Kraft 2006 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2006 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

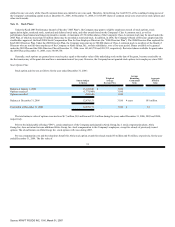

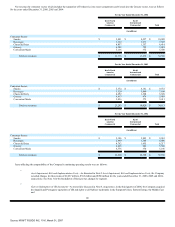

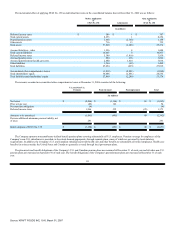

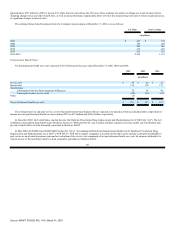

The incremental effect of applying SFAS No. 158 on individual line items in the consolidated balance sheet at December 31, 2006 was as follows:

Before Application

of

SFAS No. 158

Adjustments

After Application

of

SFAS No. 158

(in millions)

Deferred income taxes $ 386 $ 1 $ 387

Total current assets 8,253 1 8,254

Prepaid pension assets 3,468 (2,300) 1,168

Other assets 716 13 729

Total assets 57,860 (2,286) 55,574

Accrued liabilities—other 1,596 8 1,604

Total current liabilities 10,465 8 10,473

Deferred income taxes 5,340 (1,410) 3,930

Accrued pension costs 804 218 1,022

Accrued postretirement health care costs 2,000 1,014 3,014

Other liabilities 1,564 (65) 1,499

Total liabilities 27,254 (235) 27,019

Accumulated other comprehensive losses (1,018) (2,051) (3,069)

Total shareholders' equity 30,606 (2,051) 28,555

Total liabilities and shareholders' equity 57,860 (2,286) 55,574

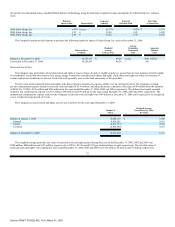

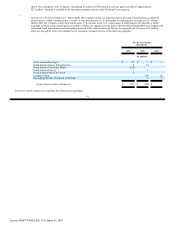

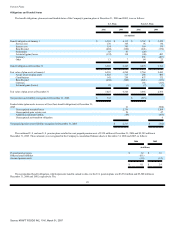

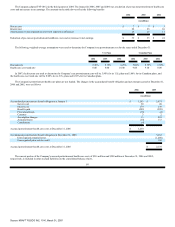

The amounts recorded in accumulated other comprehensive losses at December 31, 2006 consisted of the following:

U.S. and Non-U.S.

Pensions

Postretirement

Postemployment

Total

(in millions)

Net losses $ (2,864) $ (1,166) $ 65 $ (3,965)

Prior service cost (89) 143 54

Net transition obligation (4) (4)

Deferred income taxes 1,066 532 (25) 1,573

Amounts to be amortized (1,891) (491) 40 (2,342)

Reverse additional minimum pension liability, net

of taxes 291 291

Initial adoption of SFAS No. 158 $ (1,600) $ (491) $ 40 $ (2,051)

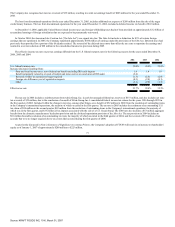

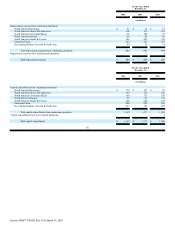

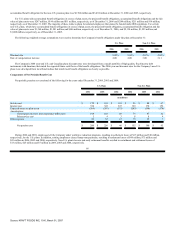

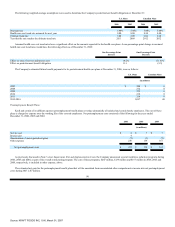

The Company sponsors noncontributory defined benefit pension plans covering substantially all U.S. employees. Pension coverage for employees of the

Company's non-U.S. subsidiaries is provided, to the extent deemed appropriate, through separate plans, many of which are governed by local statutory

requirements. In addition, the Company's U.S. and Canadian subsidiaries provide health care and other benefits to substantially all retired employees. Health care

benefits for retirees outside the United States and Canada are generally covered through local government plans.

The plan assets and benefit obligations of the Company's U.S. and Canadian pension plans are measured at December 31 of each year and all other non-U.S.

pension plans are measured at September 30 of each year. The benefit obligations of the Company's postretirement plans are measured at December 31 of each

year.

84

Source: KRAFT FOODS INC, 10-K, March 01, 2007