Honeywell 2004 Annual Report Download - page 218

Download and view the complete annual report

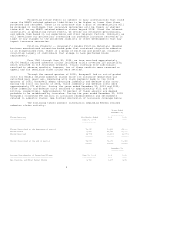

Please find page 218 of the 2004 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.and recorded a charge of $1.4 billion for NARCO related asbestos litigation

charges, net of insurance recoveries. This charge consisted of the estimated

liability to settle current asbestos related claims, the estimated liability

related to future asbestos related claims through 2018 and obligations to

NARCO's parent, net of insurance recoveries of $1.8 billion.

The estimated liability for current claims is based on terms and

conditions, including evidentiary requirements, in definitive agreements with in

excess of 90 percent of current claimants. Settlement payments with respect to

current claims are expected to be made through 2007.

The liability for future claims estimates the probable value of

future asbestos related bodily injury claims asserted against NARCO through 2018

and obligations to NARCO's parent as discussed above. The estimate is based upon

the disease criteria and payment values contained in the NARCO Trust

Distribution Procedures negotiated with the NARCO Committee of Asbestos

Creditors and the NARCO future claimants representative. In light of the

uncertainties inherent in making long-term projections we do not believe that we

have a reasonable basis for estimating asbestos claims beyond 2018 under

Statement of Financial Accounting Standards No. 5. Honeywell retained the expert

services of Hamilton, Rabinovitz and Alschuler, Inc. (HR&A) to project the

probable number and value, including trust claim handling costs, of asbestos

related future liabilities based upon historical experience with similar trusts.

The methodology used to estimate the liability for future claims has been

commonly accepted by numerous courts and is the same methodology that is

utilized by an expert who is routinely retained by the asbestos claimants

committee in asbestos related bankruptcies. The valuation methodology includes

an analysis of the population likely to have been exposed to asbestos containing

products, epidemiological studies to estimate the number of people likely to

develop asbestos related diseases, NARCO claims filing history, the pending

inventory of NARCO asbestos related claims and payment rates expected to be

established by the NARCO trust.

Honeywell has approximately $1.4 billion in insurance limits

remaining that reimburses it for portions of the costs incurred to settle NARCO

related claims and court judgments as well as defense costs. This coverage is

provided by a large number of insurance policies written by dozens of insurance

companies in both the domestic insurance market and the London excess market. At

June 30, 2004, a significant portion of this coverage is with insurance

companies with whom we have agreements to pay full policy limits based on

corresponding Honeywell claims costs. This includes agreements with a

substantial majority of the London-based insurance companies entered into

primarily in the first quarter of 2004. We conduct analyses to determine the

amount of insurance that we estimate is probable that we will recover in

relation to payment of current and projected future claims. While the

substantial majority of our insurance carriers are solvent, some of our

individual carriers are insolvent, which has been considered in our analysis of

probable recoveries. In the second quarter of 2004, based on our ongoing

evaluation of our ability to enforce our rights under the various insurance

policies, we concluded that we had additional probable insurance recoveries of

$47 million, net of solvency reserves, which has been reflected in insurance

receivables. We made judgments concerning insurance coverage that we believe are

reasonable and consistent with our historical dealings with our insurers, our

knowledge of any pertinent solvency issues surrounding insurers and various

judicial determinations relevant to our insurance programs.

5