Kraft 2006 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2006 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

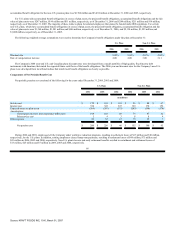

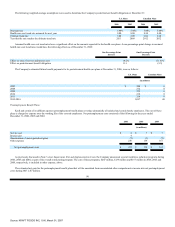

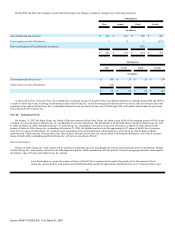

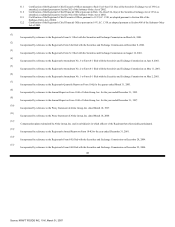

During 2006 and 2005, the Company recorded the following pre-tax charges or (gains) in earnings from continuing operations:

2006 Quarters

First

Second

Third

Fourth

(in millions)

Asset impairment and exit costs $ 202 $ 226 $ 125 $ 449

Losses (gains) on sales of businesses 3 8 3 (131)

Gain on redemption of United Biscuits investment (251)

$ 205 $ 234 $ (123) $ 318

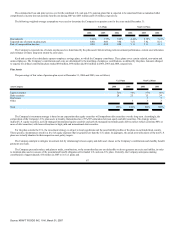

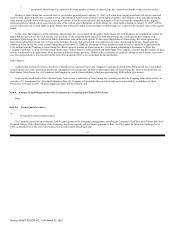

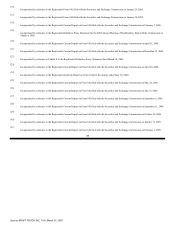

2005 Quarters

First

Second

Third

Fourth

(in millions)

Asset impairment and exit costs $ 150 $ 29 $ 26 $ 274

(Gains) losses on sales of businesses (116) 1 7

$ 34 $ 30 $ 26 $ 281

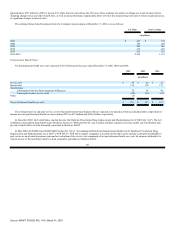

As discussed in Note 13.Income Taxes, the Company has recognized income tax benefits in the consolidated statements of earnings during 2006 and 2005 as

a result of various tax events, including a reimbursement from Altria Group, Inc. in cash for unrequired federal tax reserves and net state tax reversals due to the

conclusion of an audit of Altria Group, Inc.'s consolidated federal income tax returns for the years 1996 through 1999, and benefits earned under the provisions

of the American Jobs Creation Act.

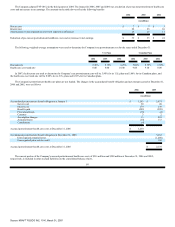

Note 20. Subsequent Event:

On January 31, 2007, the Altria Group, Inc. Board of Directors announced that Altria Group, Inc. plans to spin off all of its remaining interest (89.0%) in the

Company on a pro rata basis to Altria Group, Inc. stockholders in a tax-free transaction. The distribution of all the Kraft shares owned by Altria Group, Inc. will

be made on March 30, 2007 ("Distribution Date"), to Altria Group, Inc. stockholders of record as of the close of business on March 16, 2007. Based on the

number of shares of Altria Group, Inc. outstanding at December 31, 2006, the distribution ratio would be approximately 0.7 shares of Kraft Class A common

stock for every share of Altria Group, Inc. common stock outstanding. Prior to the distribution, Altria Group, Inc. will convert its Class B shares of Kraft

common stock, which carry ten votes per share, into Class A shares of Kraft, which carry one vote per share. Following the distribution, only Class A common

shares of Kraft will be outstanding and Altria Group, Inc. will not own any shares of Kraft.

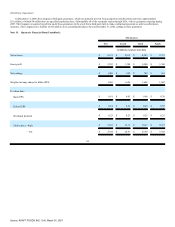

Stock Compensation:

Holders of Altria Group, Inc. stock options will be treated as stockholders and will, accordingly, have their stock awards split into two instruments. Holders

of Altria Group, Inc. stock options will receive the following stock options, which, immediately after the spin-off, will have an aggregate intrinsic value equal to

the intrinsic value of the pre-spin Altria Group, Inc. options:

•

a new Kraft option to acquire the number of shares of Kraft Class A common stock equal to the product of (a) the number of Altria

Group, Inc. options held by such person on the Distribution Date and (b) the approximate distribution ratio of 0.7 mentioned above; and

96

Source: KRAFT FOODS INC, 10-K, March 01, 2007