Kraft 2006 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2006 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Executive Summary

The following executive summary is intended to provide significant highlights of the Discussion and Analysis that follows.

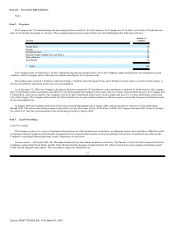

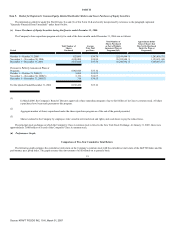

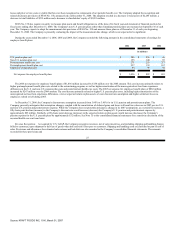

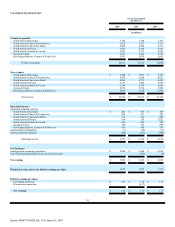

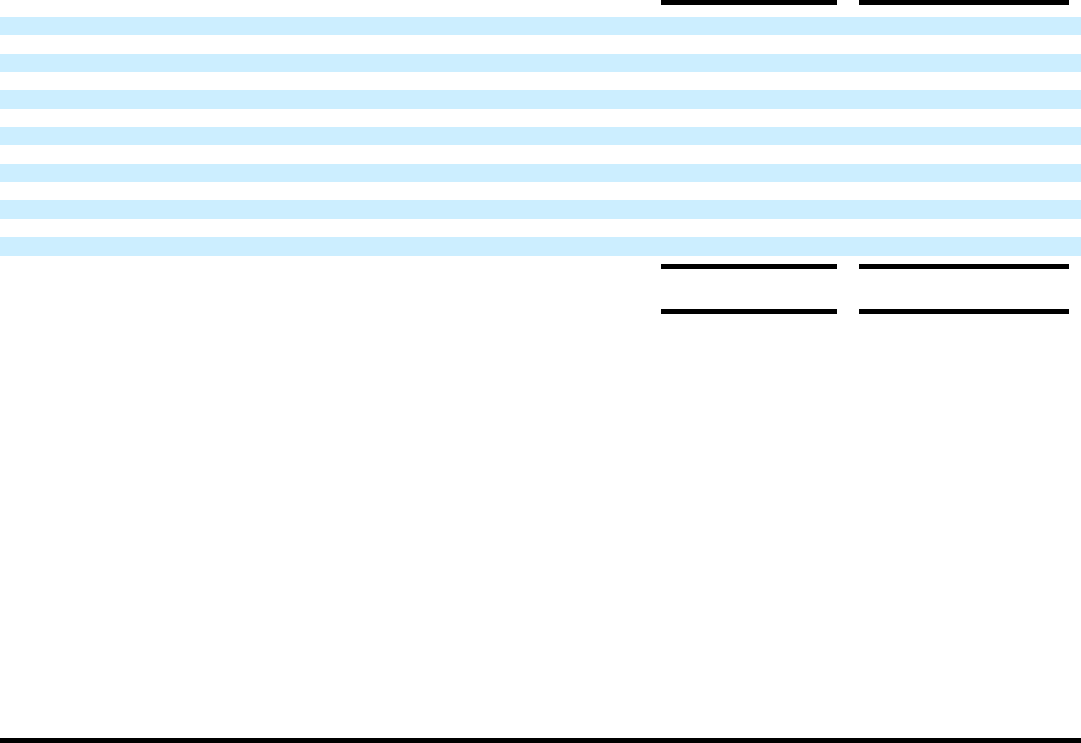

Consolidated Operating Results—The changes in the Company's earnings and diluted earnings per share ("EPS") from continuing operations for the year

ended December 31, 2006 from the year ended December 31, 2005, were due primarily to the following (in millions, except per share data):

Earnings from

Continuing

Operations

Diluted EPS from

Continuing

Operations

For the year ended December 31, 2005 $ 2,904 $ 1.72

2006 Asset impairment, exit and implementation costs—restructuring (444) (0.27)

2005 Asset impairment, exit and implementation costs—restructuring 199 0.12

2006 Asset impairments—non-restructuring (284) (0.17)

2005 Asset impairments—non-restructuring 140 0.08

2006 Gain on redemption of United Biscuits investment 148 0.09

2006 Gains on sales of businesses 31 0.02

2005 Gains on sales of businesses (65) (0.04)

Change in tax rate (66) (0.04)

Favorable resolution of the Altria Group, Inc. 1996-1999 IRS Tax Audit 405 0.24

Shares outstanding 0.04

Currency 19 0.01

Operations 73 0.05

For the year ended December 31, 2006 $ 3,060 $ 1.85

See discussion of events affecting the comparability of statement of earnings amounts in the Consolidated Operating Results section of the following

Discussion and Analysis.

The unfavorable net impact of asset impairment, exit and implementation costs on earnings and diluted EPS from continuing operations is due primarily to

the following:

Restructuring Program—The Company announced a three-year restructuring program in January 2004. In January 2006, the Company announced plans to

expand its restructuring efforts through 2008. During the years ended December 31, 2006 and 2005, the Company recorded pre-tax charges of $673 million

($444 million after-tax) and $297 million ($199 million after-tax), respectively, for the restructuring plan, including pre-tax implementation costs of $95 million

and $87 million, respectively.

Asset Impairment Charges—During 2006, the Company incurred a pre-tax asset impairment charge of $86 million ($63 million after-tax) in recognition of

the sale of its pet snacks brand and assets. In January 2007, the Company announced the sale of its hot cereal assets and trademarks. In recognition of the

anticipated sale, the Company recorded a pre-tax asset impairment charge of $69 million ($49 million after-tax) in 2006 for these assets. These charges, which

included the write-off of a portion of the associated goodwill, and intangible and fixed assets, were recorded as asset impairment and exit costs on the

consolidated statement of earnings. In addition, during the first quarter of 2006, the Company completed its annual review of goodwill and intangible assets and

recorded non-cash pre-tax charges of $24 million ($15 million after-tax) related to an intangible asset impairment for biscuits assets in Egypt and hot cereal

assets in the United States. Also during 2006, the Company re-evaluated the

24

Source: KRAFT FOODS INC, 10-K, March 01, 2007