Kraft 2006 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2006 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Company, which cannot currently be utilized on a separate company basis, are utilized in Altria Group, Inc.'s consolidated federal income tax return, the benefit

is recognized in the calculation of the Company's provision for income taxes. Based on the Company's current estimate, this benefit is calculated to be

approximately $195 million, $225 million and $70 million for the years ended December 31, 2006, 2005 and 2004, respectively. The amounts in 2005 and 2006

include dividend repatriations and the impact of certain legal entity reorganizations. The benefit is dependent on a variety of tax attributes that have a tendency to

vary year to year. The Company makes payments to, or is reimbursed by, Altria Group, Inc. for the tax effects resulting from its inclusion in Altria Group, Inc.'s

consolidated federal income tax return including current taxes payable and net changes in tax provisions. The Company is assessing opportunities to mitigate the

loss of tax benefits upon Altria Group, Inc.'s distribution of its Kraft shares, and currently estimates the annual amount of lost tax benefits to be in the range of

$50 million to $75 million.

Significant judgment is required in determining income tax provisions and in evaluating tax positions. The Company establishes additional provisions for

income taxes when, despite the belief that existing tax positions are fully supportable, there remain certain positions that are likely to be challenged and that may

not be sustained on review by tax authorities. The Company evaluates and potentially adjusts these provisions in light of changing facts and circumstances. The

consolidated tax provision includes the impact of changes to accruals that are deemed necessary. The Company expects its effective tax rate to average 35.5% in

2007 (up from 31.7% in 2006), excluding the impact of changes for asset impairment, exit and implementation costs, and one-time gains and losses related to

acquisitions and divestitures.

In 2006, the United States Internal Revenue Service concluded its examination of Altria Group, Inc.'s consolidated tax returns for the years 1996 through

1999 and issued a final Revenue Agents Report on March 15, 2006. Consequently, Altria Group, Inc. reimbursed the Company in cash for unrequired federal tax

reserves of $337 million and pre-tax interest of $46 million ($29 million after-tax). The Company also recognized net state tax reversals of $39 million, resulting

in a total net earnings benefit of $405 million or $0.24 per diluted share during 2006.

In October 2004, the American Jobs Creation Act ("the Jobs Act") was signed into law. The Jobs Act includes a deduction for 85% of certain foreign

earnings that are repatriated. In 2005, the Company repatriated approximately $500 million of earnings under the provisions of the Jobs Act. Deferred taxes had

previously been provided for a portion of the dividends to be remitted. The reversal of the deferred taxes more than offset the tax costs to repatriate the earnings

and resulted in a net tax reduction of $28 million in the consolidated income tax provision during 2005.

In July 2006, the FASB issued FASB Interpretation No. 48, "Accounting for Uncertainty in Income Taxes—an interpretation of FASB Statement No. 109"

("FIN 48"), which will become effective for the Company on January 1, 2007. The Interpretation prescribes a recognition threshold and a measurement attribute

for the financial statement recognition and measurement of tax positions taken or expected to be taken in a tax return. For those benefits to be recognized, a tax

position must be more-likely-than-not to be sustained upon examination by taxing authorities. The amount recognized is measured as the largest amount of

benefit that is greater than 50 percent likely of being realized upon ultimate settlement. The adoption of FIN 48 will result in an increase to shareholders' equity

as of January 1, 2007 of approximately $200 million to $225 million.

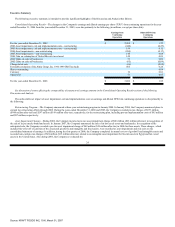

Consolidation. The consolidated financial statements include Kraft Foods Inc., as well as its wholly-owned and majority-owned subsidiaries. Investments

in which Kraft Foods Inc. exercises significant influence (20% - 50% ownership interest), are accounted for under the equity method of accounting. Investments

in which the Company has an ownership interest of less than 20%, or does not exercise significant influence, are accounted for by the cost method of accounting.

All intercompany transactions and balances between and among Kraft's subsidiaries have been eliminated. Transactions between any of the Company's

businesses and Altria Group, Inc. and its affiliates are included in the consolidated financial statements.

30

Source: KRAFT FOODS INC, 10-K, March 01, 2007