Kraft 2006 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2006 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

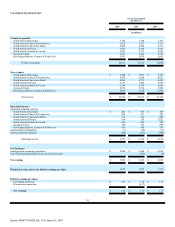

•

Lower interest and other debt expense, net, reflecting lower debt levels, the redemption of higher coupon Nabisco bonds and interest

income on the federal tax reimbursement from Altria Group, Inc., partially offset by higher short-term interest rates.

Partially offset by:

•

Lower income in North America Beverages, reflecting higher commodity costs, partially offset by higher pricing.

•

Lower income in the European Union, reflecting increased promotional spending, and higher product and marketing costs, partially offset

by higher pricing.

For further details, see the Consolidated Operating Results and Operating Results by Business Segment sections of the following Discussion and Analysis.

Discussion and Analysis

Critical Accounting Policies and Estimates

Note 2 to the consolidated financial statements includes a summary of the significant accounting policies and methods used in the preparation of the

Company's consolidated financial statements. In most instances, the Company must use an accounting policy or method because it is the only policy or method

permitted under accounting principles generally accepted in the United States of America ("U.S. GAAP").

The preparation of all financial statements includes the use of estimates and assumptions that affect a number of amounts included in the Company's

financial statements, including, among other things, employee benefit costs and income taxes. The Company bases its estimates on historical experience and

other assumptions that it believes are reasonable. If actual amounts are ultimately different from previous estimates, the revisions are included in the Company's

consolidated results of operations for the period in which the actual amounts become known. Historically, the aggregate differences, if any, between the

Company's estimates and actual amounts in any year have not had a significant impact on the Company's consolidated financial statements.

The selection and disclosure of the Company's critical accounting policies and estimates have been discussed with the Company's Audit Committee. The

following is a review of the more significant assumptions and estimates, as well as the accounting policies and methods used in the preparation of the Company's

consolidated financial statements:

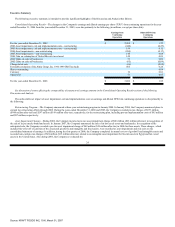

Employee Benefit Plans. As discussed in Note 15 to the consolidated financial statements, the Company provides a range of benefits to its employees and

retired employees, including pensions, postretirement health care benefits and postemployment benefits (primarily severance). The Company records amounts

relating to these plans based on calculations specified by U.S. GAAP, which include various actuarial assumptions, such as discount rates, assumed rates of

return on plan assets, compensation increases, turnover rates and health care cost trend rates. The Company reviews its actuarial assumptions on an annual basis

and makes modifications to the assumptions based on current rates and trends when it is deemed appropriate to do so. As permitted by U.S. GAAP, any effect of

the modifications is generally amortized over future periods. The Company believes that the assumptions utilized in recording its obligations under its plans,

which are presented in Note 15 to the consolidated financial statements, are reasonable based on its experience and advice from its actuaries.

In September 2006, the Financial Accounting Standards Board ("FASB") issued Statement of Financial Accounting Standards ("SFAS") No. 158,

"Employers' Accounting for Defined Benefit Pension and Other Postretirement Plans" ("SFAS No. 158"). SFAS No. 158 requires that employers recognize the

funded status of their defined benefit pension and other postretirement plans on the consolidated balance sheet and record as a component of other comprehensive

income, net of tax, the gains or

26

Source: KRAFT FOODS INC, 10-K, March 01, 2007