Honeywell 2004 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2004 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

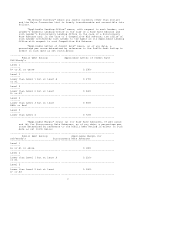

(footnotes continued from previous page)

The AlliedSignal Incentive Compensation Plan for Executive Employees of AlliedSignal Inc. and its Subsidiaries was a cash

incentive compensation plan maintained by AlliedSignal Inc. This plan has expired. Employees were permitted to defer receipt of

a cash bonus payable under the plan and invest the deferred bonus in notional shares of Honeywell common stock. The notional

shares are distributed in the form of actual shares of Honeywell common stock when payments are made to participants under the

plan. No further deferrals can be made under this plan. The number of Honeywell securities that remain to be issued under this

expired plan is 55,658.

The Deferred Compensation Plan for Non-Employee Directors of Honeywell International Inc. provides for mandatory and

elective deferral of certain payments to non-employee directors. Mandatory deferrals are invested in notional shares of Honeywell

common stock. Directors may also invest any elective deferrals in notional shares of Honeywell common stock. Additional

notional shares are credited to participant accounts equal to the value of any cash dividends payable on actual shares of Honeywell

common stock. Notional shares of Honeywell common stock are converted to an equivalent amount of cash at the time the

distributions are made from the plan to directors. However, one former director is entitled to receive periodic distributions of actual

shares of Honeywell common stock that were notionally allocated to his account in years prior to 1992. The number of Honeywell

securities that remain to be issued to this director is 2,993.

(5) Column (b) does not include any exercise price for notional shares allocated to employees under Honeywell's equity compensation

plans not approved by shareowners because all of these shares are notionally allocated as a matching contribution under the non-

qualified savings plans or as a notional investment of deferred bonuses or fees under the cash incentive compensation and

directors' plans as described in note 4 and are only settled for shares of Honeywell common stock on a one-for-one basis.

(6) No securities are available for future issuance under the AlliedSignal Incentive Compensation Plan for Executive Employees of

AlliedSignal Inc. and its Subsidiaries and the Deferred Compensation Plan for Non-Employee Directors of Honeywell

International Inc. The cash incentive compensation plan has expired. All notional investments in shares of Honeywell common

stock are converted to cash when payments are made under the directors' plan (other than with respect to 2,993 shares of

Honeywell common stock included in column (a) that is payable to one former director). The amount of securities available for

future issuance under the Supplemental Non-Qualified Savings Plan for Highly Compensated Employees of Honeywell

International Inc. and its Subsidiaries is not determinable because the number of securities that may be issued under these plans

depends upon the amount deferred to the plans by participants in future years.

The table does not contain information for the following plans and arrangements:

• Employee benefit plans of Honeywell intended to meet the requirements of Section 401(a) of the Internal Revenue

Code and a small number of foreign employee benefit plans that are similar to such Section 401(a) plans.

• Equity compensation plans maintained by Honeywell Inc. immediately prior to the merger of Honeywell Inc. and

AlliedSignal Inc. on December 1, 1999. The right to receive Honeywell International Inc. securities was substituted for

the right to receive Honeywell Inc. securities under these plans. No new awards have been granted under these plans

after the merger date. The number of shares to be issued under these plans upon exercise of outstanding options,

warrants and rights is 5,852,355 and their weighted-average exercise price is $42.53.

95