Kraft 2006 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2006 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

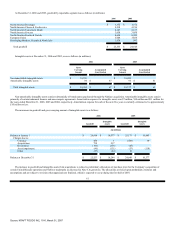

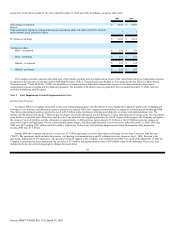

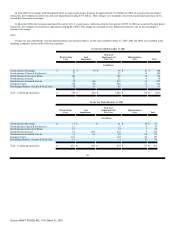

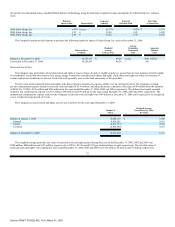

Substantially all implementation costs incurred in 2006 will require cash payments. These costs were recorded on the consolidated statements of earnings as

follows:

2006

2005

2004

(in millions)

Net Revenues $ — $ 2 $ 7

Cost of sales 25 56 30

Marketing, administration and research costs 70 29 13

Total—continuing operations 95 87 50

Discontinued operations 8

Total implementation costs $ 95 $ 87 $ 58

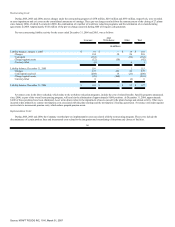

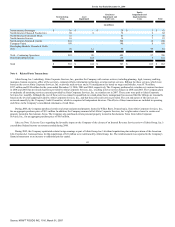

Asset Impairment Charges:

During 2006, the Company sold its pet snacks brand and assets, and recorded tax expense of $57 million and incurred a pre-tax asset impairment charge of

$86 million in 2006 in recognition of this sale. In January 2007, the Company announced the sale of its hot cereal assets and trademarks. In recognition of the

anticipated sale, the Company recorded a pre-tax asset impairment charge of $69 million in 2006 for these assets. These pre-tax asset impairment charges, which

included the write-off of a portion of the associated goodwill, and intangible and fixed assets, were recorded as asset impairment and exit costs on the

consolidated statement of earnings.

During 2006, the Company completed its annual review of goodwill and intangible assets, and recorded non-cash pre-tax charges of $24 million related to

an intangible asset impairment for biscuits assets in Egypt and hot cereal assets in the United States. Also during 2006, the Company re-evaluated the business

model for itsTassimo hot beverage system, the revenues of which lagged the Company's projections. This evaluation resulted in a $245 million non-cash pre-tax

asset impairment charge related to lower utilization of existing manufacturing capacity. These charges were recorded as asset impairment and exit costs on the

consolidated statement of earnings. In addition, the Company anticipates that the impairment will result in related cash expenditures of approximately $3 million,

primarily related to decommissioning of idle production lines. During 2005, the Company completed its annual review of goodwill and intangible assets and no

charges resulted from this review. During 2004, the Company recorded a $29 million non-cash pre-tax charge related to an intangible asset impairment for a

small confectionery business in the United States and certain brands in Mexico. A portion of this charge, $17 million, was reclassified to earnings from

discontinued operations on the consolidated statement of earnings in the fourth quarter of 2004. The remaining charge was recorded as asset impairment and exit

costs on the consolidated statement of earnings.

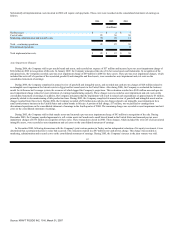

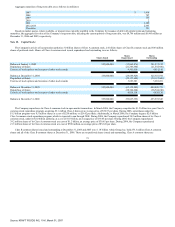

During 2005, the Company sold its fruit snacks assets and incurred a pre-tax asset impairment charge of $93 million in recognition of the sale. During

December 2005, the Company reached agreements to sell certain assets in Canada and a small biscuit brand in the United States and incurred pre-tax asset

impairment charges of $176 million in recognition of these sales. These transactions closed in 2006. These charges, which included the write-off of all associated

intangible assets, were recorded as asset impairment and exit costs on the consolidated statement of earnings.

In November 2004, following discussions with the Company's joint venture partner in Turkey and an independent valuation of its equity investment, it was

determined that a permanent decline in value had occurred. This valuation resulted in a $47 million non-cash pre-tax charge. This charge was recorded as

marketing, administration and research costs on the consolidated statement of earnings. During 2005, the Company's interest in the joint venture was sold.

67

Source: KRAFT FOODS INC, 10-K, March 01, 2007