Kraft 2006 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2006 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

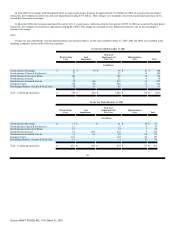

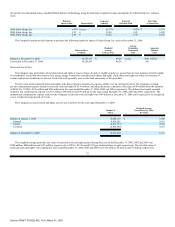

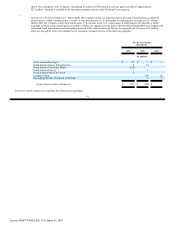

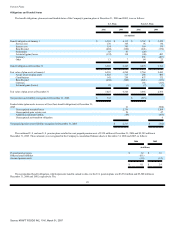

The tax effects of temporary differences that gave rise to deferred income tax assets and liabilities consisted of the following at December 31, 2006 and

2005:

2006

2005

(in millions)

Deferred income tax assets:

Accrued postretirement and postemployment benefits $ 1,531 $ 902

Other 421 691

Total deferred income tax assets 1,952 1,593

Deferred income tax liabilities:

Trade names (3,746) (3,966)

Property, plant and equipment (1,627) (1,734)

Prepaid pension costs (161) (1,081)

Total deferred income tax liabilities (5,534) (6,781)

Net deferred income tax liabilities $ (3,582) $ (5,188)

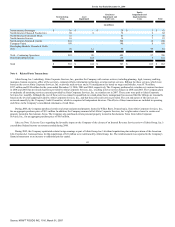

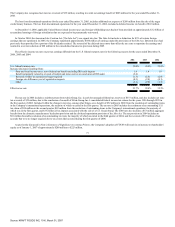

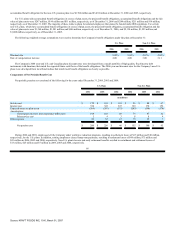

Note 14. Segment Reporting:

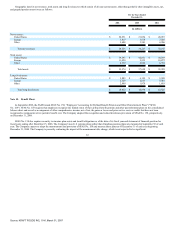

The Company manufactures and markets packaged food products, consisting principally of beverages, cheese, snacks, convenient meals and various

packaged grocery products. Kraft manages and reports operating results through two units, Kraft North America Commercial and Kraft International

Commercial. Reportable segments for Kraft North America Commercial are organized and managed principally by product category. Kraft North America

Commercial's segments are North America Beverages; North America Cheese & Foodservice; North America Convenient Meals; North America Grocery; and

North America Snacks & Cereals. Kraft International Commercial's operations are organized and managed by geographic location. Kraft International

Commercial's segments are European Union and Developing Markets, Oceania & North Asia.

In October 2005, the Company announced that, effective January 1, 2006, its Canadian business will be realigned to better integrate it into the Company's

North American business by product category. Beginning in the first quarter of 2006, the operating results of the Canadian business are being reported

throughout the North American food segments. In addition, in the first quarter of 2006, the Company's international businesses were realigned to reflect the

reorganization announced within Europe in November 2005. The two revised international segments, which are reflected in these consolidated financial

statements and notes, are European Union; and Developing Markets, Oceania & North Asia, the latter to reflect the Company's increased management focus on

developing markets. Accordingly, prior period segment results have been restated.

The Company's management uses operating companies income, which is defined as operating income before general corporate expenses and amortization of

intangibles, to evaluate segment performance and allocate resources. Management believes it is appropriate to disclose this measure to help investors analyze the

business performance and trends of the various business segments. Interest and other debt expense, net, and provision for income taxes are centrally managed

and, accordingly, such items are not presented by segment since they are not included in the measure of segment profitability reviewed by management. The

Company's assets, which are principally in the United States and Europe, are managed geographically. The accounting policies of the segments are the same as

those described in Note 2.Summary of Significant Accounting Policies.

78

Source: KRAFT FOODS INC, 10-K, March 01, 2007