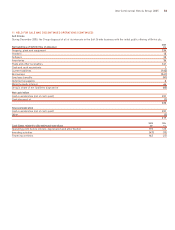

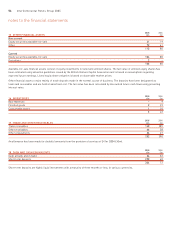

Holiday Inn 2005 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2005 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

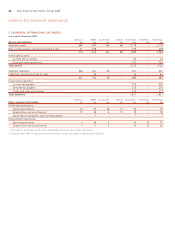

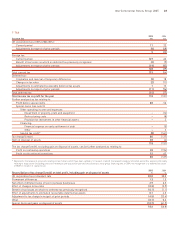

7TAX

2005 2004

Income tax £m £m

UK corporation tax at 30% (2004 30%):

Current period 11 23

Adjustments in respect of prior periods (6) (48)

5(25)

Foreign tax:

Current period 149 62

Benefit of tax losses on which no deferred tax previously recognised (2) (9)

Adjustments in respect of prior periods (19) (82)

128 (29)

Total current tax 133 (54)

Deferred tax:

Origination and reversal of temporary differences (3) 18

Changes in tax rates (2) (11)

Adjustments to estimated recoverable deferred tax assets 112

Adjustments in respect of prior periods (11) (96)

Total deferred tax (15) (77)

Total income tax on profit for the year 118 (131)

Further analysed as tax relating to:

Profit before special items 88 56

Special items (see note 5):

Other operating income and expenses:

Impairment of property, plant and equipment –(14)

Restructuring costs –(8)

Provision for investment in other financial assets –3

Financing:

Financial expense on early settlement of debt –(5)

Other –2

Special tax credit* (8) (161)

Tax charge/(credit) 80 (127)

Gain on disposal of assets 38 (4)

118 (131)

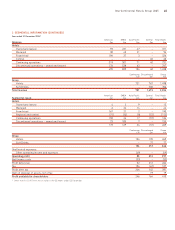

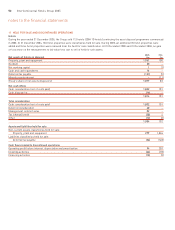

The tax charge/(credit), excluding gain on disposal of assets, can be further analysed as relating to:

Profit on continuing operations 28 (194)

Profit on discontinued operations 52 67

80 (127)

* Represents the release of provisions relating to tax matters which have been settled or in respect of which the relevant statutory limitation period has expired, principally

relating to acquisitions (including provisions relating to pre-acquisition periods) and disposals, intra-group financing and, in 2004, the recognition of a deferred tax asset

of £83m in respect of capital losses.

2005 2004

Reconciliation of tax charge/(credit) on total profit, including gain on disposal of assets %%

UK corporation tax at standard rate 30.0 30.0

Permanent differences 1.3 1.5

Net effect of different rates of tax in overseas businesses 2.9 6.3

Effect of changes in tax rates (0.3) (3.9)

Benefit of tax losses on which no deferred tax previously recognised (0.1) (1.1)

Effect of adjustments to estimated recoverable deferred tax assets 0.1 4.3

Adjustment to tax charge in respect of prior periods (4.5) (22.6)

Other (0.1) 0.6

Special items and gains on disposal of assets (10.7) (61.9)

18.6 (46.8)

InterContinental Hotels Group 2005 49