Kraft 2006 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2006 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

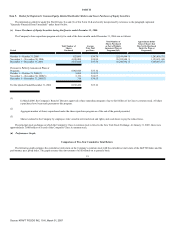

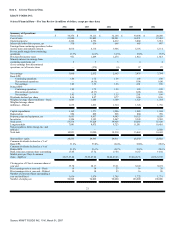

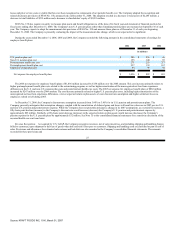

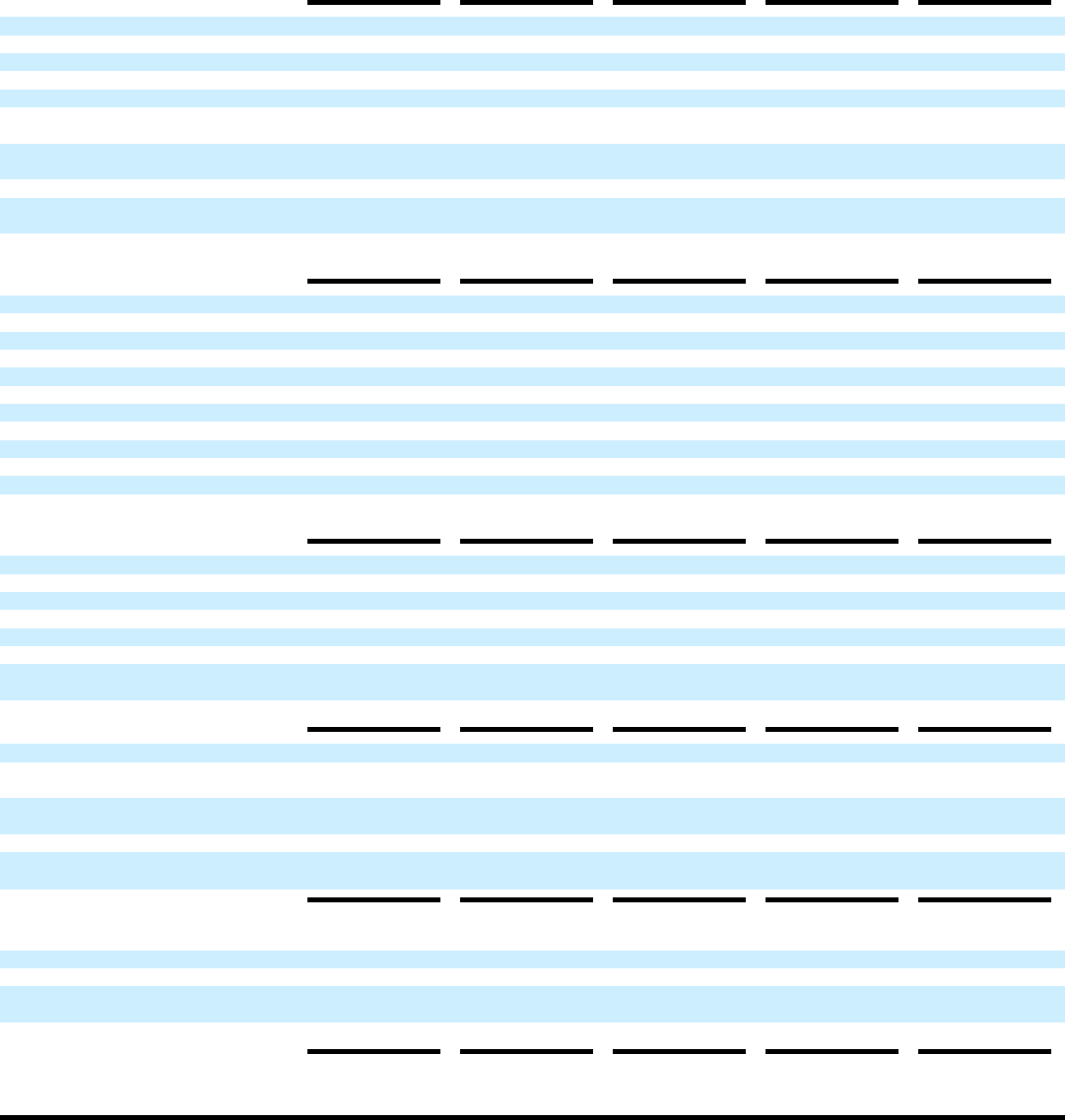

Item 6. Selected Financial Data.

KRAFT FOODS INC.

Selected Financial Data—Five Year Review (in millions of dollars, except per share data)

2006

2005

2004

2003

2002

Summary of Operations:

Net revenues $ 34,356 $ 34,113 $ 32,168 $ 30,498 $ 29,248

Cost of sales 21,940 21,845 20,281 18,531 17,463

Operating income 4,526 4,752 4,612 5,860 5,961

Interest and other debt expense, net 510 636 666 665 847

Earnings from continuing operations, before

income taxes and minority interest 4,016 4,116 3,946 5,195 5,114

Pre-tax profit margin from continuing

operations 11.7% 12.1% 12.3% 17.0% 17.5%

Provision for income taxes 951 1,209 1,274 1,812 1,813

Minority interest in earnings from

continuing operations, net 5 3 3 4 4

(Loss) earnings from discontinued

operations, net of income taxes — (272) (4) 97 97

Net earnings 3,060 2,632 2,665 3,476 3,394

Basic EPS:

Continuing operations 1.86 1.72 1.56 1.95 1.90

Discontinued operations — (0.16) — 0.06 0.06

Net earnings 1.86 1.56 1.56 2.01 1.96

Diluted EPS:

Continuing operations 1.85 1.72 1.55 1.95 1.90

Discontinued operations — (0.17) — 0.06 0.06

Net earnings 1.85 1.55 1.55 2.01 1.96

Dividends declared per share 0.96 0.87 0.77 0.66 0.56

Weighted average shares (millions)—Basic 1,643 1,684 1,709 1,727 1,734

Weighted average shares

(millions)—Diluted 1,655 1,693 1,714 1,728 1,736

Capital expenditures 1,169 1,171 1,006 1,085 1,184

Depreciation 884 869 868 804 709

Property, plant and equipment, net 9,693 9,817 9,985 10,155 9,559

Inventories 3,506 3,343 3,447 3,343 3,382

Total assets 55,574 57,628 59,928 59,285 57,100

Long-term debt 7,081 8,475 9,723 11,591 10,416

Notes payable to Altria Group, Inc. and

affiliates — — — — 2,560

Total debt 10,821 11,200 12,518 13,462 14,443

Shareholders' equity 28,555 29,593 29,911 28,530 25,832

Common dividends declared as a % of

Basic EPS 51.6% 55.8% 49.4% 32.8% 28.6%

Common dividends declared as a % of

Diluted EPS 51.9% 56.1% 49.7% 32.8% 28.6%

Book value per common share outstanding 17.45 17.72 17.54 16.57 14.92

Market price per Class A common

share—high/low 36.67-27.44 35.65-27.88 36.06-29.45 39.40-26.35 43.95-32.50

Closing price of Class A common share at

year end 35.70 28.17 35.61 32.22 38.93

Price/earnings ratio at year end—Basic 19 18 23 16 20

Price/earnings ratio at year end—Diluted 19 18 23 16 20

Number of common shares outstanding at

year end (millions) 1,636 1,670 1,705 1,722 1,731

Number of employees 90,000 94,000 98,000 106,000 109,000

21

Source: KRAFT FOODS INC, 10-K, March 01, 2007