Kraft 2006 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2006 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

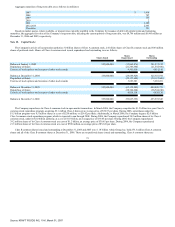

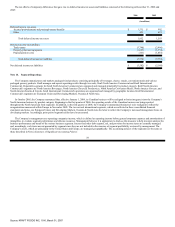

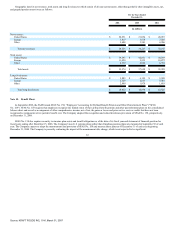

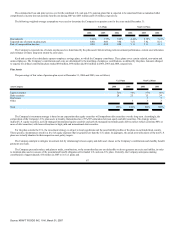

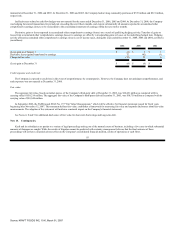

Geographic data for net revenues, total assets and long-lived assets (which consist of all non-current assets, other than goodwill, other intangible assets, net,

and prepaid pension assets) were as follows:

For the Years Ended

December 31,

2006

2005

2004

(in millions)

Net revenues:

United States $ 20,931 $ 21,054 $ 20,057

Europe 7,817 7,678 7,205

Other 5,608 5,381 4,906

Total net revenues $ 34,356 $ 34,113 $ 32,168

Total assets:

United States $ 39,595 $ 42,851 $ 44,293

Europe 11,420 9,935 10,872

Other 4,559 4,842 4,763

Total assets $ 55,574 $ 57,628 $ 59,928

Long-lived assets:

United States $ 5,885 $ 6,153 $ 5,998

Europe 2,528 2,663 3,010

Other 2,009 1,878 1,818

Total long-lived assets $ 10,422 $ 10,694 $ 10,826

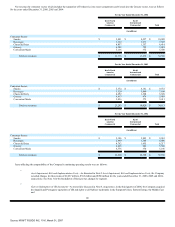

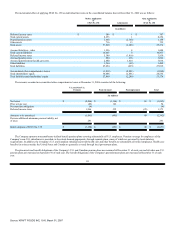

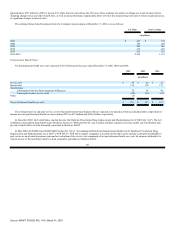

Note 15. Benefit Plans:

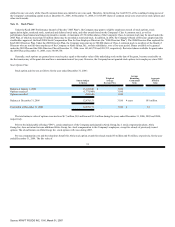

In September 2006, the FASB issued SFAS No. 158, "Employers' Accounting for Defined Benefit Pension and Other Postretirement Plans" ("SFAS

No. 158"). SFAS No. 158 requires that employers recognize the funded status of their defined benefit pension and other postretirement plans on the consolidated

balance sheet and record as a component of other comprehensive income, net of tax, the gains or losses and prior service costs or credits that have not been

recognized as components of net periodic benefit cost. The Company adopted the recognition and related disclosure provisions of SFAS No. 158, prospectively,

on December 31, 2006.

SFAS No. 158 also requires an entity to measure plan assets and benefit obligations as of the date of its fiscal year-end statement of financial position for

fiscal years ending after December 15, 2008. The Company's non-U.S. pension plans (other than Canadian pension plans) are measured at September 30 of each

year. The Company expects to adopt the measurement date provision of SFAS No. 158 and measure these plans as of December 31 of each year beginning

December 31, 2008. The Company is presently evaluating the impact of the measurement date change, which is not expected to be significant.

83

Source: KRAFT FOODS INC, 10-K, March 01, 2007