Kraft 2006 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2006 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

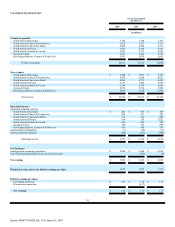

Net revenues increased $144 million (3.1%), due primarily to higher volume/mix ($138 million, including the 53rd week in 2005), favorable currency

($14 million) and higher pricing, net of increased promotional spending ($7 million), partially offset by the impact of divestitures ($15 million). In meats, higher

net revenues were driven by continued strong results for new products and higher net pricing. Pizza net revenues increased due to higher shipments and favorable

mix from new products, partially offset by higher promotional spending. Dinners net revenues decreased due to the impact of lower volume.

Operating companies income increased $121 million (15.3%), due primarily to the 2006 gain on the sale of the rice brand and assets ($226 million), lower

fixed manufacturing costs ($24 million) and favorable currency ($4 million), partially offset by higher pre-tax charges for asset impairment and exit costs

($93 million), higher product costs and promotional spending, net of higher pricing ($24 million), the impact of divestitures ($9 million) and higher

implementation costs ($5 million).

North America Grocery. Volume decreased 21.6%, including the 53 rd week of shipments in 2005 (representing approximately 2 percentage points of

decline), due primarily to the divestitures of fruit snacks and Canadian grocery assets, the discontinuation of certain Canadian condiment product lines and lower

shipments of ready-to-eat and dry packaged desserts, and spoonable salad dressings.

Net revenues decreased $293 million (9.7%), due primarily to the impact of divestitures ($266 million) and lower volume/mix ($85 million, including the

53rd week in 2005), partially offset by higher pricing ($30 million) and the impact of favorable currency ($26 million). Ready-to-eat and dry packaged desserts

net revenues declined due to lower shipment volume. In spoonable salad dressing, net revenues decreased due to lower shipments, partially offset by lower

promotional spending. Pourable salad dressing net revenues declined due to higher promotional spending.

Operating companies income increased $195 million (26.9%), due primarily to lower pre-tax charges for asset impairment and exit costs ($206 million,

including the $113 million asset impairment charge in 2005 related to the sale of the Canadian grocery assets and the $93 million asset impairment charge related

to the 2005 sale of the fruit snacks assets), lower marketing, administration and research costs ($30 million, including costs associated with the 53rd week in

2005), favorable currency ($8 million) and higher pricing, net of unfavorable costs ($7 million), partially offset by lower volume/mix ($50 million, including the

53rd week in 2005) and the impact of divestitures ($9 million).

North America Snacks & Cereals. Volume decreased 3.4%, including the 53 rd week of shipments in 2005 (representing approximately 2 percentage

points of decline), due primarily to the divestitures of the pet snacks brand and assets, and a small biscuit brand, and lower shipments of snack nuts, partially

offset by higher shipments of biscuits and snack bars.

Net revenues increased $108 million (1.7%), due primarily to favorable volume/mix ($106 million, including the 53rd week in 2005) and higher pricing, net

of increased promotional spending ($86 million, reflecting commodity-driven pricing in biscuits and ready-to-eat cereals) and favorable currency ($38 million),

partially offset by the impact of divestitures ($123 million). Biscuit net revenues increased due to higher pricing to offset the impact of commodity cost increases

in energy and packaging, higher shipment volume and favorable mix. In snack bars, net revenue increases were driven by new product introductions. Canadian

snack net revenues also increased due to sales of co-manufactured products related to the 2005 divested confectionery business. Snack nuts net revenues

decreased due to lower shipments.

Operating companies income decreased $101 million (10.9%), due primarily to higher pre-tax charges for asset impairment and exit costs ($138 million,

including the $86 million asset impairment charge in 2006 related to the sale of the pet snacks brand and assets, the $69 million impairment charge in 2006

related to the sale of the hot cereal assets and trademarks, the $13 million hot cereal intangible asset impairment in 2006 and the $63 million asset impairment

charge in 2005 related to the sale of a small biscuit brand), the impact of divestitures ($47 million) and 2006 losses on sales of businesses

40

Source: KRAFT FOODS INC, 10-K, March 01, 2007