Honeywell 2004 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2004 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

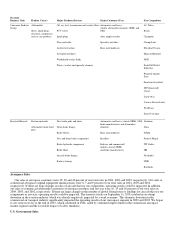

repair and overhaul. Exports were principally made to Europe, Asia and Canada. Foreign manufactured products and systems and

performance of services comprised 14 percent of total 2004 Aerospace net sales.

Approximately 3 percent of total 2004 net sales of Automation and Control Solutions products were exports of U.S. manufactured

products. Foreign manufactured products and performance of services accounted for 49 percent of total 2004 net sales of Automation

and Control Solutions. The principal manufacturing facilities outside the U.S. are in Europe and Mexico, with less significant

operations in Asia and Canada.

Approximately 11 percent of total 2004 net sales of Specialty Materials were exports of U.S. manufactured products. Exports were

principally made to Asia, Europe, Latin America and Canada. Foreign manufactured products comprised 29 percent of total 2004 net

sales of Specialty Materials. The principal manufacturing facilities outside the U.S. are in Europe, with less significant operations in

Asia and Canada.

Exports of U.S. manufactured products comprised 1 percent of total 2004 net sales of Transportation Systems products. Foreign

manufactured products accounted for 62 percent of total 2004 net sales of Transportation Systems. The principal manufacturing

facilities outside the U.S. are in Europe, with less significant operations in Asia, Latin America and Canada.

Raw Materials

The principal raw materials used in our operations are generally readily available. We experienced no significant or unusual

problems in the purchase of key raw materials and commodities in 2004. We are not dependent on any one supplier for a material

amount of our raw materials. However, we are highly dependent on our suppliers and subcontractors in order to meet commitments to

our customers. In addition, many major components and product equipment items are procured or subcontracted on a sole-source basis

with a number of domestic and foreign companies. We maintain a qualification and performance surveillance process to control risk

associated with such reliance on third parties. While we believe that sources of supply for raw materials and components are generally

adequate, it is difficult to predict what effects shortages or price increases may have in the future. The costs of certain key raw

materials, including natural gas and benzene, in our Specialty Materials' business were at historically high levels in 2004 and are

expected to remain at those levels in 2005. We will continue to attempt to offset raw material cost increases with price increases where

feasible. At present, we have no reason to believe a shortage of raw materials will cause any material adverse impact during 2005.

Patents, Trademarks, Licenses and Distribution Rights

Our business as a whole, and that of our strategic business units, are not dependent upon any single patent or related group of

patents, or any licenses or distribution rights. We own, or are licensed under, a large number of patents, patent applications and

trademarks acquired over a period of many years, which relate to many of our products or improvements to those products and which

are of importance to our business. From time to time, new patents and trademarks are obtained, and patent and trademark licenses and

rights are acquired from others. We also have distribution rights of varying terms for a number of products and services produced by

other companies. In our judgment, those rights are adequate for the conduct of our business. We believe that, in the aggregate, the

rights under our patents, trademarks and licenses are generally important to our operations, but we do not consider any patent,

trademark or related group of patents, or any licensing or distribution rights related to a specific process or product, to be of material

importance in relation to our total business.

We have registered trademarks for a number of our products, including such consumer brands as Honeywell, Prestone, FRAM,

Anso, Autolite, Bendix, Jurid and Garrett.

Research and Development

Our research activities are directed toward the discovery and development of new products and processes and the development of

new uses for existing products.

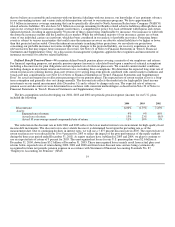

Research and development expense totaled $917, $751 and $757 million in 2004, 2003 and 2002, respectively. The increase in

research and development expense in 2004 compared with 2003 results primarily from design and developments costs associated with

new aircraft platforms in Aerospace and new product development costs in Automation and Control Solutions. Customer-sponsored

(principally the U.S. Government) research and development activities amounted to an additional $593, $608 and $603 million in

2004, 2003 and 2002, respectively.

9