Honeywell 2004 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2004 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

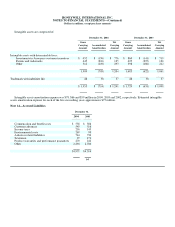

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

write-down of property, plant and equipment of our Performance Fibers business in our Specialty Materials reportable segment. This

business was sold in December 2004. We recognized a charge of $14 million for the write-off of receivables, inventories and other

assets. We also reversed a reserve of $10 million established in the prior year for a contract settlement.

In 2003, we recognized a charge of $261 million for other probable and reasonably estimable legal and environmental liabilities.

This included $235 million for environmental liabilities mainly related to the matter entitled Interfaith Community Organization, et al.

v. Honeywell International Inc., et al. and for remediation of environmental conditions in and around Onondaga Lake in Syracuse,

New York, both as discussed in Note 21. We also recognized a charge of $4 million in our Specialty Materials reportable segment

including a loss on sale of an investment owned by an equity investee.

In 2002, we recognized business impairment charges of $877 million related to businesses in our Specialty Materials and

Automation and Control Solutions reportable segments, as well as our Friction Materials business. Based on current operating losses

and deteriorating economic conditions in certain chemical and telecommunications end markets, we performed impairment tests and

recognized impairment charges of $785 million principally related to the write-down of property, plant and equipment held and used

in our Nylon System, Performance Fibers and Metglas Specialty Materials businesses, as well as an Automation and Control Solutions

communication business. We also recognized impairment charges of $92 million related principally to the write-down of property,

plant and equipment of our Friction Materials business, which was classified as assets held for disposal in Other Current Assets as of

December 31, 2002. A plan of disposal of Friction Materials was adopted in 2001; in January 2003, we entered into a letter of intent to

sell this business to Federal-Mogul Corp. The assets were reclassified from held for sale to held and used as of December 31, 2003

following the cessation of negotiations to sell our Friction Materials business to Federal-Mogul Corp. At that time, no adjustment to

the carrying value of Friction Materials' assets was required based on a current reassessment of the fair value of those assets. Such

reassessment of the fair value of the property, plant and equipment was performed using discounted estimated future cash flows of the

business. The fair value approximated the written-down held for sale value and was also less than the carrying amount of the property,

plant and equipment prior to being classified as held for sale, adjusted for depreciation expense that would have otherwise been

recognized had these assets been classified as held and used (See Note 21). We recognized asbestos related litigation charges of

$1,548 million principally related to costs associated with the potential resolution of asbestos claims of NARCO (see Note 21). We

also recognized other charges consisting of customer claims and settlements of contract liabilities of $152 million and write-offs of

receivables, inventories and other assets of $60 million. These other charges related mainly to our Advanced Circuits business,

bankruptcy of a customer in our Aerospace reportable segment, and customer claims in our Aerospace and Automation and Control

Solutions reportable segments. Additionally, we recognized other charges consisting of other probable and reasonably estimable

environmental liabilities of $30 million and write-offs related to an other than temporary decline in the value of certain equity

investments of $15 million.

56