Honeywell 2004 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2004 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

change. This accounting change did not have a material impact on results of operations for 2004 and 2003. Pro forma effects for 2002

assuming adoption of SFAS No. 143 as of January 1, 2002, were not material to net income or per share amounts.

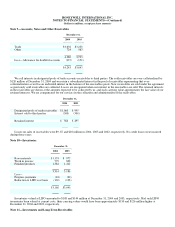

Note 2—Acquisitions

We acquired businesses for an aggregate cost of $396, $199 and $520 million in 2004, 2003 and 2002, respectively. All of our

acquisitions were accounted for under the purchase method of accounting, and accordingly, the assets and liabilities of the acquired

businesses were recorded at their estimated fair values at the dates of acquisition. Significant acquisitions made in these years are

discussed below.

In May 2003, Honeywell sold its Engineering Plastics business to BASF in exchange for BASF's nylon fiber business and $90

million in cash. BASF's nylon fiber business became part of Specialty Materials' nylon business. Since the cash consideration received

from BASF was in excess of 25 percent of the fair value of this exchange, this transaction was viewed as “monetary” in accordance

with Issue 8(a) of EITF 01-2, “Interpretations of APB Opinion No. 29”. Accordingly, the pre-tax gain on the sale of our Engineering

Plastics business of $38 million was based on the fair value of the consideration received from BASF less the sum of the net book

value of our Engineering Plastics business and related transaction costs. We recorded the assets and liabilities acquired in the BASF

business at fair market value based on a valuation performed by an independent appraisal firm at the acquistion date which

corresponded to the value agreed upon in the asset purchase agreement for this transaction. Specialty Materials' Engineering Plastics

business and BASF's nylon fiber business both had annual sales of approximately $400 million.

In October 2002 we acquired Invensys Sensor Systems (ISS) for approximately $416 million in cash with $115 million allocated

to tangible net assets, $206 million allocated to goodwill and $95 million allocated to other intangible assets with determinable lives.

ISS is a global supplier of sensors and controls used in the medical, office automation, aerospace, HVAC, automotive, off-road vehicle

and consumer appliance industries. ISS is part of our Automation and Control Products business in our Automation and Control

Solutions reportable segment. ISS had sales of approximately $253 million in 2002.

In connection with all acquisitions in 2004, 2003 and 2002, the amounts recorded for transaction costs and the costs of integrating

the acquired businesses into Honeywell were not material. The results of operations of all acquired businesses have been included in

the consolidated results of Honeywell from their respective acquisition dates. The pro forma results for 2004, 2003 and 2002,

assuming these acquisitions had been made at the beginning of the year, would not be materially different from reported results.

On December 13, 2004, we announced that we had reached agreement with the board of directors of Novar plc (Novar) on the

terms of recommended Offers for the entire issued and ordinary preference share capital of Novar. The aggregate value of the Offers is

$2.4 billion (fully diluted for the exercise of all outstanding options), including the assumption of approximately $580 million of

outstanding debt, net of cash. The Novar board has unanimously recommended the Offers. We expect to complete the transaction in

the first quarter of 2005 and to fund the acquisition with existing cash resources.

Novar is a UK listed holding company which operates globally in the electrical, electronic and control products, the aluminum

extrusion and the security printing businesses and had reported 2003 revenues of $2.7 billion. We do not intend to hold the aluminum

extrusion and security printing businesses in the long-term and expect to pursue strategic alternatives for these units as soon as

practical.

53