Honeywell 2004 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2004 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

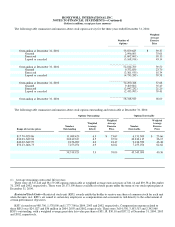

shares for issuance under the Directors' Plan. Options generally become exercisable over a three-year period and expire after ten years.

Note 21—Commitments and Contingencies

Shareowner Litigation—Honeywell and three of its former officers were defendants in a class action lawsuit filed in the United

States District Court for the District of New Jersey. Plaintiffs alleged, among other things, that the defendants violated federal

securities laws by purportedly making false and misleading statements and by failing to disclose material information concerning

Honeywell's financial performance, thereby allegedly causing the value of Honeywell's stock to be artificially inflated. The Court

certified a class consisting of all purchasers of Honeywell stock between December 20, 1999 and June 19, 2000. On June 4, 2004

Honeywell and the lead plaintiffs agreed to a settlement of this matter which required a payment to the class of $100 million.

Honeywell's contribution to the settlement was $15 million, which amount had previously been fully reserved. Honeywell's insurance

carriers paid the remainder of the settlement. The settlement was approved by the Court on August 16, 2004. A small number of class

members, including the Florida State Board of Administration (FSBA), opted out of the settlement. The FSBA claims have been

settled for $1.25 million. Honeywell believes that all opt-out claims, including that of the FSBA, are fully insured.

ERISA Class Action Lawsuit—Honeywell and several of its current and former officers and directors are defendants in a

purported class action lawsuit filed in the United States District Court for the District of New Jersey. The complaint principally alleges

that the defendants breached their fiduciary duties to participants in the Honeywell Savings and Ownership Plan (the “Savings Plan”)

by purportedly making false and misleading statements, failing to disclose material information concerning Honeywell's financial

performance, and failing to diversify the Savings Plan's assets and monitor the prudence of Honeywell stock as a Savings Plan

investment. In September 2004, Honeywell reached an agreement in principle to settle this matter for $14 million plus an agreement to

permit Savings Plan participants greater diversification rights. The settlement will be paid in full by Honeywell's insurers. The

settlement will require Court approval, which is expected in 2005.

Environmental Matters—We are subject to various federal, state, local and foreign government requirements relating to the

protection of the environment. We believe that, as a general matter, our policies, practices and procedures are properly designed to

prevent unreasonable risk of environmental damage and personal injury and that our handling, manufacture, use and disposal of

hazardous or toxic substances are in accord with environmental and safety laws and regulations. However, mainly because of past

operations and operations of predecessor companies, we, like other companies engaged in similar businesses, have incurred remedial

response and voluntary cleanup costs for site contamination and are a party to lawsuits and claims associated with environmental and

safety matters, including past production of products containing toxic substances. Additional lawsuits, claims and costs involving

environmental matters are likely to continue to arise in the future.

With respect to environmental matters involving site contamination, we continually conduct studies, individually or jointly with

other responsible parties, to determine the feasibility of various remedial techniques to address environmental matters. It is our policy

to record appropriate liabilities for environmental matters when remedial efforts or damage claim payments are probable and the costs

can be reasonably estimated. Such liabilities are based on our best estimate of the undiscounted future costs required to complete the

remedial work. The recorded liabilities are adjusted periodically as remediation efforts progress or as additional technical or legal

information becomes available. Given the uncertainties regarding the status of laws, regulations, enforcement policies, the impact of

other potentially responsible parties, technology and information related to individual sites, we do not believe it is possible to develop

an estimate of the range of reasonably possible environmental loss in excess of our accruals. We expect to fund expenditures for these

matters from operating cash flow. The timing

71