Kraft 2006 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2006 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

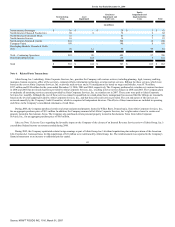

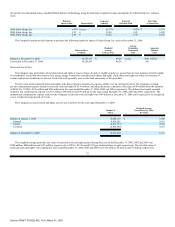

In December 2005, the Company purchased an airport hangar and certain personal property located at the hangar in Milwaukee, Wisconsin, from Altria

Corporate Services, Inc. for an aggregate purchase price of approximately $3.3 million.

In December 2004, the Company purchased two corporate aircraft from Altria Corporate Services, Inc. for an aggregate purchase price of approximately

$47 million. The Company also entered into an Aircraft Management Agreement with Altria Corporate Services, Inc. in December 2004, pursuant to which

Altria Corporate Services, Inc. agreed to perform aircraft management, pilot services, maintenance and other aviation services for the Company.

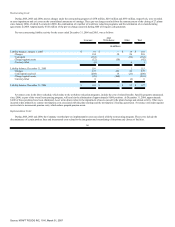

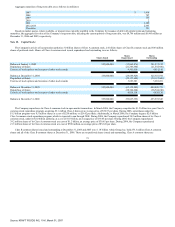

At December 31, 2006 and 2005, the Company had short-term amounts payable to Altria Group, Inc. of $607 million and $652 million, respectively. The

amounts payable to Altria Group, Inc. generally include accrued dividends, taxes and service fees. Interest on intercompany borrowings is based on the

applicable London Interbank Offered Rate.

The fair values of the Company's short-term amounts due to Altria Group, Inc. and affiliates approximate carrying amounts.

Note 5. Divestitures:

Discontinued Operations:

In June 2005, the Company sold substantially all of its sugar confectionery business for pre-tax proceeds of approximately $1.4 billion. The sale included

theLife Savers,Creme Savers,Altoids,Trolli andSugus brands. The Company has reflected the results of its sugar confectionery business prior to the closing date

as discontinued operations on the consolidated statements of earnings.

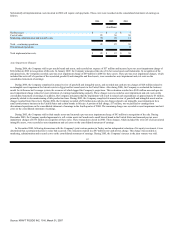

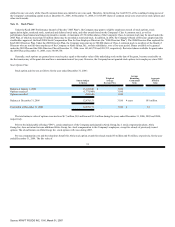

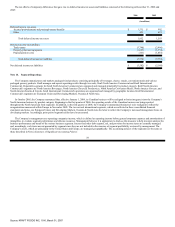

Summary results of operations for the sugar confectionery business were as follows:

For the Years Ended

December 31,

2005

2004

(in millions)

Net revenues $ 228 $ 477

Earnings before income taxes $ 41 $ 103

Impairment loss on assets of discontinued operations held for sale (107)

Provision for income taxes (16)

Loss on sale of discontinued operations (297)

Loss from discontinued operations, net of income taxes $ (272) $ (4)

The loss on sale of discontinued operations, above, for the year ended December 31, 2005, related largely to taxes on the transaction.

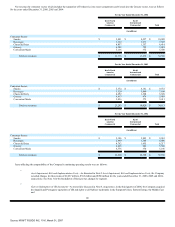

Other:

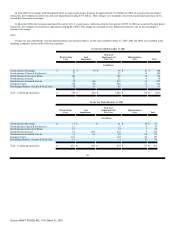

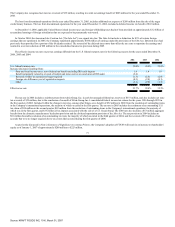

During 2006, the Company sold its rice brand and assets, and its industrial coconut assets. The Company also sold its pet snacks brand and assets in 2006

and recorded tax expense of $57 million related to the sale. In addition, the Company incurred a pre-tax asset impairment charge of $86 million in 2006 in

recognition of this sale. Additionally, during 2006, the Company sold certain Canadian assets and a small U.S. biscuit brand, and incurred pre-tax asset

impairment charges of $176 million in 2005 in recognition of these sales. Also during 2006, the Company sold a U.S. coffee plant. The aggregate proceeds

received from these sales were $946 million, on which the Company recorded pre-tax gains of $117 million.

70

Source: KRAFT FOODS INC, 10-K, March 01, 2007