Honeywell 2004 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2004 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

date of disposition. Such expected costs are accrued when environmental assessments are made or remedial efforts are probable and

the costs can be reasonably estimated.

In the normal course of business we issue product warranties and product performance guarantees. We accrue for the estimated

cost of product warranties and performance guarantees based on contract terms and historical experience at the time of sale.

Adjustments to initial obligations for warranties and guarantees are made as changes in the obligations become reasonably estimable.

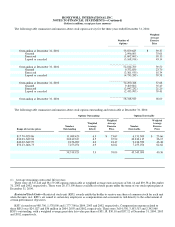

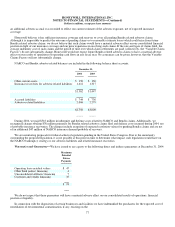

The following table summarizes information concerning our recorded obligations for product warranties and product performance

guarantees:

Years Ended December 31,

2004 2003 2002

Beginning of year $ 275 $ 217 $ 217

Accruals for warranties/guarantees issued during the year 236 215 158

Adjustment of pre-existing warranties/guarantees 1 35 (18)

Settlement of warranty/guarantee claims (213) (192) (140)

End of year $ 299 $ 275 $ 217

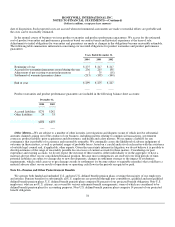

Product warranties and product performance guarantees are included in the following balance sheet accounts:

December 31,

2004 2003

Accrued liabilities $270 $242

Other liabilities 29 33

$299 $275

Other Matters—We are subject to a number of other lawsuits, investigations and disputes (some of which involve substantial

amounts claimed) arising out of the conduct of our business, including matters relating to commercial transactions, government

contracts, product liability, prior acquisitions and divestitures, and health and safety matters. We recognize a liability for any

contingency that is probable of occurrence and reasonably estimable. We continually assess the likelihood of adverse judgments of

outcomes in these matters, as well as potential ranges of probable losses, based on a careful analysis of each matter with the assistance

of outside legal counsel and, if applicable, other experts. Given the uncertainty inherent in litigation, we do not believe it is possible to

develop estimates of the range of reasonably possible loss in excess of current accruals for these matters. Considering our past

experience and existing accruals, we do not expect the outcome of these matters, either individually or in the aggregate, to have a

material adverse effect on our consolidated financial position. Because most contingencies are resolved over long periods of time,

potential liabilities are subject to change due to new developments, changes in settlement strategy or the impact of evidentiary

requirements, which could cause us to pay damage awards or settlements (or become subject to equitable remedies) that could have a

material adverse effect on our results of operations or operating cash flows in the periods recognized or paid.

Note 22—Pension and Other Postretirement Benefits

We sponsor both funded and unfunded U.S. and non-U.S. defined benefit pension plans covering the majority of our employees

and retirees. Pension benefits for substantially all U.S. employees are provided through non-contributory, qualified and non-qualified

defined benefit pension plans. U.S. defined benefit pension plans comprise 86 percent of our projected benefit obligation. Non-U.S.

employees, who are not U.S. citizens, are covered by various retirement benefit arrangements, some of which are considered to be

defined benefit pension plans for accounting purposes. Non-U.S. defined benefit pension plans comprise 14 percent of our projected

benefit obligation.

78