Honeywell 2004 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2004 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Rate of increase in global diesel and gasoline turbocharger OEM demand arising from continued penetration of diesel

passenger cars into the European market, and North America truck shipments.

• The adoption of regulations aimed at reducing emissions.

• Change in consumer spending for automotive aftermarket products.

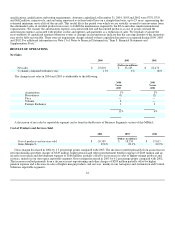

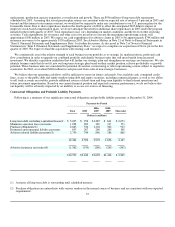

Repositioning and Other Charges

A summary of repositioning and other charges follows:

2004 2003 2002

(Dollars in millions)

Severance $ 85 $ 69 $ 270

Asset impairments 21 6 121

Exit costs 10 7 62

Reserve adjustments (28) (69) (76)

Total net repositioning charge 88 13 377

Asbestos related litigation charges, net of insurance 76 — 1,548

Other probable and reasonably estimable legal and

environmental liabilities 565 261 30

Business impairment charges 42 — 877

Customer claims and settlements of contract liabilities (10) — 152

Write-offs of receivables, inventories and other assets 14 2 60

Investment impairment charges — 2 15

Total net repositioning and other charges $ 775 $ 278 $ 3,059

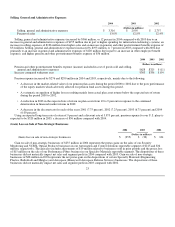

The following table summarizes the pretax distribution of total net repositioning and other charges by income statement

classification:

2004 2003 2002

(Dollars in millions)

Cost of products and services sold $ 621 $ 272 $ 561

Selling, general and administrative expenses 25 4 45

Asbestos related litigation charges, net of insurance 76 — 1,548

Business impairment charges 42 — 877

Equity in (income) loss of affiliated companies 6 2 13

Other (income) expense 5 — 15

$ 775 $ 278 $ 3,059

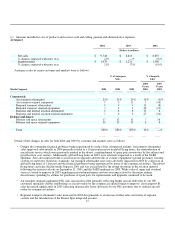

In 2004, we recognized repositioning charges totaling $116 million primarily for severance costs related to workforce reductions

of 2,272 manufacturing and administrative positions across all of our reportable segments. Also, $28 million of previously established

accruals, primarily for severance, were returned to income in 2004, due to fewer employee separations than originally planned

associated with certain prior repositioning actions, resulting in reduced severance liabilities principally in our Automation and Control

Solutions reportable segment.

In 2003, we recognized repositioning charges totaling $82 million primarly for severance costs related to workforce reductions of

1,501 manufacturing and administrative positions across all of our reportable segments. Also, $69 million of previously established

accruals, primarily for severance, were returned to income in 2003, due to fewer employee separations than originally planned

associated with certain prior repositioning actions, resulting in reduced severance liabilities in our Automation and Control Solutions,

Aerospace and Specialty Materials reportable segments.

31