Honeywell 2004 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2004 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

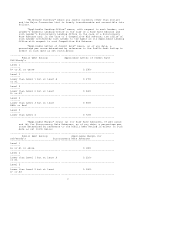

(footnotes continued from previous page)

Incentive Plan) (9,666,400 common shares to be issued for options; 2,241,706 restricted units subject to attainment of certain

performance goals or continued employment; and 423,582 deferred restricted units of previously earned and vested awards under

prior plans approved by shareowners where delivery of shares has been deferred); the 1993 Stock Plan for Employees of

Honeywell International Inc. and its Affiliates (42,630,949 common shares to be issued for options; 169,225 shares to be issued for

SARs; and 1,449,850 restricted units subject to attainment of certain performance goals or continued employment); and the Stock

Plan for Non-Employee Directors of Honeywell International Inc. and predecessor plans (206,000 common shares to be issued for

options and 48,000 shares of restricted stock). 822,060 growth plan units were issued in the first quarter of 2005 pursuant to a

long-term compensation program established under the 2003 Stock Incentive Plan. The ultimate value of any growth plan award

may be paid in cash or shares of Honeywell common stock and, thus, growth plan units are not included in the table above. The

ultimate value of growth plan units depends upon the achievement of pre-established performance goals during a two-year

performance cycle relating to growth in earnings per share, revenue and return on investment. The growth plan units issued in the

first quarter of 2005 relate to the performance cycle commencing January 1, 2005 and ending December 31, 2006. Awards made

with respect to the prior two-year performance cycle (January 1, 2003–December 31, 2004) were paid in cash.

(2) Column (b) does not include any exercise price for restricted units or growth plan units granted to employees or non-employee

directors under equity compensation plans approved by shareowners. Restricted units do not have an exercise price because their

value is dependent upon attainment of certain performance goals or continued employment or service and they are settled for

shares of Honeywell common stock on a one-for-one basis. Growth plan units are denominated in cash units and the ultimate value

of the award is dependent upon attainment of certain performance goals.

(3) The number of shares that may be issued under the 2003 Stock Incentive Plan as of December 31, 2004 is 20,173,109 which

includes the following additional shares under the 2003 Stock Incentive Plan (or any Prior Plan as defined in the 2003 Stock

Incentive Plan) that may again be available for issuance: shares that are settled for cash, expire, are cancelled, are tendered in

satisfaction of an option exercise price or tax withholding obligations, are reacquired with cash tendered in satisfaction of an

option exercise price or with monies attributable to any tax deduction enjoyed by Honeywell to the exercise of an option, and are

under any outstanding awards assumed under any equity compensation plan of an entity acquired by Honeywell. The remaining

109,000 shares included in column (c) are shares remaining for future grants under the Stock Plan for Non-Employee Directors of

Honeywell International Inc.

(4) Equity compensation plans not approved by shareowners that are included in the table are the Supplemental Non-Qualified

Savings Plans for Highly Compensated Employees of Honeywell International Inc. and its Subsidiaries, the AlliedSignal Incentive

Compensation Plan for Executive Employees of AlliedSignal Inc. and its Subsidiaries, and the Deferred Compensation Plan for

Non-Employee Directors of Honeywell International Inc.

The Supplemental Non-Qualified Savings Plans for Highly Compensated Employees of Honeywell International Inc. and its

Subsidiaries are unfunded, nonqualified plans that provide benefits equal to the employee deferrals and company matching

allocations that would have been provided under Honeywell's U.S. tax-qualified savings plan if the Internal Revenue Code

limitations on compensation and contributions did not apply. The company matching contribution is credited to participants'

accounts in the form of notional shares of Honeywell common stock. Additional notional shares are credited to participants'

accounts equal to the value of any cash dividends payable on actual shares of Honeywell common stock. The notional shares are

distributed in the form of actual shares of Honeywell common stock when payments are made to participants under the plans.

(footnotes continued on next page)

94