Holiday Inn 2005 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2005 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

InterContinental Hotels Group 2005 7

Room Count and Pipeline

The IHG global system (that is, the number of hotels/rooms owned,

leased, managed or franchised by the Group) grew significantly during

2005 ending the year at 3,606 hotels and 537,533 rooms, 66 hotels and

3,331 rooms higher than at 31 December 2004 (see figure 5). During

the year, 254 hotels with 34,880 rooms joined the system, while

188 hotels with 31,549 rooms left the system. Of the hotels leaving

the system 139 (21,764 rooms) were in the Americas and 46 (7,896

rooms) were in EMEA. The EMEA removals included 6,338 rooms

from the termination of franchise agreements in South Africa.

Excluding the South African franchise removals and eight hotels

(2,135 rooms) exiting the system due to hurricane damage, net

system size increased by 101 hotels (11,804 rooms).

One of the key elements of the asset disposal programme is the

retention of management contracts for the hotels sold. Of those

sold since April 2003, management contracts or franchise

agreements were retained on 126 hotels. Overall, the number of

owned and leased rooms fell by 22,935 while the number of

managed and franchised rooms in the system grew by 22,296

rooms and 3,970 rooms respectively.

At the end of 2005, the number of rooms in the pipeline (that is,

contracts signed but hotels/rooms yet to enter the system) was

108,512 – 31% up on 31 December 2004 and the highest ever for the

Group (see figure 6). This positions the Group well to achieve its stated

goal of organic growth of 50,000 to 60,000 net rooms in the period

June 2005 to December 2008. Whilst there is no guarantee that all

of the pipeline will enter the system in that period, a number of

initiatives are in place to both secure new deals and to reduce the

time between a hotel signing with IHG and opening.

The growth in pipeline was fuelled by record signings during 2005;

69,970 rooms were signed which was over 60% up on the average

for the last five years. This partly reflects the increased investment

in development resource particularly in the Americas and Asia Pacific.

Reservation Systems and Loyalty Programme

IHG supports revenue delivery into its hotels through its global

reservation systems and global loyalty programme, Priority Club

Rewards. In 2005, global system room revenue booked through

IHG’s reservation channels rose by approximately 19% to $4.8bn,

and the proportion of IHG global system room revenue booked via

IHG’s reservation channels increased from 38% to 41%.

The internet channel continued to show strong growth, with global

system room revenue booked via the internet increasing by 23% to

$1.7bn, accounting for approximately 14% of IHG global system

room revenue (up from 13% in 2004).

Room revenue generated from Priority Club Rewards members

was $3.8bn and represented approximately 32% of IHG global

system room revenue.

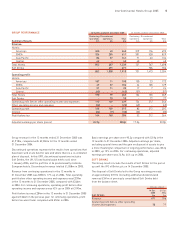

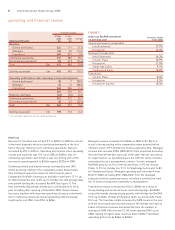

FIGURE 5

Hotels Rooms

Global hotel and room count Change Change

at 31 December 2005 2005 over 2004 2005 over 2004

Analysed by brand:

InterContinental 137 546,262 1,746

Crowne Plaza 235 20 65,404 3,777

Holiday Inn 1,435 (49) 267,816 (10,971)

Holiday Inn Express 1,590 78 133,554 7,519

Staybridge Suites 87 89,915 726

Candlewood Suites 112 312,683 276

Hotel indigo 32497 357

Other brands 7(1) 1,402 (99)

Total 3,606 66 537,533 3,331

Analysed by ownership type:

Owned and leased 55 (111) 15,485 (22,935)

Managed 504 101 121,249 22,296

Franchised 3,047 76 400,799 3,970

Total 3,606 66 537,533 3,331

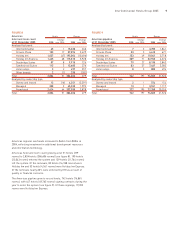

FIGURE 6

Hotels Rooms

Global pipeline Change Change

at 31 December 2005 2005 over 2004 2005 over 2004

Analysed by brand:

InterContinental 27 69,353 2,513

Crowne Plaza 54 17 13,514 4,201

Holiday Inn 204 48 31,035 5,630

Holiday Inn Express 429 71 38,066 6,351

Staybridge Suites 79 27 8,195 2,843

Candlewood Suites 83 37 7,467 3,583

Hotel indigo 85882 494

Total 884 211 108,512 25,615

Analysed by ownership type:

Owned and leased 2–574 (96)

Managed 98 14 27,805 5,387

Franchised 784 197 80,133 20,324

Total 884 211 108,512 25,615