Honeywell 2004 Annual Report Download - page 220

Download and view the complete annual report

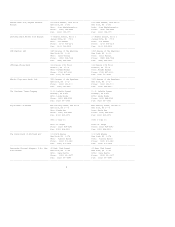

Please find page 220 of the 2004 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Other Claims 70,447 69,699 47,011

------ ------ ------

Total Claims 74,178 72,976 50,821

====== ====== ======

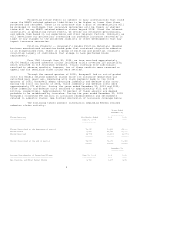

Approximately 30 percent of the 74,000 pending claims at June 30,

2004 are on the inactive, deferred, or similar dockets established in some

jurisdictions for claimants who allege minimal or no impairment. The

approximately 74,000 pending claims also include claims filed in jurisdictions

such as Texas, Virginia and Mississippi that allow for consolidated filings. In

these jurisdictions, plaintiffs are permitted to file complaints against a

pre-determined master list of defendants, regardless of whether they have claims

against each individual defendant. Many of these plaintiffs may not actually

have claims against Honeywell. Based on state rules and prior experience in

these jurisdictions, we anticipate that many of these claims will ultimately be

dismissed. During 2003, Honeywell was served with numerous complaints filed in

Mississippi in advance of the January 1, 2003 effective date for tort reform in

that state. Also during 2003, Honeywell experienced an increase in nonmalignancy

filings that we believe were in response to the possibility of federal

legislation. Based on prior experience, we anticipate that many of these claims

will be placed on deferred, inactive or similar dockets or be dismissed.

Honeywell has experienced average resolution values excluding legal costs for

malignant claims of approximately ninety five thousand and one hundred sixty six

thousand dollars in 2003 and 2002, respectively. Honeywell has experienced

average resolution values excluding legal costs for nonmalignant claims of

approximately three thousand five hundred and one thousand three hundred dollars

in 2003 and 2002, respectively. It is not possible to predict whether resolution

values for Bendix related asbestos claims will increase, decrease or stabilize

in the future.

We have accrued for the estimated cost of pending asbestos related

claims. The estimate is based on the number of pending claims at June 30, 2004,

disease classifications, expected settlement values and historic dismissal

rates. Honeywell retained the expert services of HR&A (see discussion of HR&A

under Refractory products above) to assist in developing the estimated expected

settlement values and historic dismissal rates. We cannot reasonably estimate

losses which could arise from future Bendix related asbestos claims because we

cannot predict how many additional claims may be brought against us, the

allegations in such claims or their probable outcomes and resulting settlement

values in the tort system.

Honeywell presently has approximately $1.9 billion of insurance

coverage remaining with respect to pending Bendix related asbestos claims as

well as claims which may be filed against us in the future. This coverage is

provided by a large number of insurance policies written by dozens of insurance

companies in both the domestic insurance market and the London excess market.

Although Honeywell has approximately $1.9 billion in insurance, there are gaps

in our coverage due to insurance company insolvencies, a comprehensive policy

buy-back settlement with Equitas in 2003 and certain uninsured periods. We

analyzed the amount of insurance that we estimate is probable that we will

recover in relation to payment of asbestos related claims and determined that

approximately 50 percent of expenditures for such claims are recoverable by

insurance. While the substantial majority of our insurance carriers are solvent,

some of our individual carriers are insolvent, which has been considered in our

analysis of probable recoveries. We made judgments concerning insurance coverage

that we believe are reasonable and consistent with our historical dealings with

our insurers, our knowledge of any pertinent solvency issues surrounding

insurers and various judicial determinations relevant to our

7