Honeywell 2004 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2004 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

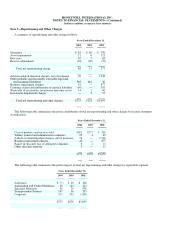

In 2003, we recognized repositioning charges totaling $82 million primarily for severance costs related to workforce reductions of

1,501 manufacturing and administrative positions across all of our reportable segments. Also, $69 million of previously established

accruals, primarily for severance, were returned to income in 2003, due to fewer employee separations than originally planned

associated with certain prior repositioning actions, resulting in reduced severance liabilities in our Automation and Control Solutions,

Aerospace and Specialty Materials reportable segments.

In 2002, we recognized repositioning charges totaling $453 million for workforce reductions across all of our reportable segments

and our UOP process technology joint venture. The charge also related to costs for the planned shutdown and consolidation of

manufacturing plants in our Specialty Materials and Automation and Control Solutions reportable segments. Severance costs related to

workforce reductions of approximately 8,100 manufacturing and administrative positions. Asset impairments principally related to

manufacturing plant and equipment held for sale and capable of being taken out of service and actively marketed in the period of

impairment. Exit costs related principally to incremental costs to exit facilities, including lease termination losses negotiated or subject

to reasonable estimation related mainly to closed facilities in our Automation and Control Solutions and Specialty Materials reportable

segments. Also, $76 million of previously established severance accruals were returned to income in 2002, due to fewer employee

separations than originally planned associated with certain prior repositioning actions and higher than expected voluntary employee

attrition, resulting in reduced severance liabilities in our Aerospace, Automation and Control Solutions and Specialty Materials

reportable segments.

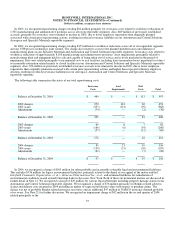

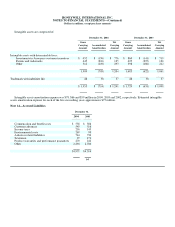

The following table summarizes the status of our total repositioning costs.

Severance

Costs Asset

Impairments Exit

Costs Total

Balance at December 31, 2001 $ 484 $ — $ 113 $ 597

2002 charges 270 121 62 453

2002 usage (355) (121) (92) (568)

Adjustments (74) — (2) (76)

Balance at December 31, 2002 325 — 81 406

2003 charges 69 6 7 82

2003 usage (166) (6) (34) (206)

Adjustments (57) — (12) (69)

Balance at December 31, 2003 171 — 42 213

2004 charges 85 21 10 116

2004 usage (138) (21) (26) (185)

Adjustments (21) — (7) (28)

Balance at December 31, 2004 $ 97 $ — $ 19 $ 116

In 2004, we recognized a charge of $565 million for other probable and reasonably estimable legal and environmental liabilities.

This includes $536 million for legacy environmental liabilities, primarily related to the denial of our appeal of the matter entitled

Interfaith Community Organization, et. al. v. Honeywell International Inc., et al., and estimated liabilities for remediation of

environmental conditions in and around Onondaga Lake in Syracuse, New York. Both of these environmental matters are discussed in

further detail in Note 21. We recognized a charge of $29 million for various legal settlements including property damage claims in our

Automation and Control Solutions reportable segment. We recognized a charge of $76 million primarily for Bendix related asbestos

claims and defense costs incurred in 2004 including an update of expected resolution values with respect to pending claims. The

charge was net of probable Bendix related insurance recoveries and an additional $47 million of NARCO insurance deemed probable

of recovery. See Note 21 for further discussion. We recognized an impairment charge of $42 million in the second quarter of 2004

related principally to the

55