Kraft 2006 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2006 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

losses and prior service costs or credits that have not been recognized as components of net periodic benefit cost. The Company adopted the recognition and

related disclosure provisions of SFAS No. 158, prospectively, on December 31, 2006. The adoption resulted in a decrease to total assets of $2,286 million, a

decrease to total liabilities of $235 million and a decrease to shareholders' equity of $2,051 million.

SFAS No. 158 also requires an entity to measure plan assets and benefit obligations as of the date of its fiscal year-end statement of financial position for

fiscal years ending after December 15, 2008. The Company's non-U.S. pension plans (other than Canadian pension plans) are measured at September 30 of each

year. The Company expects to adopt the measurement date provision of SFAS No. 158 and measure these plans as of December 31 of each year beginning

December 31, 2008. The Company is presently evaluating the impact of the measurement date change, which is not expected to be significant.

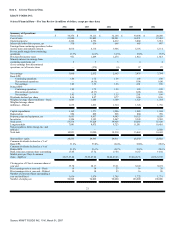

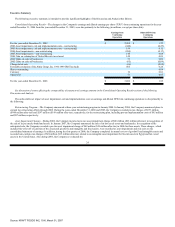

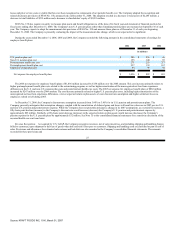

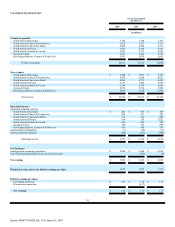

During the years ended December 31, 2006, 2005 and 2004, the Company recorded the following amounts in the consolidated statements of earnings for

employee benefit plans:

2006

2005

2004

(in millions)

U.S. pension plan cost $ 289 $ 256 $ 46

Non-U.S. pension plan cost 155 140 93

Postretirement health care cost 271 253 237

Postemployment benefit plan cost 237 139 167

Employee savings plan cost 84 94 92

Net expense for employee benefit plans $ 1,036 $ 882 $ 635

The 2006 net expense for employee benefit plans of $1,036 million increased by $154 million over the 2005 amount. This cost increase primarily relates to

higher postemployment benefit plan costs related to the restructuring program, as well as higher amortization of the unrecognized net loss from experience

differences in the U.S. and non-U.S. pension plan costs and postretirement health care costs. The 2005 net expense for employee benefit plans of $882 million

increased by $247 million over the 2004 amount. The cost increase primarily related to higher U.S. pension plan costs, including higher amortization of the

unrecognized net loss from experience differences, a lower expected return on plan assets, a lower discount rate assumption and higher settlement losses as

employees retired or left during 2005.

At December 31, 2006, the Company's discount rate assumption increased from 5.60% to 5.90% for its U.S. pension and postretirement plans. The

Company presently anticipates that assumption changes, coupled with the amortization of deferred gains and losses will result in a decrease in 2007 pre-tax U.S.

and non-U.S. pension and postretirement expense. While the Company does not presently anticipate a change in its 2007 assumptions, as a sensitivity measure, a

fifty-basis point decline (increase) in the Company's discount rate would increase (decrease) the Company's U.S. pension and postretirement expense by

approximately $85 million. Similarly, a fifty-basis point decrease (increase) in the expected return on plan assets would increase (decrease) the Company's

pension expense for the U.S. pension plans by approximately $32 million. See Note 15 to the consolidated financial statements for a sensitivity discussion of the

assumed health care cost trend rates.

Revenue Recognition. As required by U.S. GAAP, the Company recognizes revenues, net of sales incentives, and including shipping and handling charges

billed to customers, upon shipment or delivery of goods when title and risk of loss pass to customers. Shipping and handling costs are classified as part of cost of

sales. Provisions and allowances for estimated sales returns and bad debts are also recorded in the Company's consolidated financial statements. The amounts

recorded for these provisions and

27

Source: KRAFT FOODS INC, 10-K, March 01, 2007