Kraft 2006 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2006 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

•

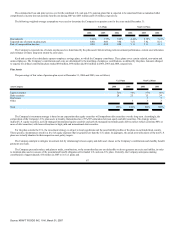

an adjusted Altria Group, Inc. option for the same number of shares of Altria Group, Inc. common stock with a reduced exercise price.

Holders of Altria Group, Inc. restricted stock or stock rights awarded prior to January 31, 2007, will retain their existing award and will receive restricted

stock or stock rights of Kraft Class A common stock. The amount of Kraft restricted stock or stock rights awarded to such holders will be calculated using the

same formula set forth above with respect to new Kraft options. All of the restricted stock and stock rights will not vest until the completion of the original

restriction period (typically, three years from the date of the original grant). Recipients of Altria Group, Inc. stock rights awarded on January 31, 2007, will not

receive restricted stock or stock rights of Kraft. Rather, they will receive additional stock rights of Altria Group, Inc. to preserve the intrinsic value of the original

award.

To the extent that employees of the remaining Altria Group, Inc. receive Kraft stock options, Altria Group, Inc. will reimburse the Company in cash for the

Black-Scholes fair value of the stock options to be received. To the extent that Kraft employees hold Altria Group, Inc. stock options, the Company will

reimburse Altria Group, Inc. in cash for the Black-Scholes fair value of the stock options. To the extent that holders of Altria Group, Inc. stock rights receive

Kraft stock rights, Altria Group, Inc. will pay to the Company the fair value of the Kraft stock rights less the value of projected forfeitures. Based upon the

number of Altria Group, Inc. stock awards outstanding at December 31, 2006, the net amount of these reimbursements would be a payment of approximately

$133 million from the Company to Altria Group, Inc. Based upon the number of Altria Group, Inc. stock awards outstanding at December 31, 2006, the

Company would have to issue 28 million stock options and 3 million shares of restricted stock and stock rights. The Company estimates that the issuance of these

awards would result in an approximate $0.02 decrease in diluted earnings per share. However, these estimates are subject to change as stock awards vest (in the

case of restricted stock) or are exercised (in the case of stock options) prior to the record date for the distribution.

Other Matters:

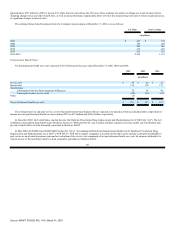

As previously mentioned in Note 2.Summary of Significant Accounting Policies, the Company is currently included in the Altria Group, Inc. consolidated

federal income tax return, and federal income tax contingencies are recorded as liabilities on the balance sheet of Altria Group, Inc. Prior to the distribution of

Kraft shares, Altria Group, Inc. will reimburse the Company in cash for these liabilities, which are approximately $300 million, plus interest.

As previously mentioned in Note 4.Related Party Transactions, a subsidiary of Altria Group, Inc. currently provides the Company with certain services at

cost plus a 5% management fee. After the Distribution Date, the Company will undertake these activities, and services provided by a subsidiary of Altria

Group, Inc. will cease in 2007. All intercompany accounts will be settled in cash.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

None.

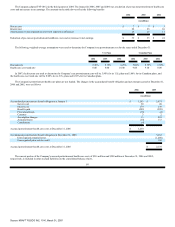

Item 9A. Controls and Procedures.

a)

Disclosure Controls and Procedures

The Company carried out an evaluation, with the participation of the Company's management, including the Company's Chief Executive Officer and Chief

Financial Officer, of the effectiveness of the Company's disclosure controls and procedures (pursuant to Rule 13a-15(e) under the Securities Exchange Act of

1934, as amended) as of the end of the period covered by this report. Based upon that

97

Source: KRAFT FOODS INC, 10-K, March 01, 2007