Kraft 2006 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2006 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

being due to customers and consumers at the end of a period, based principally on historical utilization and redemption rates. For interim reporting purposes,

advertising and consumer incentive expenses are charged to operations as a percentage of volume, based on estimated volume and related expense for the full

year.

Revenue recognition:

The Company recognizes revenues, net of sales incentives and including shipping and handling charges billed to customers, upon shipment or delivery of

goods when title and risk of loss pass to customers. Shipping and handling costs are classified as part of cost of sales.

Software costs:

The Company capitalizes certain computer software and software development costs incurred in connection with developing or obtaining computer software

for internal use. Capitalized software costs are included in property, plant and equipment on the consolidated balance sheets and amortized on a straight-line basis

over the estimated useful lives of the software, which do not exceed five years.

Stock-based compensation:

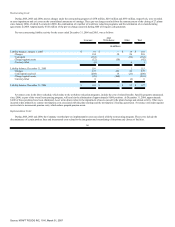

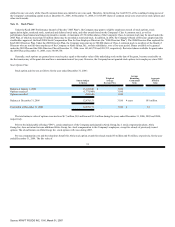

Effective January 1, 2006, the Company adopted the provisions of SFAS No. 123 (Revised 2004), "Share-Based Payment," ("SFAS No. 123(R)") using the

modified prospective method, which requires measurement of compensation cost for all stock-based awards at fair value on date of grant and recognition of

compensation over the service periods for awards expected to vest. The fair value of restricted stock and rights to receive shares of stock is determined based on

the number of shares granted and the market value at date of grant. The fair value of stock options is determined using a modified Black-Scholes methodology.

The impact of adoption was not material.

The adoption of SFAS No. 123(R) resulted in a cumulative effect gain of $6 million, which is net of $3 million in taxes, in the consolidated statement of

earnings for the year ended December 31, 2006. This gain resulted from the impact of estimating future forfeitures on restricted stock and rights to receive shares

of stock in the determination of periodic expense for unvested awards, rather than recording forfeitures only when they occur. The gross cumulative effect was

recorded in marketing, administration and research costs for the year ended December 31, 2006.

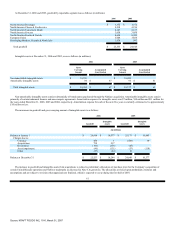

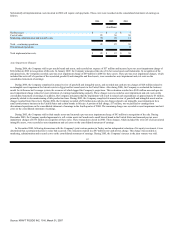

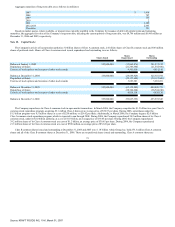

The Company previously applied the recognition and measurement principles of Accounting Principles Board Opinion No. 25, "Accounting for Stock

Issued to Employees," ("APB 25") and provided the pro forma disclosures required by SFAS No. 123, "Accounting for Stock-Based Compensation" ("SFAS

No. 123"). No compensation expense for employee stock options was reflected in net earnings in 2005 and 2004, as all stock options granted under those plans

had an exercise price equal to the market value of the common stock on the date of the grant. Historical consolidated statements of earnings already include the

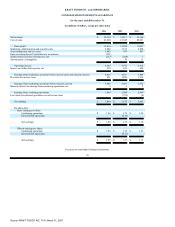

compensation expense for restricted stock and rights to receive shares of stock. The following table illustrates the effect on net earnings and earnings per share

("EPS") if the Company had applied the fair value recognition provisions of SFAS No. 123 to measure compensation

64

Source: KRAFT FOODS INC, 10-K, March 01, 2007