Honeywell 2004 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2004 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283

|

|

Financial Instruments

As a result of our global operating and financing activities, we are exposed to market risks from changes in interest and foreign

currency exchange rates and commodity prices, which may adversely affect our operating results and financial position. We minimize

our risks from interest and foreign currency exchange rate and commodity price fluctuations through our normal operating and

financing activities and, when deemed appropriate, through the use of derivative financial instruments. We do not use derivative

financial instruments for trading or other speculative purposes and do not use leveraged derivative financial instruments. A summary

of our accounting policies for derivative financial instruments is included in Note 1 of Notes to Financial Statements in “Item 8.

Financial Statements and Supplementary Data”.

We conduct our business on a multinational basis in a wide variety of foreign currencies. Our exposure to market risk for changes

in foreign currency exchange rates arises from international financing activities between subsidiaries, foreign currency denominated

monetary assets and liabilities and anticipated transactions arising from international trade. Our objective is to preserve the economic

value of non-functional currency cash flows. We attempt to have all transaction exposures hedged with natural offsets to the fullest

extent possible and, once these opportunities have been exhausted, through foreign currency forward and option agreements with third

parties. Our principal currency exposures relate to the Euro, the Canadian dollar, British pound, and the U.S. dollar.

Our exposure to market risk from changes in interest rates relates primarily to our debt obligations. As described in Notes 15 and

17 of Notes to Financial Statements in “Item 8. Financial Statements and Supplementary Data”, we issue both fixed and variable rate

debt and use interest rate swaps to manage our exposure to interest rate movements and reduce overall borrowing costs.

Financial instruments, including derivatives, expose us to counterparty credit risk for nonperformance and to market risk related to

changes in interest or currency exchange rates. We manage our exposure to counterparty credit risk through specific minimum credit

standards, diversification of counterparties, and procedures to monitor concentrations of credit risk. Our counterparties are substantial

investment and commercial banks with significant experience using such derivative instruments. We monitor the impact of market risk

on the fair value and cash flows of our derivative and other financial instruments considering reasonably possible changes in interest

and currency exchange rates and restrict the use of derivative financial instruments to hedging activities.

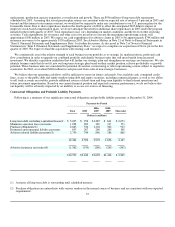

The following table illustrates the potential change in fair value for interest rate sensitive instruments based on a hypothetical

immediate one-percentage-point increase in interest rates across all maturities, the potential change in fair value for foreign exchange

rate sensitive instruments based on a 10 percent weakening of the U.S. dollar versus local currency exchange rates across all

maturities, and the potential change in fair value of contracts hedging commodity purchases based on

40