Kraft 2006 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2006 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

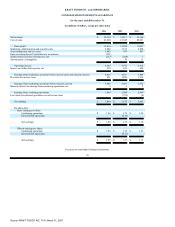

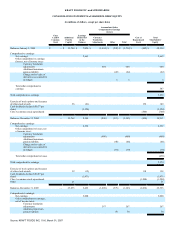

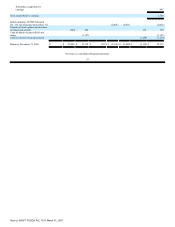

Equity and Dividends

In December 2004, the Company commenced repurchasing shares under a two-year $1.5 billion Class A common stock repurchase program authorized by

its Board of Directors. In March 2006, the Company completed the program, acquiring 49.1 million Class A shares at an average price of $30.57 per share. In

March 2006, the Company's Board of Directors authorized a new share repurchase program to repurchase up to $2.0 billion of the Company's Class A common

stock. This new program is expected to run through 2008. During 2006 and 2005, the Company repurchased 8.5 million and 39.2 million shares, respectively, of

its Class A common stock under its $1.5 billion repurchase program at a cost of $250 million and $1.2 billion, respectively. In addition, as of December 31, 2006,

the Company repurchased 30.2 million shares of its Class A common stock, under its new $2.0 billion authority, at an aggregate cost of $1.0 billion, bringing

total repurchases for 2006 to 38.7 million shares for $1.2 billion.

In February 2007, the Company announced that the Board of Directors authorized a stock repurchase plan pursuant to which the Company may repurchase

shares of the Company's Class A common stock having an aggregate value up to $5 billion through March 2009. The repurchase program will become effective

immediately following the distribution of the approximately 89% of the Company's outstanding shares owned by Altria Group Inc. The program does not

obligate the Company to acquire any particular amount of Class A common stock, it replaces the existing share repurchase program, and it may be suspended at

any time at the Company's discretion.

As discussed in Note 11 to the consolidated financial statements, during 2006 and 2005, the Company granted approximately 4.8 million and 4.2 million

restricted Class A shares, respectively, to eligible U.S.-based employees, and during 2006 and 2005, also issued to eligible non-U.S. employees rights to receive

approximately 2.0 million and 1.8 million Class A equivalent shares, respectively. The market value per restricted share or right was $29.16 and $33.26 on the

dates of the 2006 and 2005 grants, respectively. Restrictions on most of the stock and rights granted in 2006 lapse in the first quarter of 2009, while restrictions

on grants in 2005 lapse in the first quarter of 2008.

Effective January 1, 2006, the Company adopted the provisions of SFAS No. 123 (Revised 2004), "Share-Based Payment," ("SFAS No. 123(R)") using the

modified prospective method, which requires measurement of compensation cost for all stock-based awards at fair value on date of grant and recognition of

compensation over the service periods for awards expected to vest. The fair value of restricted stock and rights to receive shares of stock is determined based on

the number of shares granted and the market value at date of grant. The fair value of stock options is determined using a modified Black-Scholes methodology.

The impact of adoption was not material. At December 31, 2006, the number of shares to be issued upon exercise of outstanding stock options and vesting of

non-U.S. rights to receive equivalent shares (excluding any options or rights to be issued as part of the Company's spin-off from Altria Group, Inc.) was

17.8 million or 1.1% of total Class A and Class B shares outstanding.

Dividends paid in 2006 and 2005 were $1,562 million and $1,437 million, respectively, an increase of 8.7%, reflecting a higher dividend rate in 2006,

partially offset by a lower number of shares outstanding as a result of Class A share repurchases. During the third quarter of 2006, the Company's Board of

Directors approved an 8.7% increase in the current quarterly dividend rate to $0.25 per share on its Class A and Class B common stock. As a result, the present

annualized dividend rate is $1.00 per common share. The declaration of dividends is subject to the discretion of the Company's Board of Directors and will

depend on various factors, including the Company's net earnings, financial condition, cash requirements, future prospects and other factors deemed relevant by

the Company's Board of Directors.

On January 31, 2007, the Altria Group, Inc. Board of Directors announced that Altria Group, Inc. plans to spin off all of its remaining interest (89.0%) in the

Company on a pro rata basis to Altria

49

Source: KRAFT FOODS INC, 10-K, March 01, 2007