Kraft 2006 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2006 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

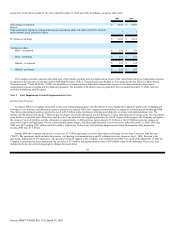

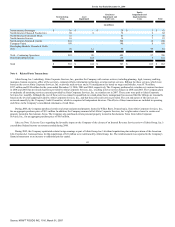

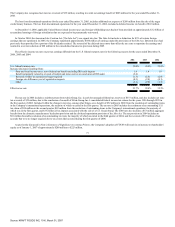

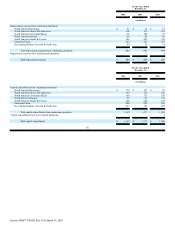

the awards was determined using a modified Black-Scholes methodology using the following weighted average assumptions for Altria Group, Inc. common

stock:

Risk-Free

Interest Rate

Expected Life

Expected

Volatility

Expected

Dividend Yield

Fair Value

at Grant Date

2006 Altria Group, Inc. 4.87% 4 years 26.73% 4.43% $ 12.79

2005 Altria Group, Inc. 3.87 4 32.90 4.43 14.08

2004 Altria Group, Inc. 2.99 4 36.63 5.39 10.30

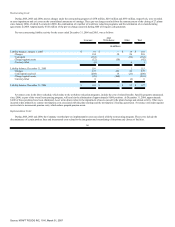

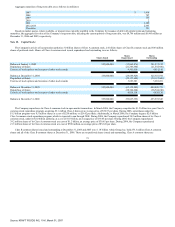

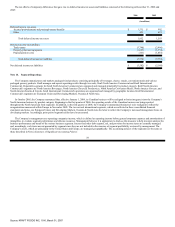

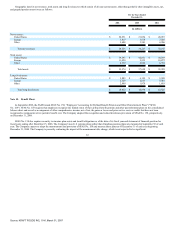

The Company's employees held options to purchase the following number of shares of Altria Group, Inc. stock at December 31, 2006:

Shares Subject

to Option

Weighted

Average

Exercise Price

Average

Remaining

Contractual

Term

Aggregate

Intrinsic

Value

Balance at December 31, 2006 14,525,177 $ 40.29 3 years $661 million

Exercisable at December 31, 2006 14,520,835 40.28 3 661

Restricted Stock Plans:

The Company may grant shares of restricted stock and rights to receive shares of stock to eligible employees, giving them in most instances all of the rights

of stockholders, except that they may not sell, assign, pledge or otherwise encumber such shares and rights. Such shares and rights are subject to forfeiture if

certain employment conditions are not met. Restricted stock generally vests on the third anniversary of the grant date.

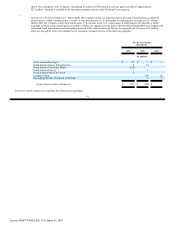

The fair value of the restricted shares and rights at the date of grant is amortized to expense ratably over the restriction period. The Company recorded

pre-tax compensation expense related to restricted stock and rights of $139 million (including the pre-tax cumulative effect gain of $9 million from the adoption

of SFAS No. 123(R)), $148 million and $106 million for the years ended December 31, 2006, 2005 and 2004, respectively. The deferred tax benefit recorded

related to this compensation expense was $51 million, $54 million and $39 million for the years ended December 31, 2006, 2005 and 2004, respectively. The

unamortized compensation expense related to the Company's restricted stock and rights was $184 million at December 31, 2006 and is expected to be recognized

over a weighted average period of 2 years.

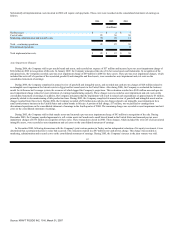

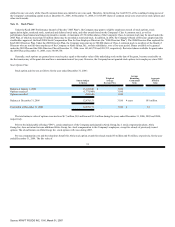

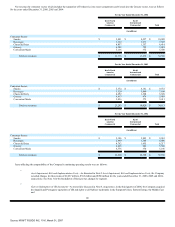

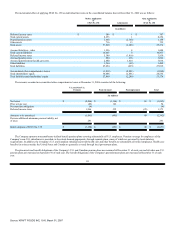

The Company's restricted stock and rights activity was as follows for the year ended December 31, 2006:

Number of

Shares

Weighted-Average

Grant Date Fair Value

Per Share

Balance at January 1, 2006 15,085,116 $ 33.80

Granted 6,850,265 29.16

Vested (4,213,377) 36.29

Forfeited (2,446,584) 32.07

Balance at December 31, 2006 15,275,420 31.31

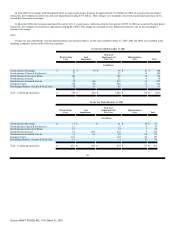

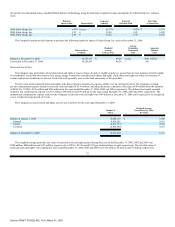

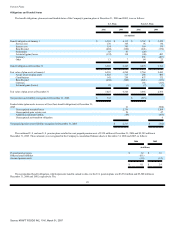

The weighted-average grant date fair value of restricted stock and rights granted during the years ended December 31, 2006, 2005 and 2004 was

$200 million, $200 million and $195 million, respectively, or $29.16, $33.26 and $32.23 per restricted share or right, respectively. The total fair value of

restricted stock and rights vested during the years ended December 31, 2006, 2005 and 2004 was $123 million, $2 million and $1 million, respectively.

75

Source: KRAFT FOODS INC, 10-K, March 01, 2007