Honeywell 2004 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2004 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

Credit and Market Risk—Financial instruments, including derivatives, expose us to counterparty credit risk for nonperformance

and to market risk related to changes in interest or currency exchange rates. We manage our exposure to counterparty credit risk

through specific minimum credit standards, diversification of counterparties, and procedures to monitor concentrations of credit risk.

Our counterparties in derivative transactions are substantial investment and commercial banks with significant experience using such

derivative instruments. We monitor the impact of market risk on the fair value and cash flows of our derivative and other financial

instruments considering reasonably possible changes in interest and currency exchange rates and restrict the use of derivative financial

instruments to hedging activities. We do not use derivative financial instruments for trading or other speculative purposes and do not

use leveraged derivative financial instruments.

We continually monitor the creditworthiness of our customers to which we grant credit terms in the normal course of business.

While concentrations of credit risk associated with our trade accounts and notes receivable are considered minimal due to our diverse

customer base, a significant portion of our customers are in the commercial air transport industry (aircraft manufacturers and airlines)

accounting for approximately 13 percent of our consolidated sales in 2004. The terms and conditions of our credit sales are designed

to mitigate or eliminate concentrations of credit risk with any single customer. Our sales are not materially dependent on a single

customer or a small group of customers.

Foreign Currency Risk Management—We conduct our business on a multinational basis in a wide variety of foreign currencies.

Our exposure to market risk for changes in foreign currency exchange rates arises from international financing activities between

subsidiaries, foreign currency denominated monetary assets and liabilities and anticipated transactions arising from international trade.

Our objective is to preserve the economic value of non-functional currency denominated cash flows. We attempt to have all

transaction exposures hedged with natural offsets to the fullest extent possible and, once these opportunities have been exhausted,

through foreign currency forward and option agreements with third parties. Our principal currency exposures relate to the Euro, the

British pound, the Canadian dollar, and the U.S. dollar.

We hedge monetary assets and liabilities denominated in non-functional currencies. Prior to conversion into U.S dollars, these

assets and liabilities are remeasured at spot exchange rates in effect on the balance sheet date. The effects of changes in spot rates are

recognized in earnings and included in Other (Income) Expense. We hedge our exposure to changes in foreign exchange rates

principally with forward contracts. Forward contracts are marked-to-market with the resulting gains and losses similarly recognized in

earnings offsetting the gains and losses on the non-functional currency denominated monetary assets and liabilities being hedged.

We partially hedge forecasted 2005 sales and purchases denominated in non-functional currencies with currency forward

contracts. When a functional currency strengthens against non-functional currencies, the decline in value of forecasted non-functional

currency cash inflows (sales) or outflows (purchases) is partially offset by the recognition of gains (sales) and losses (purchases),

respectively, in the value of the forward contracts designated as hedges. Conversely, when a functional currency weakens against non-

functional currencies, the increase in value of forecasted non-functional currency cash inflows (sales) or outflows (purchases) is

partially offset by the recognition of losses (sales) and gains (purchases), respectively, in the value of the forward contracts designated

as hedges. Market value gains and losses on these contracts are recognized in earnings when the hedged transaction is recognized. All

open forward contracts mature by December 31, 2005.

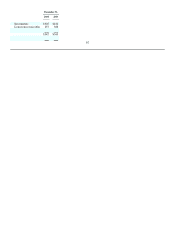

At December 31, 2004 and 2003, we had contracts with notional amounts of $790 and $641 million, respectively, to exchange

foreign currencies, principally in the Euro countries and Great Britain.

Commodity Price Risk Management—Our exposure to market risk for commodity prices arises from changes in our cost of

production. We mitigate our exposure to commodity price risk through the

67