Honeywell 2004 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2004 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

use of long-term, firm-price contracts with our suppliers and forward commodity purchase agreements with third parties hedging

anticipated purchases of several commodities (principally natural gas). Forward commodity purchase agreements are marked-to-

market, with the resulting gains and losses recognized in earnings when the hedged transaction is recognized.

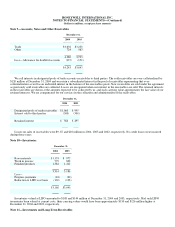

Interest Rate Risk Management—We use a combination of financial instruments, including medium-term and short-term

financing, variable-rate commercial paper, and interest rate swaps to manage the interest rate mix of our total debt portfolio and

related overall cost of borrowing. At December 31, 2004 and 2003, interest rate swap agreements designated as fair value hedges

effectively changed $1,218 and $1,189 million, respectively, of fixed rate debt at an average rate of 6.42 and 6.45 percent,

respectively, to LIBOR based floating rate debt. Our interest rate swaps mature through 2007.

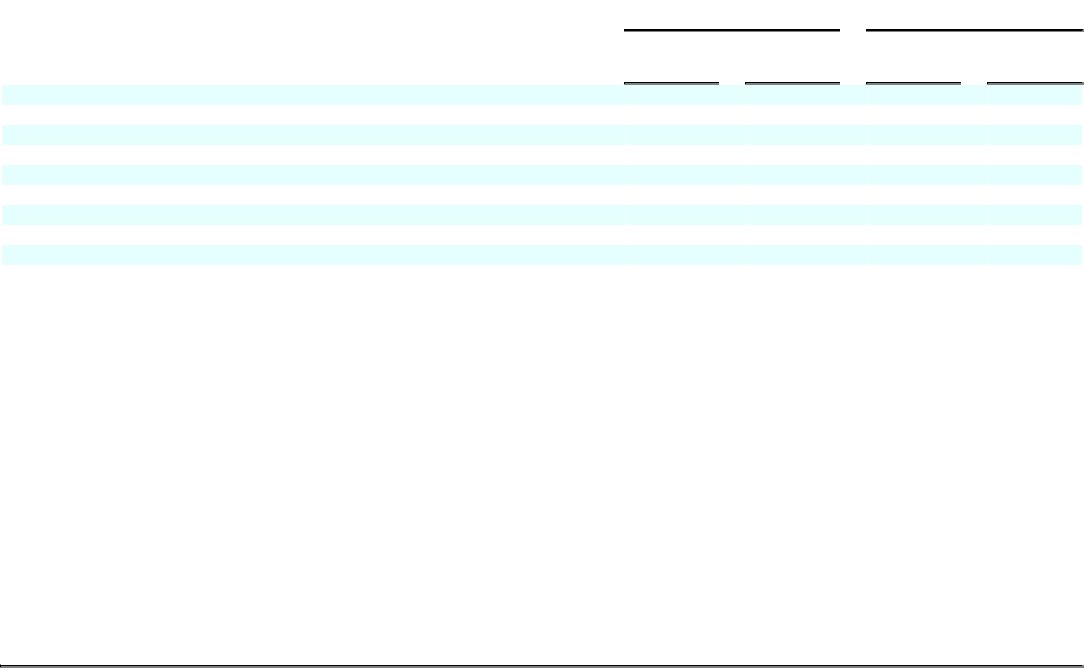

Fair Value of Financial Instruments—The carrying value of cash and cash equivalents, trade accounts and notes receivables,

payables, commercial paper and short-term borrowings contained in the Consolidated Balance Sheet approximates fair value.

Summarized below are the carrying values and fair values of our other financial instruments at December 31, 2004 and 2003. The fair

values are based on the quoted market prices for the issues (if traded), current rates offered to us for debt of the same remaining

maturity and characteristics, or other valuation techniques, as appropriate.

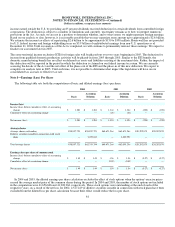

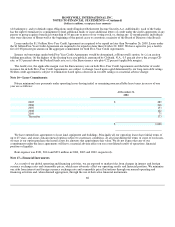

December 31, 2004 December 31, 2003

Carrying

Value Fair

Value Carrying

Value Fair

Value

Assets

Long-term receivables $ 237 $ 218 $ 388 $ 369

Interest rate swap agreements 39 39 67 67

Foreign currency exchange contracts 22 22 12 12

Forward commodity contracts 10 10 18 18

Liabilities

Long-term debt and related current maturities $ (5,025) $ (5,411) $ (5,008) $ (5,508)

Foreign currency exchange contracts (6) (6) (11) (11)

Forward commodity contracts (2) (2) — —

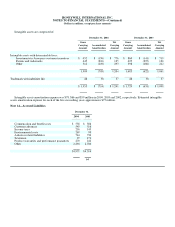

Note 18—Capital Stock

We are authorized to issue up to 2,000,000,000 shares of common stock, with a par value of one dollar. Common shareowners are

entitled to receive such dividends as may be declared by the Board, are entitled to one vote per share, and are entitled, in the event of

liquidation, to share ratably in all the assets of Honeywell which are available for distribution to the common shareowners. Common

shareowners do not have preemptive or conversion rights. Shares of common stock issued and outstanding or held in the treasury are

not liable to further calls or assessments. There are no restrictions on us relative to dividends or the repurchase or redemption of

common stock.

In November 2003, Honeywell announced its intention to repurchase sufficient outstanding shares of its common stock to offset

the dilutive impact of employee stock based compensation plans, including future option exercises, restricted unit vesting and

matching contributions under our savings plans. While we estimate the issuance of approximately 10 million shares annually under

such plans, in 2004, we repurchased 20.1 million shares for $699 million, which included shares repurchased in response to market

conditions in the fourth quarter to offset the anticipated 2005 dilutive impact of employee stock based compensation plans.

68