contractual Obligations. The following table summarizes the Company's contractual obligations at December 31, 2006:

Payments Due

Total

2007

2008-09

2010-11

2012 and

Thereafter

(in millions)

Long-term debt(1) $ 8,530 $ 1,418 $ 1,462 $ 2,204 $ 3,446

Interest expense(2) 2,269 438 763 656 412

Operating leases(3) 930 244 349 197 140

Purchase obligations(4):

Inventory and production costs 3,597 2,969 557 55 16

Other 771 675 79 12 5

4,368 3,644 636 67 21

Other long-term liabilities(5) 2,274 221 456 451 1,146

$ 18,371 $ 5,965 $ 3,666 $ 3,575 $ 5,165

(1)

Amounts represent the expected cash payments of the Company's long-term debt and do not include unamortized bond premiums or discounts.

(2)

Amounts represent the expected cash payments of the Company's interest expense on its long-term debt. Due to the complex nature of forecasting

expected variable rate interest payments on the Company's insignificant balance of variable rate long-term debt, those amounts are not included in the

table.

(3)

Operating leases represent the minimum rental commitments under non-cancelable operating leases. The Company has no significant capital lease

obligations.

(4)

Purchase obligations for inventory and production costs (such as raw materials, indirect materials and supplies, packaging, co-manufacturing

arrangements, storage and distribution) are commitments for projected needs to be utilized in the normal course of business. Other purchase

obligations include commitments for marketing, advertising, capital expenditures, information technology and professional services. Arrangements are

considered purchase obligations if a contract specifies all significant terms, including fixed or minimum quantities to be purchased, a pricing structure

and approximate timing of the transaction. Most arrangements are cancelable without a significant penalty, and with short notice (usually 30 days).

Any amounts reflected on the consolidated balance sheet as accounts payable and accrued liabilities are excluded from the table above.

(5)

Other long-term liabilities primarily consist of postretirement health care costs. The following long-term liabilities included on the consolidated

balance sheet are excluded from the table above: accrued pension costs, income taxes, minority interest, insurance accruals and other accruals. The

Company is unable to estimate the timing of the payments (or contributions in the case of accrued pension costs) for these items. Currently, the

Company anticipates making U.S. pension contributions of approximately $16 million in 2007 and non-U.S. pension contributions of approximately

$157 million in 2007, based on current tax law (as discussed in Note 15 to the consolidated financial statements).

The Company believes that its cash from operations and existing credit facility will provide sufficient liquidity to meet its working capital needs (including

the cash requirements of the restructuring program), planned capital expenditures, future contractual obligations and payment of its anticipated quarterly

dividends.

48

Source: KRAFT FOODS INC, 10-K, March 01, 2007