Honeywell 2004 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2004 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

when applying the impairment rules to determine the timing of the impairment test, the undiscounted cash flows used to assess

impairment, and the fair value of an impaired long-lived asset group. The dynamic economic environment in which each of our

businesses operate and the resulting assumptions used to estimate future cash flows, such as economic growth rates, industry growth

rates, product life cycles, selling price changes and cost inflation can significantly influence and impact the outcome of all impairment

tests. For a discussion of the result of management's judgment applied in the recognition and measurement of impairment charges see

the repositioning and other charges section of this MD&A.

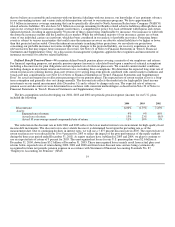

Income Taxes—The future tax benefit arising from net deductible temporary differences and tax carryforwards was $1.7 and $1.8

billion at December 31, 2004 and 2003, respectively. We believe that our earnings during the periods when the temporary differences

become deductible will be sufficient to realize the related future income tax benefits. For those jurisdictions where the expiration date

of tax carryforwards or the projected operating results indicate that realization is not likely, a valuation allowance is provided.

In assessing the need for a valuation allowance, we consider all available positive and negative evidence, including past operating

results, estimates of future taxable income and the feasibility of ongoing tax planning strategies. Significant management judgment is

required in determining the provision for income taxes and, in particular, any valuation allowance recorded against our deferred tax

assets. Additionally, valuation allowances related to deferred tax assets can be impacted by changes to tax laws and future taxable

income levels. In the event we determine that we will not be able to realize our deferred tax assets in the future, we will reduce such

amounts through a charge to income in the period that such determination is made. Conversely, if we determine that we will be able to

realize deferred tax assets in excess of the carrying amounts, we will decrease the recorded valuation allowance through a credit to

income in the period that such determination is made.

Sales Recognition on Long-Term Contracts—In 2004, we recognized approximately 8 percent of our total net sales using the

percentage-of-completion method for long-term contracts in our Automation and Control Solutions and Aerospace reportable

segments. The percentage-of-completion method requires us to make judgments in estimating contract revenues, contract costs and

progress toward completion. These judgments form the basis for our determinations regarding overall contract value, contract

profitability and timing of revenue recognition based on measured progress toward contract completion. Revenue and cost estimates

are monitored on an ongoing basis and revised based on changes in circumstances. Anticipated losses on long-term contracts are

recognized when such losses become evident. We maintain financial controls over the customer qualification, contract pricing and

cost estimation processes to reduce the risk of contract losses.

Aerospace Customer Incentives—Consistent with other suppliers to commercial aircraft manufacturers and airlines, we provide

sales incentives to commercial aircraft manufacturers and airlines in connection with their selection of our aircraft wheel and braking

system hardware and auxiliary power units for installation on commercial aircraft. These incentives consist of free or deeply

discounted products, product credits and upfront cash payments. The cost of these incentives are capitalized at the time we deliver the

products to our customers or, in the case of product credits, at the time the credit is issued, or in the case of upfront cash payments, at

the time the payment is made. In the case of free or deeply discounted product, the cost to manufacture less any amount recovered

from the airframe manufacturer or airline is capitalized. Product credits and upfront cash payments are capitalized at exchanged value.

Research, design, development and qualification costs related to these products are expensed as incurred, unless contractually

guaranteed of reimbursement. The cost of the sales incentives described above is capitalized because the selection of our aircraft

wheel and braking system hardware and auxiliary power units for installation on commercial aircraft results in the creation of future

revenues and cash flows through aftermarket sales to fulfill long-term product maintenance requirements mandated by the Federal

Aviation Administration (FAA) and other similar international organizations over the useful life of the aircraft. Once our products are

certified and selected on an aircraft, the recovery of our investment is virtually guaranteed over the useful life of the aircraft. The

likelihood of displacement by an alternative supplier is remote due to contractual sole-sourcing, the high cost to alternative suppliers

and aircraft operators of product retrofits, and/or rigorous regulatory

21