Kraft 2006 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2006 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

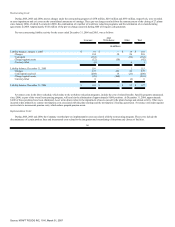

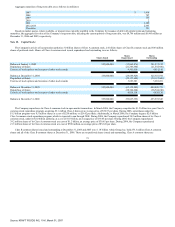

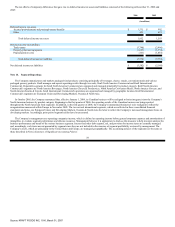

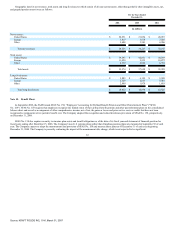

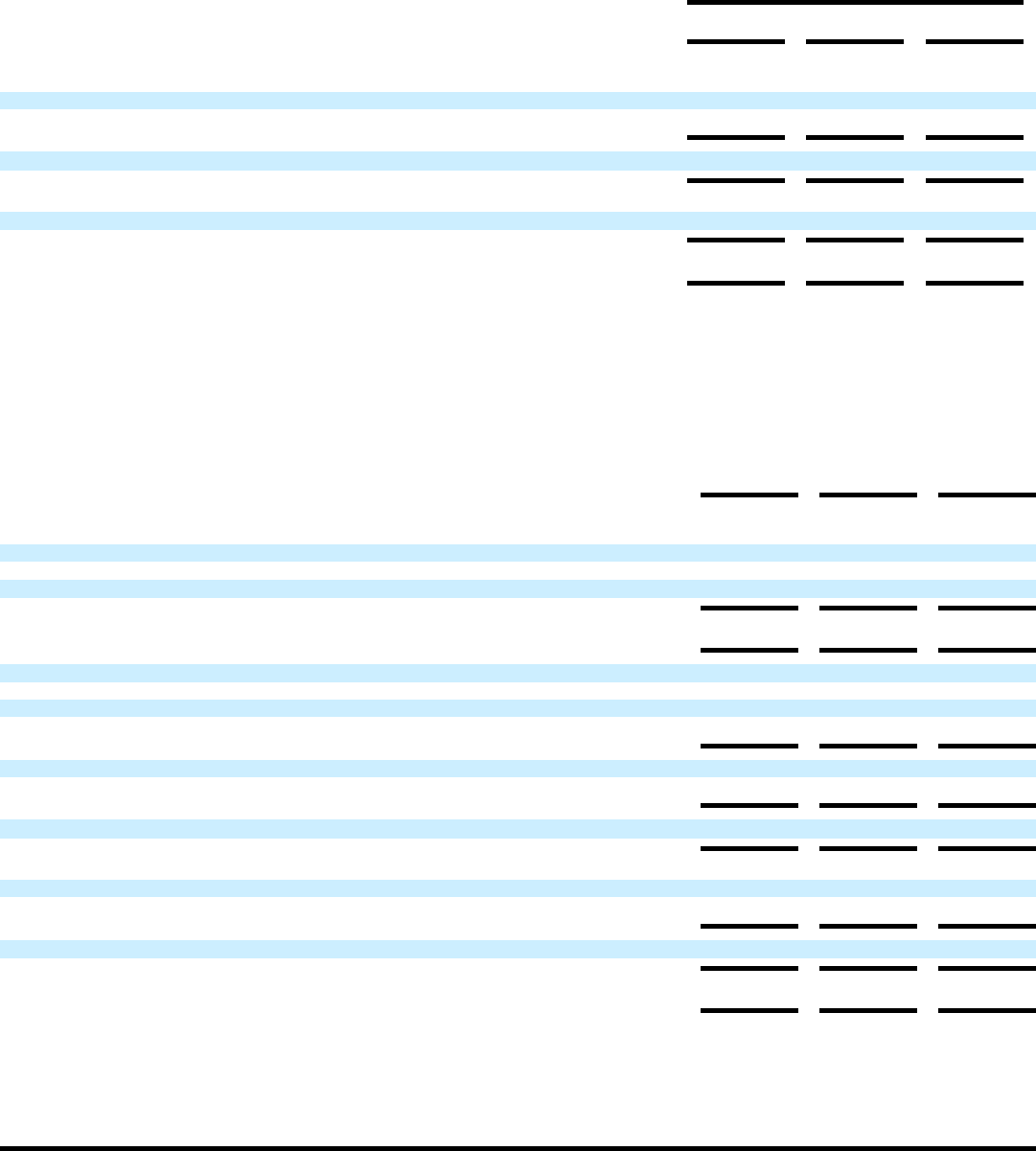

Note 12. Earnings Per Share:

Basic and diluted EPS from continuing and discontinued operations were calculated using the following:

For the Years Ended

December 31,

2006

2005

2004

(in millions)

Earnings from continuing operations $ 3,060 $ 2,904 $ 2,669

Loss from discontinued operations (272) (4)

Net earnings $ 3,060 $ 2,632 $ 2,665

Weighted average shares for basic EPS 1,643 1,684 1,709

Plus incremental shares from assumed conversions of stock options, restricted stock and stock rights 12 9 5

Weighted average shares for diluted EPS 1,655 1,693 1,714

For the years ended December 31, 2006, 2005 and 2004, the number of stock options excluded from the calculation of weighted average shares for diluted

EPS because their effects were antidilutive was immaterial.

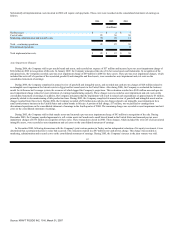

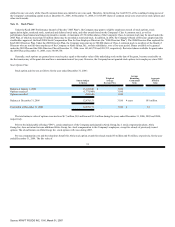

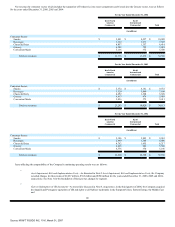

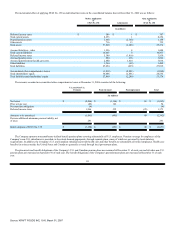

Note 13. Income Taxes:

Earnings from continuing operations before income taxes and minority interest, and provision for income taxes consisted of the following for the years

ended December 31, 2006, 2005 and 2004:

2006

2005

2004

(in millions)

Earnings from continuing operations before income taxes and minority interest:

United States $ 2,754 $ 2,774 $ 2,616

Outside United States 1,262 1,342 1,330

Total $ 4,016 $ 4,116 $ 3,946

Provision for income taxes:

United States federal:

Current $ 613 $ 876 $ 675

Deferred (150) (210) 69

463 666 744

State and local 95 115 112

Total United States 558 781 856

Outside United States:

Current 411 466 403

Deferred (18) (38) 15

Total outside United States 393 428 418

Total provision for income taxes $ 951 $ 1,209 $ 1,274

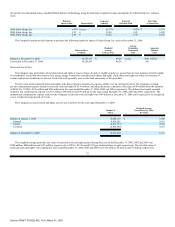

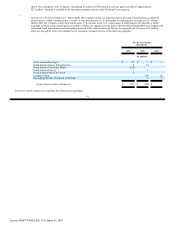

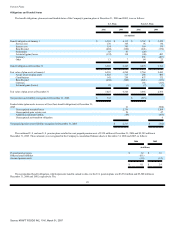

During 2006, the United States Internal Revenue Service concluded its examination of Altria Group, Inc.'s consolidated tax returns for the years 1996

through 1999 and issued a final Revenue Agents Report on March 15, 2006. Consequently, Altria Group, Inc. reimbursed the Company in cash for unrequired

federal tax reserves of $337 million and pre-tax interest of $46 million ($29 million after-tax).

76

Source: KRAFT FOODS INC, 10-K, March 01, 2007