Kraft 2006 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2006 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

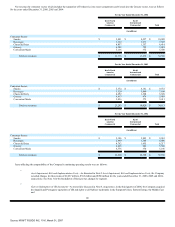

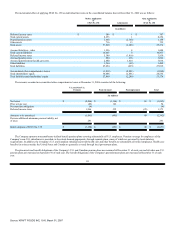

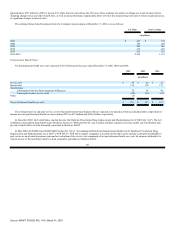

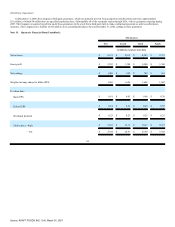

The Company adopted FSP 106-2 in the third quarter of 2004. The impact for 2006, 2005 and 2004 was a reduction of pre-tax net postretirement health care

costs and an increase in net earnings. The amounts in the table above reflect the following benefits:

2006

2005

2004

(in millions)

Service cost $ 7 $ 7 $ 3

Interest cost 26 23 10

Amortization of unrecognized net loss from experience differences 26 25 11

Reduction of pre-tax net postretirement healthcare costs and an increase in net earnings $ 59 $ 55 $ 24

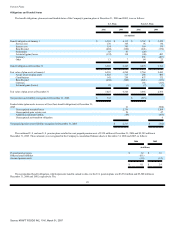

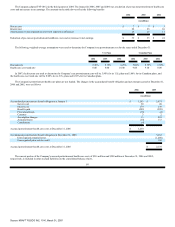

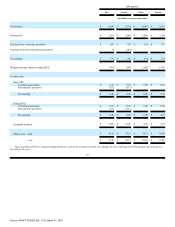

The following weighted-average assumptions were used to determine the Company's net postretirement cost for the years ended December 31:

U.S. Plans

Canadian Plans

2006

2005

2004

2006

2005

2004

Discount rate 5.60% 5.75% 6.25% 5.00% 5.75% 6.50%

Health care cost trend rate 8.00 8.00 10.00 9.00 9.50 8.00

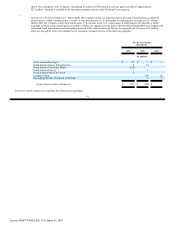

In 2007, the discount rate used to determine the Company's net postretirement cost will be 5.90% for its U.S. plans and 5.00% for its Canadian plans, and

the health care cost trend rate will be 8.00% for its U.S. plans and 8.50% for its Canadian plans.

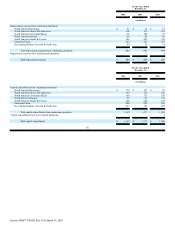

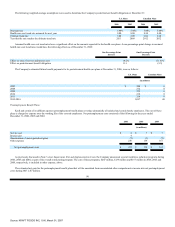

The Company's postretirement health care plans are not funded. The changes in the accumulated benefit obligation and net amount accrued at December 31,

2006 and 2005, were as follows:

2006

2005

(in millions)

Accumulated postretirement benefit obligation at January 1 $ 3,263 $ 2,931

Service cost 50 48

Interest cost 174 170

Benefits paid (203) (220)

Plan amendments (16) (4)

Currency 3 2

Assumption changes 13 203

Actuarial losses (50) 133

Curtailments (4)

Accrued postretirement health care costs at December 31, 2006 $ 3,230

Accumulated postretirement benefit obligation at December 31, 2005 3,263

Unrecognized actuarial losses (1,280)

Unrecognized prior service credit 156

Accrued postretirement health care costs at December 31, 2005 $ 2,139

The current portion of the Company's accrued postretirement health care costs of $216 million and $208 million at December 31, 2006 and 2005,

respectively, is included in other accrued liabilities on the consolidated balance sheets.

89

Source: KRAFT FOODS INC, 10-K, March 01, 2007