Honeywell 2004 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2004 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(3)

These amounts are estimates of asbestos related cash payments for NARCO and Bendix. NARCO estimated payments are based

on the terms and conditions, including evidentiary requirements, specified in the definitive agreements or agreements in principle

and pursuant to Trust Distribution Procedures. Bendix payments are based on our estimate of pending claims. Projecting future

events is subject to many uncertainties that could cause asbestos liabilities to be higher or lower than those projected and

recorded. There is no assurance that NARCO or Bendix insurance recoveries will be timely, that a NARCO plan of

reorganization will be proposed or confirmed, or whether there will be any NARCO related asbestos claims beyond 2018. See

Asbestos Matters in Note 21 of Notes to Financial Statements in “Item 8. Financial Statements and Supplementary Data”.

(4) These amounts represent probable insurance recoveries through 2018. See Asbestos Matters in Note 21 of Notes to Financial

Statements in “Item 8. Financial Statements and Supplementary Data.”

The table excludes our pension and other postretirement benefits (OPEB) obligations. We made voluntary contributions of $40,

$670 and $830 million to our U.S. pension plans in 2004, 2003 and 2002, respectively. Future plan contributions are dependent upon

actual plan asset returns and interest rates. Assuming that actual plan asset returns are consistent with our expected plan return of 9

percent in 2005 and beyond, and that interest rates remain constant, we would not be required to make any contributions to our U.S.

pension plans for the foreseeable future. Payments due under our OPEB plans are not required to be funded in advance, but are paid as

medical costs are incurred by covered retiree populations, and are principally dependent upon the future cost of retiree medical

benefits under our plans. We expect our OPEB payments to approximate $208 million in 2005. See Note 22 of Notes to Financial

Statements in “Item 8. Financial Statements and Supplementary Data” for further discussion of our pension and OPEB plans.

Off-Balance Sheet Arrangements

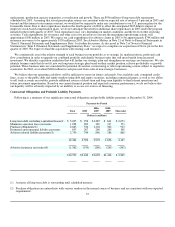

Following is a summary of our off-balance sheet arrangements:

Guarantees—We have issued or are a party to the following direct and indirect guarantees at December 31, 2004:

Maximum

Potential

Future

Payments

(Dollars

in millions)

Operating lease residual values $ 47

Other third parties' financing 4

Unconsolidated affiliates' financing 7

Customer and vendor financing 35

$ 93

We do not expect that these guarantees will have a material adverse effect on our consolidated results of operations, financial

position or liquidity.

In connection with the disposition of certain businesses and facilities we have indemnified the purchasers for the expected cost of

remediation of environmental contamination, if any, existing on the date of disposition. Such expected costs are accrued when

environmental assessments are made or remedial efforts are probable and the costs can be reasonably estimated.

Retained Interests in Factored Pools of Trade Accounts Receivables—As a source of liquidity, we sell interests in designated

pools of trade accounts receivables to third parties. The sold receivables ($500 million at December 31, 2004) are over-collateralized

and we retain a subordinated interest in the pool of receivables representing that over-collateralization as well as an undivided interest

in the balance of the receivables pools. The over-collateralization provides credit support to the purchasers of the receivable interest by

limiting their losses in the event that a portion of the

38