Honeywell 2004 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2004 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

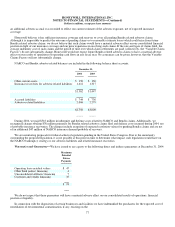

Major actuarial assumptions used in determining the benefit obligations and net periodic benefit cost (income) for our U.S. benefit

plans are presented in the following table. For non-U.S. benefit plans, no one of which was material, assumptions reflect economic

assumptions applicable to each country.

Pension Benefits Other Postretirement

Benefits

2004 2003 2002 2004 2003 2002

Actuarial assumptions used to determine benefit obligations as of

December 31:

Discount rate 5.875% 6.00% 6.75% 5.50% 6.00% 6.75%

Expected annual rate of compensation increase 4.00% 4.00% 4.00% — — —

Actuarial assumptions used to determine net periodic benefit cost

(income) for years ended December 31:

Discount rate 6.00% 6.75% 7.25% 6.00% 6.75% 7.25%

Expected rate of return on plan assets 9.00% 9.00% 10.00% — — —

Expected annual rate of compensation increase 4.00% 4.00% 4.00% — — —

We considered the available yields on high-quality fixed-income investments with maturities corresponding to the expected

payment dates of our benefit obligations to determine our discount rates at each measurement date.

Pension Benefits

Pension plans with accumulated benefit obligations exceeding the fair value of plan assets were as follows:

December 31,

2004 2003

Projected benefit obligation $1,801 $1,639

Accumulated benefit obligation 1,720 1,566

Fair value of plan assets 950 906

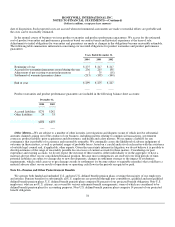

Statement of Financial Accounting Standards No. 87, “Employers Accounting for Pensions” (SFAS No. 87) requires recognition

of an additional minimum pension liability if the fair value of plan assets is less than the accumulated benefit obligation at the end of

the plan year. In 2004, we recorded a non-cash adjustment to equity through accumulated other nonowner changes of $15 million

($19 million on a pretax basis) which increased the additional minimum pension liability. In 2003, we recorded a non-cash adjustment

to equity through accumulated other nonowner changes of $369 million ($604 million on a pretax basis) to reduce the additional

minimum pension liability by $304 million and reinstate a portion of the pension assets ($300 million) written off in the prior year's

minimum pension liability adjustment. This 2003 adjustment resulted from an increase in our pension assets in 2003 due to the

improvement in equity markets and our contribution of $670 million to our U.S. plans. In 2002, due to the poor performance of the

equity markets which adversely affected our pension assets and a decline in the discount rate, we recorded a non-cash adjustment to

equity through accumulated other nonowner changes of $606 million ($956 million on a pretax basis) which increased the additional

minimum pension liability.

Under SFAS No. 87, for our U.S. pension plans, we use the market-related value of plan assets reflecting changes in the fair value

of plan assets over a three-year period. Further, unrecognized

82