Kraft 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

KRAFT FOODS INC - KFT

Filed: March 01, 2007 (period: December 31, 2006)

Annual report which provides a comprehensive overview of the company for the past year

Table of contents

-

Page 1

FORM 10-K KRAFT FOODS INC - KFT Filed: March 01, 2007 (period: December 31, 2006) Annual report which provides a comprehensive overview of the company for the past year -

Page 2

...about Market Risk. Financial Statements and Supplementary Data. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure. Controls and Procedures. Other Information. PART III Item 10. Directors, Executive Officers and Corporate Governance. Item 11. Executive Compensation... -

Page 3

EX-21 (EX-21) EX-23 (EX-23) EX-24 (EX-24) EX-31.1 (EX-31.1) EX-31.2 (EX-31.2) EX-32.1 (EX-32.1) EX-32.2 (EX-32.2) -

Page 4

... 1-16483 KRAFT FOODS INC. (Exact name of registrant as specified in its charter) (State or other jurisdiction of incorporation or organization) Virginia (I.R.S. Employer Identification No.) 52-2284372 (Address of principal executive offices) Three Lakes Drive, Northfield, Illinois (Zip Code... -

Page 5

... the pre-spin Altria Group, Inc. options: • a new Kraft option to acquire the number of shares of Kraft Class A common stock equal to the product of (a) the number of Altria Group, Inc. options held by such person on the Distribution Date and (b) the approximate distribution ratio of 0.7 mentioned... -

Page 6

... that holders of Altria Group, Inc. stock rights receive Kraft stock rights, Altria Group, Inc. will pay to the Company the fair value of the Kraft stock rights less the value of projected forfeitures. Based upon the number of Altria Group, Inc. stock awards outstanding at December 31, 2006, the net... -

Page 7

... of beverages, cheese, snacks, convenient meals and various packaged grocery products. The Company manages and reports operating results through two units: Kraft North America Commercial and Kraft International Commercial. Kraft North America Commercial operates in the United States and Canada, and... -

Page 8

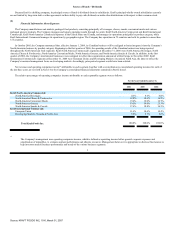

...processed meats. The following table shows each reportable segment's participation in these five core consumer sectors. Percentage of 2006 Net Revenues by Consumer Sector(2) Cheese & Dairy Convenient Meals Segment(1) Snacks Beverages Grocery Total Kraft North America Commercial: North America... -

Page 9

...) coffees;Capri Sun (under license),Kool-Aid, andCrystal Light aseptic juice drinks;Kool-Aid, Tang, Crystal Light, andCountry Time powdered beverages;Veryfine juices; Tazo teas (under license); andFruit 2O water. North America Cheese & Foodservice Cheese & Dairy: Kraft andCracker Barrel natural... -

Page 10

... cream cheese. Kraft pourable and spoonable salad dressings;Miracel Whip spoonable dressings; andMirácoli sauces. Lunchables lunch combinations;Kraft andMirácoli pasta dinners and sauces; andSimmenthal canned meats. Beverages: Cheese & Dairy: Grocery: Convenient Meals: Developing Markets... -

Page 11

... salad dressings; Miracle Whip spoonable dressings;Jell-O dessert toppings;Kraft peanut butter; andVegemite yeast spread. Kraft macaroni & cheese dinners. Distribution, Competition and Raw Materials Kraft North America Commercial's products are generally sold to supermarket chains, wholesalers... -

Page 12

...sale of dairy products and imposing their own labeling requirements on food products. Many of the food commodities on which Kraft North America Commercial's United States businesses rely are subject to governmental agricultural programs. These programs have substantial effects on prices and supplies... -

Page 13

... Nabisco trademarks in the European Union, Eastern Europe, the Middle East and Africa, which UB has held since 2000, for a total cost of approximately $1.1 billion. The Spanish and Portuguese operations of UB include its biscuits, dry desserts, canned meats, tomato and fruit juice businesses as well... -

Page 14

...Italia coffee for sale in United States grocery stores and other distribution channels,Capri Sun aseptic juice drinks for sale in the United States and Canada,Taco Bell Home Originals Mexican style food products for sale in United States grocery stores,California Pizza Kitchen frozen pizzas for sale... -

Page 15

Canada,Pebbles ready-to-eat cereals,Tazo teas for sale in grocery stores in the United States, andSouth Beach Diet pizzas, meals, breakfast wraps, lunch wrap kits, crackers, cookies, snack bars, cereals and dressings for sale in grocery stores in the United States. The Company also has a license ... -

Page 16

... Kraft's U.S. subsidiaries export coffee products, refreshment beverages products, grocery products, cheese, biscuits, and processed meats. In 2006, exports from the United States by these subsidiaries amounted to approximately $151 million. (e) Available Information The Company is required to file... -

Page 17

... of its products to respond to competitive and customer pressures and to maintain market share. Such pressures also may restrict the Company's ability to increase prices, including in response to commodity and other cost increases. The Company's results of operations will suffer if profit margins... -

Page 18

...'s control, including fluctuations in commodities markets, currency fluctuations and changes in governmental agricultural programs. Commodity prices impact the Company's business directly through the cost of raw materials used to make the Company's products (such as cheese), the cost of inputs used... -

Page 19

... brand image. New regulations could adversely affect the Company's business. Food production and marketing are highly regulated by a variety of federal, state, local and foreign agencies, and new regulations and changes to existing regulations are issued regularly. Increased 15 Source: KRAFT FOODS... -

Page 20

... pro rata basis to Altria Group, Inc. stockholders in a tax-free transaction. When the spin-off occurs, it will significantly change the profile of the Company's stockholders. If a number of the Company's new stockholders choose to sell their shares, or if there is a perception that such sales might... -

Page 21

.... In North America, the Company has 67 facilities, and outside of North America there are 92 facilities located in 41 countries. These manufacturing and processing facilities are located throughout the following territories: Territory Number of Facilities United States Canada European Union Eastern... -

Page 22

... for his group of companies, including Les Cafes Ennasr (renamed Kraft Foods Maroc), which was acquired by Kraft Foods International, Inc. from Mr. Berrada in 2001. In June 2003, the court issued a preliminary judgment against Kraft Foods Maroc and Mr. Berrada holding that the Gaouars are entitled... -

Page 23

...Equity Securities during the Quarter ended December 31, 2006. The Company's share repurchase program activity for each of the three months ended December 31, 2006 was as follows: Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs(1)(2) Approximate Dollar Value of Shares... -

Page 24

The performance peer group index consists of companies considered market competitors of the Company, or that have been selected on the basis of industry, level of management complexity, global focus or industry leadership. Date Kraft Foods S&P 500 Kraft Foods Peer Group December 2001 $ 100.00 $... -

Page 25

Item 6. Selected Financial Data. KRAFT FOODS INC. Selected Financial Data-Five Year Review (in millions of dollars, except per share data) 2006 2005 2004 2003 2002 Summary of Operations: Net revenues $ Cost of sales Operating income Interest and other debt expense, net Earnings from continuing ... -

Page 26

... "Company"), manufactures and markets packaged food products, consisting principally of beverages, cheese, snacks, convenient meals and various packaged grocery products. Kraft manages and reports operating results through two units, Kraft North America Commercial and Kraft International Commercial... -

Page 27

..., the operating results of the Canadian business were being reported throughout the North American food segments. Kraft North America Commercial's segments are North America Beverages; North America Cheese & Foodservice; North America Convenient Meals; North America Grocery; and North America Snacks... -

Page 28

...-non-restructuring 2006 Gain on redemption of United Biscuits investment 2006 Gains on sales of businesses 2005 Gains on sales of businesses Change in tax rate Favorable resolution of the Altria Group, Inc. 1996-1999 IRS Tax Audit Shares outstanding Currency Operations For the year ended December 31... -

Page 29

... increased marketing costs, higher product costs, and the 2005 recovery of a previously written-off account receivable. Higher income in North America Cheese & Foodservice, reflecting lower commodity costs, partially offset by lower net pricing and lower volume/mix. 25 • • Source: KRAFT FOODS... -

Page 30

...• • Lower income in North America Beverages, reflecting higher commodity costs, partially offset by higher pricing. Lower income in the European Union, reflecting increased promotional spending, and higher product and marketing costs, partially offset by higher pricing. For further details, see... -

Page 31

...benefit plan costs related to the restructuring program, as well as higher amortization of the unrecognized net loss from experience differences in the U.S. and non-U.S. pension plan costs and postretirement health care costs. The 2005 net expense for employee benefit plans of $882 million increased... -

Page 32

...the market conditions noted below in the Business Environment section and under the "Risk Factors" section in Part 1, Item 1A of this Annual Report on Form 10-K, as well as interest rates, general economic conditions and projected growth rates. During the first quarter of 2006, the Company completed... -

Page 33

...statements, Altria Group, Inc.'s subsidiary, Altria Corporate Services, Inc., provides the Company with various services, including planning, legal, treasury, auditing, insurance, human resources, office of the secretary, corporate affairs, information technology, aviation and tax services. Billings... -

Page 34

... costs, and one-time gains and losses related to acquisitions and divestitures. In 2006, the United States Internal Revenue Service concluded its examination of Altria Group, Inc.'s consolidated tax returns for the years 1996 through 1999 and issued a final Revenue Agents Report on March 15... -

Page 35

...; changing consumer preferences, including diet and health/wellness trends; competitors with different profit objectives and less susceptibility to currency exchange rates; and increasing scrutiny of product labeling and marketing practices as well as concerns and/or regulations regarding food... -

Page 36

...cash flows, and future sales of businesses could in some cases result in losses on sale. During 2006, the Company acquired the Spanish and Portuguese operations of United Biscuits ("UB"), and rights to all Nabisco trademarks in the European Union, Eastern Europe, the Middle East and Africa, which UB... -

Page 37

...Colombia, a minor trademark in Mexico and a small equity investment in Turkey. The aggregate proceeds received from these sales were $238 million, on which the Company recorded pre-tax gains of $108 million. During 2004, the Company sold a Brazilian snack nuts business and trademarks associated with... -

Page 38

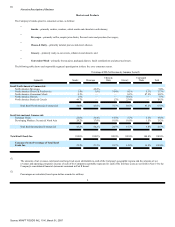

...: Operating companies income: North America Beverages North America Cheese & Foodservice North America Convenient Meals North America Grocery North America Snacks & Cereals European Union Developing Markets, Oceania & North Asia Amortization of intangibles General corporate expenses Operating income... -

Page 39

...Grocery North America Snacks & Cereals European Union Developing Markets, Oceania & North Asia Total-Continuing Operations $ 11 15 13 21 6 127 17 210 $ - 206 63 $ 11 15 13 227 69 127 17 479 $ 10 4 7 8 26 20 12 87 $ 21 19 20 235 95 147 29 566 $ $ 269 $ $ $ 35 Source: KRAFT FOODS INC... -

Page 40

... operating companies income of the following segments: • For the Years Ended December 31, 2006 2005 (in millions) 2004 North America Beverages North America Cheese & Foodservice North America Convenient Meals North America Grocery North America Snacks & Cereals European Union Developing Markets... -

Page 41

... of certain ready-to-drink and foodservice product lines and lower grocery shipments in North America, partially offset by higher shipments of meat, biscuits and cheese in North America and higher shipments in Developing Markets, Oceania & North Asia. Net revenues increased $243 million... -

Page 42

..., a SKU reduction program, the impact of higher retail prices on category growth trends in the United States and declines in certain international countries (most notably Germany), partially offset by new product introductions and growth in developing markets. Net revenues increased $1,945 million... -

Page 43

...), driven by higher meat shipments (cold cuts, hot dogs and bacon) and higher shipments of pizza, partially offset by lower shipments of dinners, due to competition in macaroni and cheese dinners, and the divestiture of the rice brand and assets. 39 Source: KRAFT FOODS INC, 10-K, March 01, 2007 -

Page 44

...In snack bars, net revenue increases were driven by new product introductions. Canadian snack net revenues also increased due to sales of co-manufactured products related to the 2005 divested confectionery business. Snack nuts net revenues decreased due to lower shipments. Operating companies income... -

Page 45

...19 million). In snacks, net revenues grew due to higher volume as well as favorable pricing in Latin America and favorable currency in Brazil. Confectionery net revenues also increased, due to growth in Russia and Ukraine. Coffee net revenues increased due to 41 Source: KRAFT FOODS INC, 10-K, March... -

Page 46

... beverages net revenues increased, due primarily to expanded distribution ofVeryfine and new product introductions in sugar-free powdered beverages. Coffee net revenues increased, due primarily to increased prices and positive mix driven by volume growth in premium brands. Operating companies income... -

Page 47

...). North America Convenient Meals. Volume increased 2.9% including the 53 rd week of shipments (representing approximately 2 percentage points of growth), due primarily to higher shipments in meats, pizza and meals. Meats volume increased, aided by higher shipments of cold cuts and new product... -

Page 48

...million, including the benefit of the 53rd week), higher pricing, net of increased promotional spending ($42 million, reflecting commodity-driven pricing in snack nuts and cereals) and favorable currency ($36 million). Biscuits net revenues increased, driven by new product introductions and improved... -

Page 49

... Asia. Net revenues declined in China, where the Company faced increased competitive activity in biscuits. Operating companies income increased $157 million (64.6%), due primarily to favorable volume/mix ($105 million, including the benefit of the 53rd week), a 2004 equity investment impairment... -

Page 50

... 31, 2005. The Company's debt-to-equity ratio was 0.38 at December 31, 2006 and 2005. The Company's debt-to-capitalization ratio was 0.27 at December 31, 2006 and 2005. The Company has a Form S-3 shelf registration statement on file with the Securities and Exchange Commission ("SEC") under which the... -

Page 51

.... The nature and amount of the Company's long-term and short-term debt and the proportionate amount of each can be expected to vary as a result of future business requirements, market conditions and other factors. In addition to the above, certain international subsidiaries of Kraft maintain credit... -

Page 52

... will provide sufficient liquidity to meet its working capital needs (including the cash requirements of the restructuring program), planned capital expenditures, future contractual obligations and payment of its anticipated quarterly dividends. 48 Source: KRAFT FOODS INC, 10-K, March 01, 2007 -

Page 53

...for all stock-based awards at fair value on date of grant and recognition of compensation over the service periods for awards expected to vest. The fair value of restricted stock and rights to receive shares of stock is determined based on the number of shares granted and the market value at date of... -

Page 54

... its exposure to changes in exchange rates relating to distributions contemplated in advance of theKraft Spin-Off from Altria Group, Inc., as referred to within the Description of the Company section above. Commodities. The Company is exposed to price risk related to forecasted purchases of certain... -

Page 55

... rates and commodity prices under normal market conditions. The computation does not purport to represent actual losses in fair value or earnings to be incurred by the Company, nor does it consider the effect of favorable changes in market rates. The Company cannot predict actual future movements in... -

Page 56

... reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with accounting principles generally accepted in the United States of America. The Company's internal... -

Page 57

... of Kraft Foods Inc.'s internal control over financial reporting based on our audit. We conducted our audit of internal control over financial reporting in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and... -

Page 58

external purposes in accordance with generally accepted accounting principles. A company's internal control over financial reporting includes those policies and procedures that (i) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and ... -

Page 59

... Accrued liabilities: Marketing Employment costs Other Income taxes Total current liabilities Long-term debt Deferred income taxes Accrued pension costs Accrued postretirement health care costs Other liabilities Total liabilities Contingencies (Note 18) SHAREHOLDERS' EQUITY Class A common stock, no... -

Page 60

... of dollars, except per share data) 2006 2005 2004 Net revenues Cost of sales Gross profit Marketing, administration and research costs Asset impairment and exit costs Gain on redemption of United Biscuits investment (Gains) losses on sales of businesses, net Amortization of intangibles Operating... -

Page 61

... dividends declared ($0.77 per share) Class A common stock repurchased Balances, December 31, 2004 Comprehensive earnings: Net earnings Other comprehensive losses, net of income taxes: Currency translation adjustments Additional minimum pension liability Change in fair value of derivatives accounted... -

Page 62

... Total comprehensive earnings Initial adoption of FASB Statement No. 158, net of income taxes (Note 15) Exercise of stock options and issuance of other stock awards Cash dividends declared ($0.96 per share) Class A common stock repurchased Balances, December 31, 2006 $ - $ (2,051) (209) 202 (1,587... -

Page 63

... short-term borrowings Long-term debt proceeds Long-term debt repaid Increase (decrease) in amounts due to Altria Group, Inc. and affiliates Repurchase of Class A common stock Dividends paid Other Net cash used in financing activities Effect of exchange rate changes on cash and cash equivalents Cash... -

Page 64

... and sale of packaged foods and beverages in the United States, Canada, Europe, Latin America, Asia Pacific and Middle East and Africa. Prior to June 13, 2001, the Company was a wholly-owned subsidiary of Altria Group, Inc. On June 13, 2001, the Company completed an initial public offering... -

Page 65

...-tax charges of $24 million related to an intangible asset impairment for biscuits assets in Egypt and hot cereal assets in the United States. Additionally, in 2006, as part of the sale of its pet snacks brand and assets, the Company recorded non-cash pre-tax asset impairment charges of $86 million... -

Page 66

...2006 and 2005, goodwill by reportable segment was as follows (in millions): 2006 2005 North America Beverages North America Cheese & Foodservice North America Convenient Meals North America Grocery North America Snacks & Cereals European Union Developing Markets, Oceania & North Asia Total goodwill... -

Page 67

...provides for expenses associated with environmental remediation obligations on an undiscounted basis when such amounts are probable and can be reasonably estimated. Such accruals are adjusted as new information develops or circumstances change. While it is not possible to quantify with certainty the... -

Page 68

...'s consolidated results of operations, financial position or cash flows. Marketing costs: The Company promotes its products with advertising, consumer incentives and trade promotions. Such programs include, but are not limited to, discounts, coupons, rebates, in-store display incentives and volume... -

Page 69

...for all stock-based awards at fair value on date of grant and recognition of compensation over the service periods for awards expected to vest. The fair value of restricted stock and rights to receive shares of stock is determined based on the number of shares granted and the market value at date of... -

Page 70

... (in millions, except per share data): 2005 2004 Net earnings, as reported Deduct: Total stock-based employee compensation expense determined under fair value method for all stock option awards, net of related tax effects Pro forma net earnings Earnings per share: Basic-as reported Basic-pro forma... -

Page 71

...2004, the Company recorded pre-tax implementation costs associated with the restructuring program. These costs include the discontinuance of certain product lines and incremental costs related to the integration and streamlining of functions and closure of facilities. 66 Source: KRAFT FOODS INC, 10... -

Page 72

.... During 2005, the Company sold its fruit snacks assets and incurred a pre-tax asset impairment charge of $93 million in recognition of the sale. During December 2005, the Company reached agreements to sell certain assets in Canada and a small biscuit brand in the United States and incurred pre-tax... -

Page 73

... America Grocery North America Snacks & Cereals European Union Developing Markets, Oceania & North Asia Total-Continuing Operations $ 11 $ 15 13 21 6 127 17 210 $ - $ 206 63 11 $ 15 13 227 69 127 17 479 $ 10 $ 4 7 8 26 20 12 87 $ 21 19 20 235 95 147 29 566 $ 269 $ 68 Source: KRAFT FOODS... -

Page 74

... Party Transactions: Altria Group, Inc.'s subsidiary, Altria Corporate Services, Inc., provides the Company with various services, including planning, legal, treasury, auditing, insurance, human resources, office of the secretary, corporate affairs, information technology, aviation and tax services... -

Page 75

... charges of $176 million in 2005 in recognition of these sales. Also during 2006, the Company sold a U.S. coffee plant. The aggregate proceeds received from these sales were $946 million, on which the Company recorded pre-tax gains of $117 million. 70 Source: KRAFT FOODS INC, 10-K, March 01, 2007 -

Page 76

... Nabisco trademarks in the European Union, Eastern Europe, the Middle East and Africa, which UB has held since 2000, for a total cost of approximately $1.1 billion. The Spanish and Portuguese operations of UB include its biscuits, dry desserts, canned meats, tomato and fruit juice businesses as well... -

Page 77

.... At December 31, 2006 the Company also had approximately $0.3 billion of outstanding short-term debt related to its United Biscuits acquisition discussed in Note 6.Acquisitions. Note 9. Long-Term Debt: At December 31, 2006 and 2005, the Company's long-term debt consisted of the following: 2006... -

Page 78

... 555,000,000 The Company repurchases its Class A common stock in open market transactions. In March 2006, the Company completed its $1.5 billion two-year Class A common stock repurchase program, acquiring 49.1 million Class A shares at an average price of $30.57 per share. During 2006, repurchases... -

Page 79

...Stock Compensation Plan for Non-Employee Directors (the "2006 Directors Plan"). The 2006 Directors Plan replaced the Kraft 2001 Directors Plan. Under the 2006 Directors Plan, the Company may grant up to 500,000 shares of Class A common stock to members of the Board of Directors who are not full-time... -

Page 80

... Expected Dividend Yield Fair Value at Grant Date 2006 Altria Group, Inc. 2005 Altria Group, Inc. 2004 Altria Group, Inc. 4.87% 4 years 3.87 4 2.99 4 26.73% 32.90 36.63 4.43% $ 4.43 5.39 12.79 14.08 10.30 The Company's employees held options to purchase the following number of shares of Altria... -

Page 81

...$ 1,274 During 2006, the United States Internal Revenue Service concluded its examination of Altria Group, Inc.'s consolidated tax returns for the years 1996 through 1999 and issued a final Revenue Agents Report on March 15, 2006. Consequently, Altria Group, Inc. reimbursed the Company in cash for... -

Page 82

... the resolution of outstanding items in the Company's international operations, the majority of which was in the first quarter, and $33 million of tax impacts associated with the sale of a U.S. biscuit brand. The 2005 rate also includes a $53 million aggregate benefit from the domestic manufacturers... -

Page 83

... America Cheese & Foodservice; North America Convenient Meals; North America Grocery; and North America Snacks & Cereals. Kraft International Commercial's operations are organized and managed by geographic location. Kraft International Commercial's segments are European Union and Developing Markets... -

Page 84

... Beverages North America Cheese & Foodservice North America Convenient Meals North America Grocery North America Snacks & Cereals European Union Developing Markets, Oceania & North Asia Amortization of intangibles General corporate expenses Operating income Interest and other debt expense, net... -

Page 85

..., 2006, 2005 and 2004: For the Year Ended December 31, 2006 Kraft North America Commercial Kraft International Commercial (in millions) Total Consumer Sector: Snacks Beverages Cheese & Dairy Grocery Convenient Meals Total net revenues $ 5,491 3,352 4,857 4,282 5,136 23,118 $ 4,537 3,973 1,557... -

Page 86

... the operating companies income of the following segments: For the Years Ended December 31, 2006 2005 (in millions) 2004 North America Beverages North America Cheese & Foodservice North America Convenient Meals North America Grocery North America Snacks & Cereals European Union Developing Markets... -

Page 87

...) 2004 Depreciation expense from continuing operations: North America Beverages North America Cheese & Foodservice North America Convenient Meals North America Grocery North America Snacks & Cereals European Union Developing Markets, Oceania & North Asia Total depreciation expense from continuing... -

Page 88

...to adopt the measurement date provision of SFAS No. 158 and measure these plans as of December 31 of each year beginning December 31, 2008. The Company is presently evaluating the impact of the measurement date change, which is not expected to be significant. 83 Source: KRAFT FOODS INC, 10-K, March... -

Page 89

... separate plans, many of which are governed by local statutory requirements. In addition, the Company's U.S. and Canadian subsidiaries provide health care and other benefits to substantially all retired employees. Health care benefits for retirees outside the United States and Canada are generally... -

Page 90

... pension costs $ 1.2 (0.1) (1.0) 0.1 $ 3.6 (1.2) $ $ 2.4 The accumulated benefit obligation, which represents benefits earned to date, for the U.S. pension plans was $5,584 million and $5,580 million at December 31, 2006 and 2005, respectively. The 85 Source: KRAFT FOODS INC, 10-K, March 01... -

Page 91

... of compensation increase 5.90% 4.00 5.60% 4.00 4.67% 3.00 4.44% 3.11 The Company's 2006 year-end U.S. and Canadian plans discount rates were developed from a model portfolio of high quality, fixed-income debt instruments with durations that match the expected future cash flows of the benefit... -

Page 92

... identical to their respective asset policy targets. The Company attempts to mitigate investment risk by rebalancing between equity and debt asset classes as the Company's contributions and monthly benefit payments are made. The Company presently makes, and plans to make, contributions, to the... -

Page 93

... loss and prior service cost for the postretirement benefit plans that are expected to be amortized from accumulated other comprehensive income into net postretirement health care costs during 2007 are $67 million and $(26) million, respectively. In December 2003, the United States enacted into law... -

Page 94

...its Canadian plans. The Company's postretirement health care plans are not funded. The changes in the accumulated benefit obligation and net amount accrued at December 31, 2006 and 2005, were as follows: 2006 (in millions) 2005 Accumulated postretirement benefit obligation at January 1 Service cost... -

Page 95

... 31, 2006: One-Percentage-Point Increase One-Percentage-Point Decrease Effect on total of service and interest cost Effect on postretirement benefit obligation 14.2% 11.1 (11.6)% (9.3) The Company's estimated future benefit payments for its postretirement health care plans at December 31, 2006... -

Page 96

.... Note 16. Additional Information: The amounts shown below are for continuing operations. For the Years Ended December 31, 2006 2005 (in millions) 2004 Research and development expense Advertising expense Interest and other debt expense, net: Interest income, Altria Group, Inc. and affiliates... -

Page 97

... of accumulated other comprehensive earnings (losses) and is recognized as a component of cost of sales in the Company's consolidated statement of earnings when the related inventory is sold. Unrealized gains or losses on net commodity positions were 92 Source: KRAFT FOODS INC, 10-K, March 01, 2007 -

Page 98

... 2005, the Company had net long commodity positions of $...gains or losses reported in accumulated other...Fair value: The aggregate fair value, based on market quotes, of the Company's third-party debt...Company's consolidated financial position, results of operations or cash flows. 93 Source: KRAFT FOODS... -

Page 99

.... The Company has a liability of $16 million on its consolidated balance sheet at December 31, 2006, relating to these guarantees. Note 19. Quarterly Financial Data (Unaudited): 2006 Quarters First Second Third Fourth (in millions, except per share data) Net revenues Gross profit Net earnings... -

Page 100

... Market price-high -low $ $ 35.65 31.34 $ $ 33.15 30.11 $ $ 32.17 29.36 $ $ 30.80 27.88 Basic and diluted EPS are computed independently for each of the periods presented. Accordingly, the sum of the quarterly EPS amounts may not agree to the total for the year. 95 Source: KRAFT FOODS... -

Page 101

... the pre-spin Altria Group, Inc. options: • a new Kraft option to acquire the number of shares of Kraft Class A common stock equal to the product of (a) the number of Altria Group, Inc. options held by such person on the Distribution Date and (b) the approximate distribution ratio of 0.7 mentioned... -

Page 102

...Chief Executive Officer and Chief Financial Officer, of the effectiveness of the Company's disclosure controls and procedures (pursuant to Rule 13a-15(e) under the Securities Exchange Act of 1934, as amended) as of the end of the period covered by this report. Based upon that 97 Source: KRAFT FOODS... -

Page 103

... the participation of the Company's Chief Executive Officer and Chief Financial Officer, any change in the Company's internal control over financial reporting and determined that there has been no change in the Company's internal control over financial reporting during the quarter ended December 31... -

Page 104

... Officer Executive Vice President & Chief Marketing Officer Executive Vice President, Corporate & Legal Affairs and General Counsel Executive Vice President, Global Human Resources Executive Vice President and President, International Commercial Executive Vice President and President, North America... -

Page 105

... follows: Equity Compensation Plan Information Number of Shares to be Issued Upon Exercise of Outstanding Options and Vesting of Restricted Stock Weighted Average Exercise Price of Outstanding Options Number of Shares Remaining Available for Future Issuance under Equity Compensation Plans Equity... -

Page 106

...-Sharing Agreement between Altria Group, Inc. and the Registrant(6) 2001 Kraft Foods Inc. Performance Incentive Plan(4) Kraft Foods Inc. 2005 Performance Incentive Plan(19) 2001 Kraft Foods Inc. Compensation Plan for Non-Employee Directors, as amended(7) Kraft Foods Inc. Supplemental Benefits Plan... -

Page 107

...21) 2006 Stock Compensation Plan for Non-Employee Directors(22) Form of Restricted Stock Award Letter(23) Master Professional Services Agreement between Kraft Foods Global, Inc. and Electronic Data Systems Services Corporation dated as of April 27, 2006(24) Purchase and Sale Agreement between Altria... -

Page 108

... reference to the Proxy Statement of Altria Group, Inc. dated March 10, 2000. Compensation plans maintained by Altria Group, Inc. and its subsidiaries in which officers of the Registrant have historically participated. Incorporated by reference to the Registrant's Annual Report on Form 10-K for the... -

Page 109

... the Securities and Exchange Commission on January 31, 2007. Incorporated by reference to the Registrant's Current Report on Form 8-K filed with the Securities and Exchange Commission on February 1, 2007. 104 (20) (21) (22) (23) (24) (25) (26) (27) (28) (29) (30) (31) Source: KRAFT FOODS INC, 10... -

Page 110

... the undersigned, thereunto duly authorized. KRAFT FOODS INC. By: /s/ JAMES P. DOLLIVE (James P. Dollive, Executive Vice President and Chief Financial Officer) Date: March 1, 2007 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following... -

Page 111

... OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM ON FINANCIAL STATEMENT SCHEDULE To the Board of Directors and Shareholders of Kraft Foods Inc.: Our audits of the consolidated financial statements, of management's assessment of the effectiveness of internal control over financial reporting and of... -

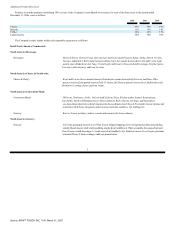

Page 112

... at Beginning of Period Charged to Costs and Expenses Charged to Other Accounts (a) Balance at End of Period Col. D Col. E Description Deductions (b) 2006: Allowance for discounts Allowance for doubtful accounts Allowance for deferred taxes $ 11 107 135 253 $ 3 12 3 18 $ - 4 1 5 $ 7 20 39... -

Page 113

... STATEMENTS Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure. Item 9A. Controls and Procedures. Item 9B. Other Information. PART III Item 10. Directors, Executive Officers and Corporate Governance. Item 11. Executive Compensation. Item 12. Security... -

Page 114

EXHIBIT 12 KRAFT FOODS INC. AND SUBSIDIARIES Computation of Ratios of Earnings to Fixed Charges (in millions of dollars) Years Ended December 31, 2006 2005 2004 2003 2002 Earnings from continuing operations before income taxes and minority interest Add (Deduct): Equity in net earnings of less than ... -

Page 115

Source: KRAFT FOODS INC, 10-K, March 01, 2007 -

Page 116

...omitted. State or Country of Organization Name 152999 Canada Inc. 3072440 Nova Scotia Company AB Kraft Foods Lietuva Aberdare Two Developments Ltd AGF SP, Inc. AGF Suzuka, Inc. Ajinomoto General Foods, Inc. Alimentos Especiales, Sociedad Anonima Balance Bar Company Beijing Nabisco Food Company Ltd... -

Page 117

... America NMB B.V. Kraft Foods Latin America VA Holding B.V. Kraft Foods Laverune SNC Kraft Foods Limited Singapore Thailand Trinidad Argentina Norway Delaware Singapore Wisconsin Belgium Brazil Bulgaria Delaware Netherlands Chile Colombia Colombia Costa Rica Czech Republic Denmark Denmark Mexico... -

Page 118

... South Africa France Sweden Sweden Delaware Taiwan United Kingdom Uruguay Venezuela Croatia Turkey China Ireland Australia France Japan Delaware Ireland China Ireland Mexico Australia Australia Canada Netherlands Austria Saudi Arabia Delaware Nicaragua Cayman Islands China Spain Source: KRAFT FOODS... -

Page 119

Nabisco International Limited Nabisco Inversiones S.R.L. Nabisco Taiwan Corporation NISA Holdings LLC NSA Holding LLC OMFC Service Company OOO Kraft Foods OOO Kraft Foods RUS OOO Kraft Foods Sales & Marketing Oy Kraft Foods Finland Ab P.T. Kraft Foods Indonesia Limited P.T. Kraft Ultrajaya Indonesia... -

Page 120

QuickLinks KRAFT FOODS INC. SUBSIDIARIES Source: KRAFT FOODS INC, 10-K, March 01, 2007 -

Page 121

...) and on Form S-3 (File Nos. 333-67770, 333-86478, 333-101829 and 333-113620), of Kraft Foods Inc., of our reports dated February 5, 2007 relating to the consolidated financial statements, management's assessment of the effectiveness of internal control over financial reporting and the effectiveness... -

Page 122

QuickLinks CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM Source: KRAFT FOODS INC, 10-K, March 01, 2007 -

Page 123

... the undersigned, a Director of Kraft Foods Inc., a Virginia corporation (the "Company"), does hereby constitute and appoint Louis C. Camilleri, Marc S. Firestone and James P. Dollive, or any one or more of them, his true and lawful attorney, for him and in his name, place and stead, to execute, by... -

Page 124

... the undersigned, a Director of Kraft Foods Inc., a Virginia corporation (the "Company"), does hereby constitute and appoint Louis C. Camilleri, Marc S. Firestone and James P. Dollive, or any one or more of them, his true and lawful attorney, for him and in his name, place and stead, to execute, by... -

Page 125

... THAT the undersigned, a Director of Kraft Foods Inc., a Virginia corporation (the "Company"), does hereby constitute and appoint Marc S. Firestone and James P. Dollive, or any one of them, his true and lawful attorney, for him and in his name, place and stead, to execute, by manual or facsimile... -

Page 126

... the undersigned, a Director of Kraft Foods Inc., a Virginia corporation (the "Company"), does hereby constitute and appoint Louis C. Camilleri, Marc S. Firestone and James P. Dollive, or any one or more of them, his true and lawful attorney, for him and in his name, place and stead, to execute, by... -

Page 127

... the undersigned, a Director of Kraft Foods Inc., a Virginia corporation (the "Company"), does hereby constitute and appoint Louis C. Camilleri, Marc S. Firestone and James P. Dollive, or any one or more of them, his true and lawful attorney, for him and in his name, place and stead, to execute, by... -

Page 128

... the undersigned, a Director of Kraft Foods Inc., a Virginia corporation (the "Company"), does hereby constitute and appoint Louis C. Camilleri, Marc S. Firestone and James P. Dollive, or any one or more of them, his true and lawful attorney, for him and in his name, place and stead, to execute, by... -

Page 129

... the undersigned, a Director of Kraft Foods Inc., a Virginia corporation (the "Company"), does hereby constitute and appoint Louis C. Camilleri, Marc S. Firestone and James P. Dollive, or any one or more of them, her true and lawful attorney, for her and in her name, place and stead, to execute, by... -

Page 130

... the undersigned, a Director of Kraft Foods Inc., a Virginia corporation (the "Company"), does hereby constitute and appoint Louis C. Camilleri, Marc S. Firestone and James P. Dollive, or any one or more of them, his true and lawful attorney, for him and in his name, place and stead, to execute, by... -

Page 131

... the undersigned, a Director of Kraft Foods Inc., a Virginia corporation (the "Company"), does hereby constitute and appoint Louis C. Camilleri, Marc S. Firestone and James P. Dollive, or any one or more of them, her true and lawful attorney, for her and in her name, place and stead, to execute, by... -

Page 132

QuickLinks POWER OF ATTORNEY Source: KRAFT FOODS INC, 10-K, March 01, 2007 -

Page 133

...information; and Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. /s/ IRENE B. ROSENFELD Irene B. Rosenfeld Chief Executive Officer (b) Date: March 1, 2007 Source: KRAFT FOODS... -

Page 134

QuickLinks Certifications Source: KRAFT FOODS INC, 10-K, March 01, 2007 -

Page 135

..., that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. /s/ JAMES P. DOLLIVE James P. Dollive Executive Vice President and Chief Financial Officer (b) Date: March 1, 2007 Source: KRAFT FOODS INC, 10-K, March 01, 2007 -

Page 136

QuickLinks Certifications Source: KRAFT FOODS INC, 10-K, March 01, 2007 -

Page 137

... In connection with the Annual Report of Kraft Foods Inc. (the "Company") on Form 10-K for the period ended December 31, 2006 as filed with the Securities and Exchange Commission on the date hereof (the "Report"), I, Irene B. Rosenfeld, Chief Executive Officer of the Company, certify, pursuant to 18... -

Page 138

QuickLinks CERTIFICATION PURSUANT TO 18 U.S.C. SECTION 1350, AS ADOPTED PURSUANT TO SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002 Source: KRAFT FOODS INC, 10-K, March 01, 2007 -

Page 139

... with the Annual Report of Kraft Foods Inc. (the "Company") on Form 10-K for the period ended December 31, 2006 as filed with the Securities and Exchange Commission on the date hereof (the "Report"), I, James P. Dollive, Executive Vice President and Chief Financial Officer of the Company, certify... -

Page 140

QuickLinks CERTIFICATION PURSUANT TO 18 U.S.C. SECTION 1350, AS ADOPTED PURSUANT TO SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002 _____ Created by 10KWizard www.10KWizard.com Source: KRAFT FOODS INC, 10-K, March 01, 2007